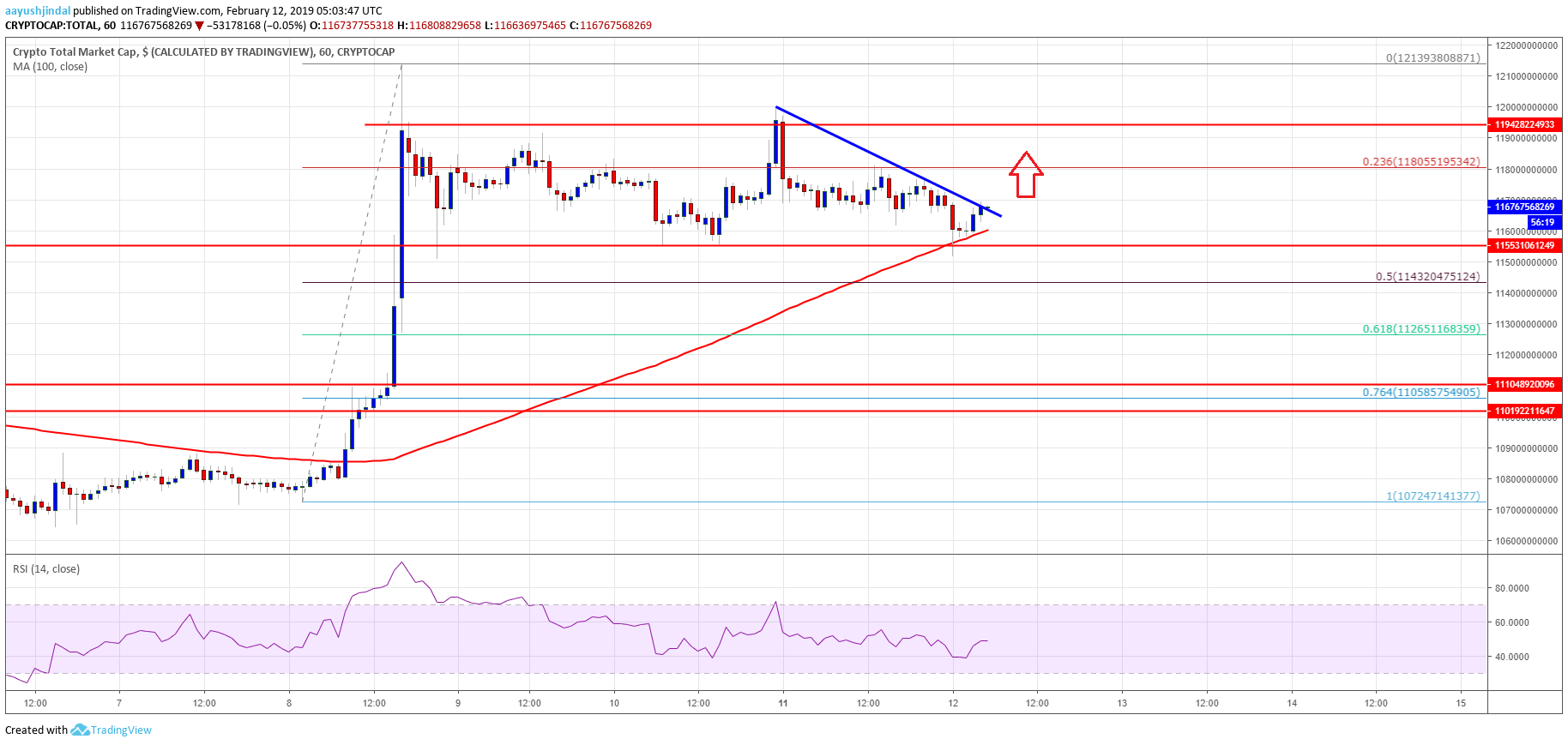

- The total crypto market cap is currently consolidating gains above the $115.0B support level.

- Litecoin (LTC) price settled above the $40 and $42 support levels, with a bullish bias.

- Bitcoin cash price is slowly correcting lower towards the $120 support.

- Tron (TRX) price declined more than 4% and broke the $0.0250 support level.

- Stellar (XLM) price remained below the $0.0850 and $0.0800 resistance levels.

The crypto market is currently moving in a range after a decent rally. Bitcoin (BTC), Ethereum (ETH), litecoin, ripple, bitcoin cash, tron (TRX), stellar (XLM) might continue to consolidate before the next move.

Bitcoin Cash Price Analysis

Bitcoin cash price spiked recently above the $120 and $125 resistance levels against the US Dollar. However, BCH/USD failed to stay above the $125 and later started a downside correction. It is trading below the $123 level and it may continue to move down towards the $120 support. On the upside, the main resistance is near the $125 level, above which the price could rally towards the $130 and $132 resistance levels.Litecoin (LTC), Tron (TRX) and Stellar (XLM) Price Analysis

Litecoin price performed really well this past week as it broke the $38 and $40 resistance levels. LTC even spiked above the $45 resistance and later started a downside correction. The price remains well supported on the downside near the $40 level. Tron price struggled to clear the $0.0265 and $0.0270 resistance levels recently and corrected lower. TRX price declined more than 4% and it is currently trading below the $0.0250 support level. Stellar price remained in a bearish zone below the $0.0285 and $0.0280 resistance levels. XLM price is currently down around 2% and it seems like it could test the $0.0750 support level in the coming sessions.