Bitcoin price is once again making headlines on mainstream media outlets, revisiting once forgotten memories of the crypto bubble of 2017, where Bitcoin’s meteoric rise captured the interest of the world and took it to its all-time high of $20,000.

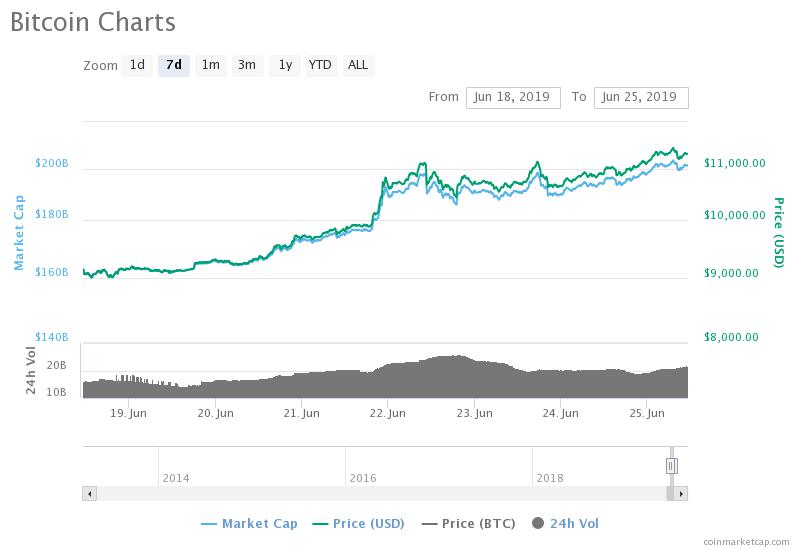

Just this past week, $10,000 was reclaimed by Bitcoin – a price point that last time around created widespread FOMO and caused investors to flock to this space.

After the new level was taken, the monthly Bitcoin price chart is forming a “three white soldiers” candlestick formation that typically signals in financial assets a strong reversal. But Bitcoin isn’t any regular financial asset, and Bitcoin’s trend reversal may be the strongest ever witnessed by humankind, according to one crypto analyst.Crypto Analyst: Bitcoin Price Bear Market Trend Reversal Is Strongest In Human History

Many people know by now that Bitcoin is the fastest rising asset in human history, with no other asset providing investors with more profits had they bought in at its inception than the first ever cryptocurrency. Everyone always wishes they bought more – even buying consistently through dollar cost averaging since the Bitcoin top would have led investors to profit.Related Reading | Tom Lee: Bitcoin Price Nearing FOMO Trigger, BTC To Trade Between $20K and $40K

But it’s also capable of extreme price crashes with each subsequent “bubble” pop, eliminating as much as 85%+ in value each time it happens. Each time it’s also pronounced dead, but makes a triumphant comeback that ultimate draws in more investors than the previous cycle.

Related Reading | Crypto Analyst: After $10,000, Bitcoin Price Will Never Again Trade at Four Digits

This is probably the strongest trend reversal of an asset human race has ever experienced and it's just getting started. — Galaxy (@galaxyBTC)According to Wikipedia, the bullish candlestick pattern “unfolds across three trading sessions and suggests a strong price reversal from a bear market to a bull market.”

“The three white soldiers help to confirm that a bear market has ended and market sentiment has turned positive,” .Published author and technical analyst Gregory L. Morris says that this sort of price pattern is so bullish, it “should never be ignored.”

Featured image from Shutterstock