- Binance Coin (BNB) falls 6.1 percent

- If the rumor is true, Binance is close to activating Margin Trading

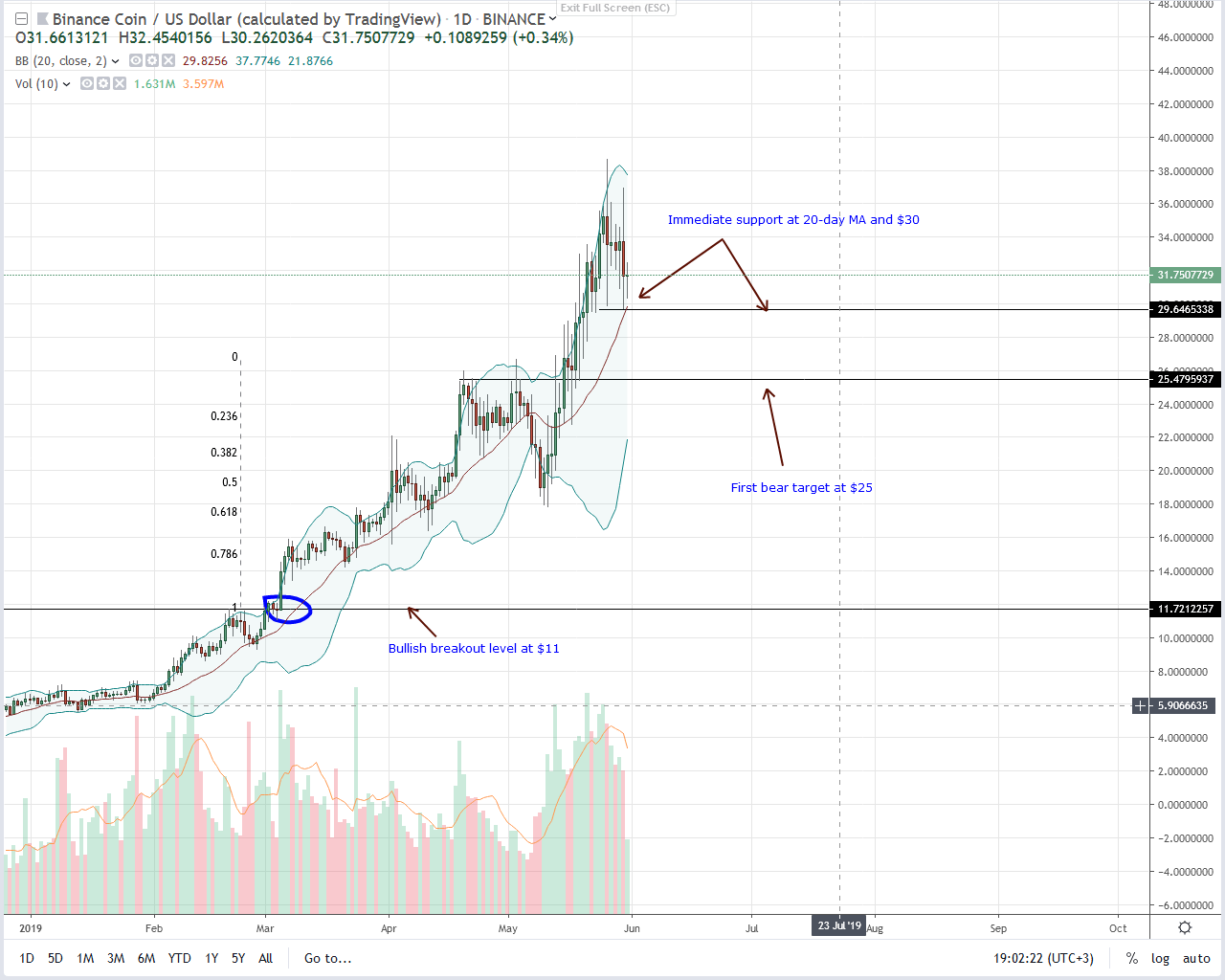

After six months of stellar performance, Binance coin (BNB) is correcting. Even so, if Binance enables margin trading, the demand for BNB will increase, buoying bulls aiming at $43.

Binance Price Analysis

Fundamentals

They may be centralized and prone to hacks, but exchanges play a crucial role in the crypto ecosystem. Not only do create a market place for even the most illiquid digital assets, but these ramps bridge fiat and cryptocurrencies. However, this space is heating up. There is ingress of Wall Street behemoths. Leading the line is Fidelity Investments whose express ambition is to build a digital asset vault for high net worth investors as well as institutions.

Meanwhile, exchanges are stepping up. Coinbase is diverging from their conservative stance, offering more support for coins with the latest beneficiary being EOS. Although the timing was wrong as investors didn’t reap benefits from the “Coinbase Effect,” others as Binance are keen and “listening to customer feedback.”

It is yet to be confirmed, but rumor has it that they plan to roll-out margin trading. Undoubtedly, these features will be introduced to cement its position as the world’s leading exchange by adjusted volumes. TechCrunch is that Binance has already launched the feature to a select group of traders.

Candlestick Arrangements

Furthermore, note that bars are printing away from the upper Bollinger Bands (BB). Because of this, what we have are lower lows. Nonetheless, otherwise, unless there is a breach of May 26th low at $30, buyers are in control with targets at $43 as laid out in previous BNB/USD price analysis.

Technical Indicator

From the above, May 26th anchors this trade plan. Behind the bar are high trading volumes-4 million. With support at $30, any bear bar closing below that mark signaling a correction ought to be accompanied by high participation exceeding 4 million.courtesy of Trading View. Image Courtesy of Shutterstock