There is no doubting that Bitcoin and crypto markets have been on fire recently. Since the beginning of April Bitcoin has almost doubled in price driving market capitalization back over $200 billion again. The ice from the crypto winter appears to have melted and some industry analysts are convinced it is now definitely over.

Tom Lee’s 13 Reasons

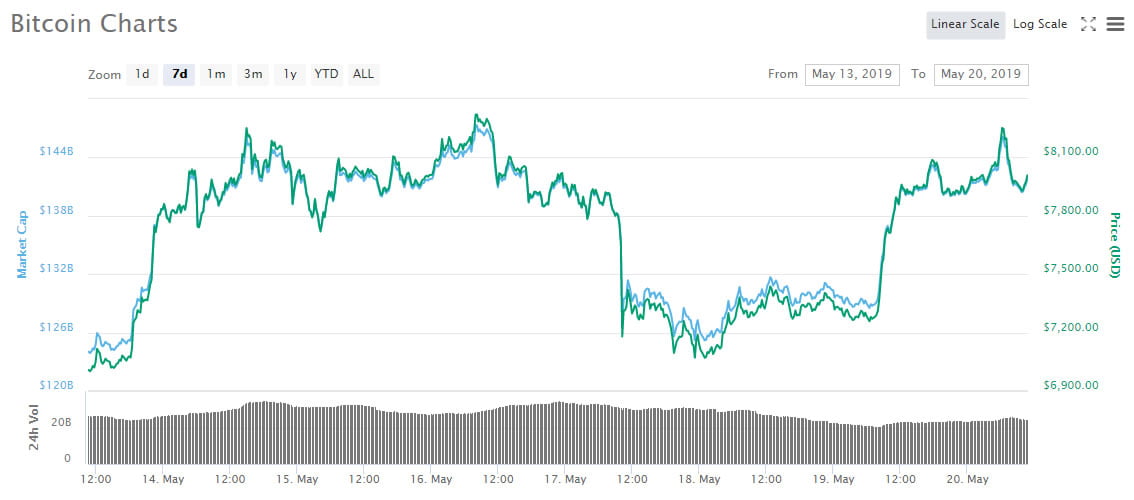

Fundstrat Global Advisors’ permabull Thomas Lee tweeted his thirteen reasons why the crypto winter is now over. After stating what he described as a ‘disturbing pullback to $6,200’ Lee added that the return to $8,000 was confirmation that the trend is intact. Some of Lee’s reasons have more weight than others but he starts with a look back to November 2018 and the Bitcoin Cash hash war that many speculated caused the final capitulation down to $3,200. Next he observed that saw its NAV premium fall to 5%, its lowest level since 2017 which also implied that the capitulation had occurred. The fund premium has since surged to 41%.Over the counter (OTC) volumes have also started surging with multiple brokers reporting new client activity surging 60-70 percent compared with four months ago. There was also speculation that US president Trump’s escalated trade war with China has spurred buyers there into loading up on Bitcoin as a safer store of value.

The Bitcoin ‘golden cross’ in late April was a huge technical indicator that the trend has reversed. Minimal reaction to negative news such as the Tether imbroglio and the Binance hack also confirms major confidence in crypto markets. Finally this month’s Consensus crypto conference was the confirmation that crypto winter is over according to Lee.After a disturbing pullback to ~$6,200, back >$8,000 further cementing positive trend intact. As we said a few weeks ago, Consensus 2019 was to prove whether crypto winter is over… …confirmed — Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat)

Big Bullish Week

Bitcoin had a huge week with record volume levels over $100 billion and a massive candle to close it. With a surge of 13 percent in seven days all talk of that massive correction has diminished as analysts look for the next levels of resistance. Full time trader ‘The Crypto Dog’ has done the charts and called weekly resistance at $8,215 and support around $7,300. He ;

“Hell of a bullish weekly close on #Bitcoin with near record breaking volume, solidifying the strength and validity of this rally.”At the time of writing Bitcoin had surpassed $8,000 again and was trading up 2.7 percent on the day. It reached an intraday high of $8,250 where it hit resistance during Asian trading a few hours ago.

Image from Shutterstock