- Ripple prices solid above 34 cents

- Will banks shift to xRapid because of the solution’s benefits?

Several analyses show that xRapid is cheap and fast. As such, it is likely that once there is regulatory certainty around XRP, more banks will shift towards xRapid supporting Ripple (XRP) prices.

Ripple Price Analysis

Fundamentals

Many proposals will see banker’s profit slashed. One of them is the proposal to shift away from the high-latency messaging network in SWIFT towards a time-saving, cost-saving and the transparent system powered by RippleNet. With xRapid–and through economies of scale, adopting firms can save up to 70 percent should they incorporate the solution. In a , Ripple Inc concludes saying:“Respondent banks that use Ripple with XRP as a bridge currency can save up to 42 percent on costs today, and up to 60 percent as XRP gains usage and volatility decreases. To accelerate market thickness and reduce volatility for XRP, Ripple will soon introduce an XRP incentive program to rebate market makers who provide liquidity through XRP algorithmically.”

This observation sync well with similar analysis that prove that xRapid, a solution that leverage XRP as a medium of exchange and xCurrent rails for functionality is super-fast benefiting the end user. Yesterday, Mercury FX, a payment processing firm that makes use of xRapid, said a customer $30k using their rails.The processor’s comment re-affirms similar findings by several observers:“We just saved a client 30k on moving the cash from selling his house in Australia to the UK. That’s a huge saving compared to what he’d get from the banks – and goes a long way toward paying Stamp Duty on the house here! #yourewelcome”

Actually, the cost savings breakdown is much higher:And,1) ILP alone 𝐰𝐢𝐭𝐡𝐨𝐮𝐭 XRP: 33%

Source: — Hodor (@Hodor)

2) xRapid 𝐰𝐢𝐭𝐡 𝘩𝘪𝘨𝘩-𝘷𝘰𝘭𝘢𝘵𝘪𝘭𝘪𝘵𝘺 XRP: 42%

3) xRapid 𝐰𝐢𝐭𝐡 𝘭𝘰𝘸-𝘷𝘰𝘭𝘢𝘵𝘪𝘭𝘪𝘵𝘺 XRP: 60%

Focus Point here: @sendfriendinc & team are solving to reduce cross border remittance costs for ppl sending money to (USD / PHP movement is 4th largest FX corridor), from 8-10% to 2.5% or less. this is a v hard problem (disclosure: am a board director) — Sandra Ro (@srolondon)

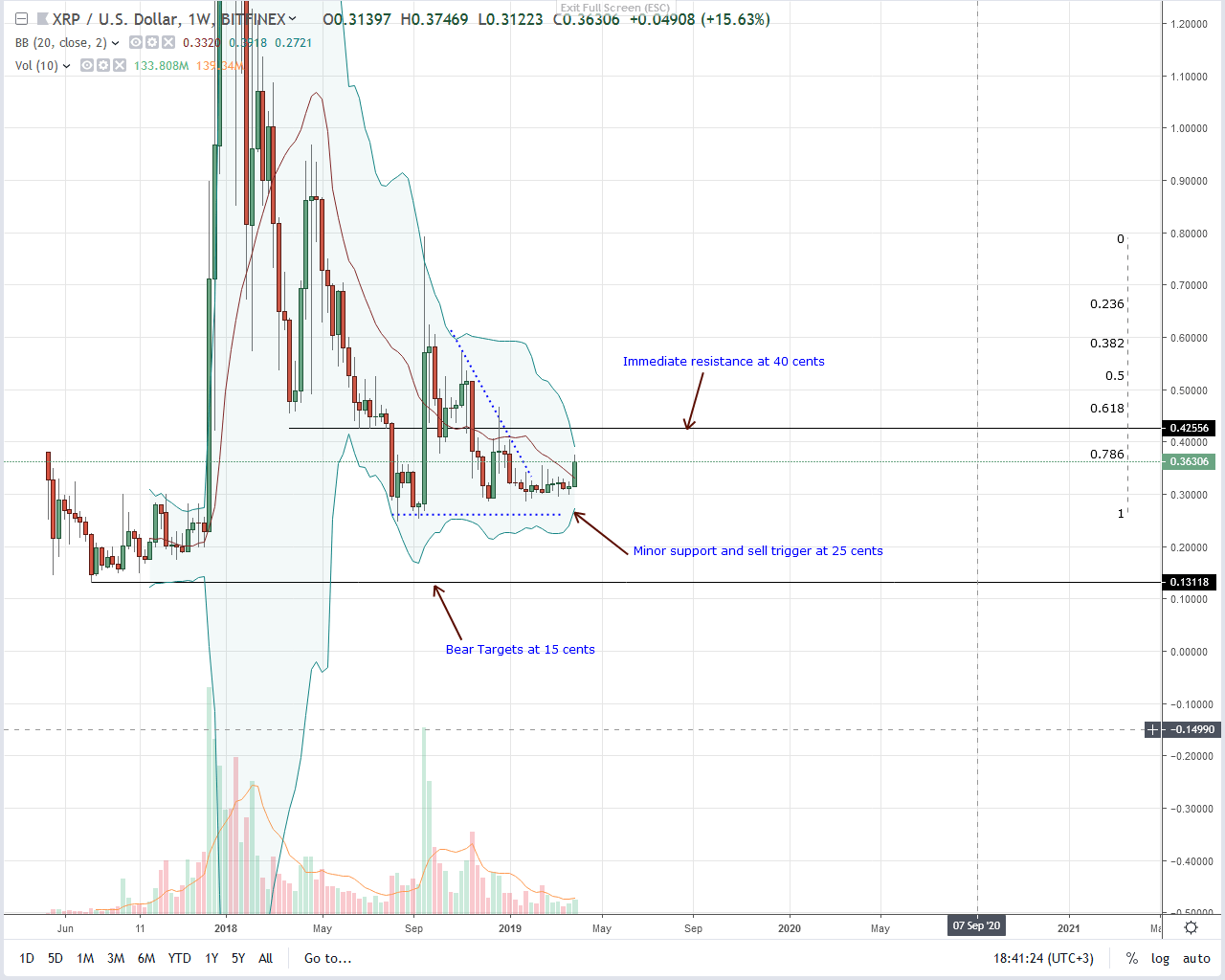

Candlestick Arrangement

Although volumes are on the rise, we shall only confirm bulls if this week’s bar is wide-ranging with high volumes above 390 million–of the conspicuous bull candlestick of late Dec 2018. If that is the case, then we shall have a classic bull breakout realigning with the trend-setting bull bar of the week ending Sep 23. In that case, it is likely that Ripple (XRP) could retest 80 cents.

Technical Indicators

Relative to last week, XRP transactional volumes are high and what we have instead is a double bar bull reversal pattern. Anchored by above average volumes, buyers are in control. Therefore, every low is technically a buying opportunity.Chart courtesy of Trading View