- Ethereum (ETH) is down 18.2 percent

- Set Labs launching an ETH trading robot

As a reputable smart contracting platform striving to improve, it’s token, ETH, is technically bullish. Regardless, with dropping BTC prices exacerbated by their direct correlation, the former could drag ETH prices lower. Even so, that is not stopping Set Labs from launching a trading bot.

Ethereum Price Analysis

Fundamentals

Blockchain is an emerging, multifaceted sub-sector. As a conflation of different fields, it is both inspiring and exciting meaning related startups will almost always attract capital. Of the many platforms promising high throughput and scalability, Ethereum remains a top choice for good reasons.

Like Bitcoin, Ethereum was the first platform in the smart contracting arena. Listed in different exchanges, ETH is desirable. Even though there are bumps in the short-term as developers negotiate their way around building a scalable network, the future is irrefutably bright. Case in point the different enhancement through code changes drawing scarcity and hard forks that promise to cement Ethereum in its rightful place.

Perhaps in preparation for the future, , an investment platform in San Francisco is launching a cryptocurrency trading robot that will take advantage of volatility to benefit investors. The robot, “Trend Trading ETH 20 Day Simple Moving Average Crossover Set” will be a momentum-based bot and back tested.

According to creators, the robot will only make traders “whenever the current price of ETH crosses the 20 Day Simple Moving Average indicator.”Candlestick Arrangement

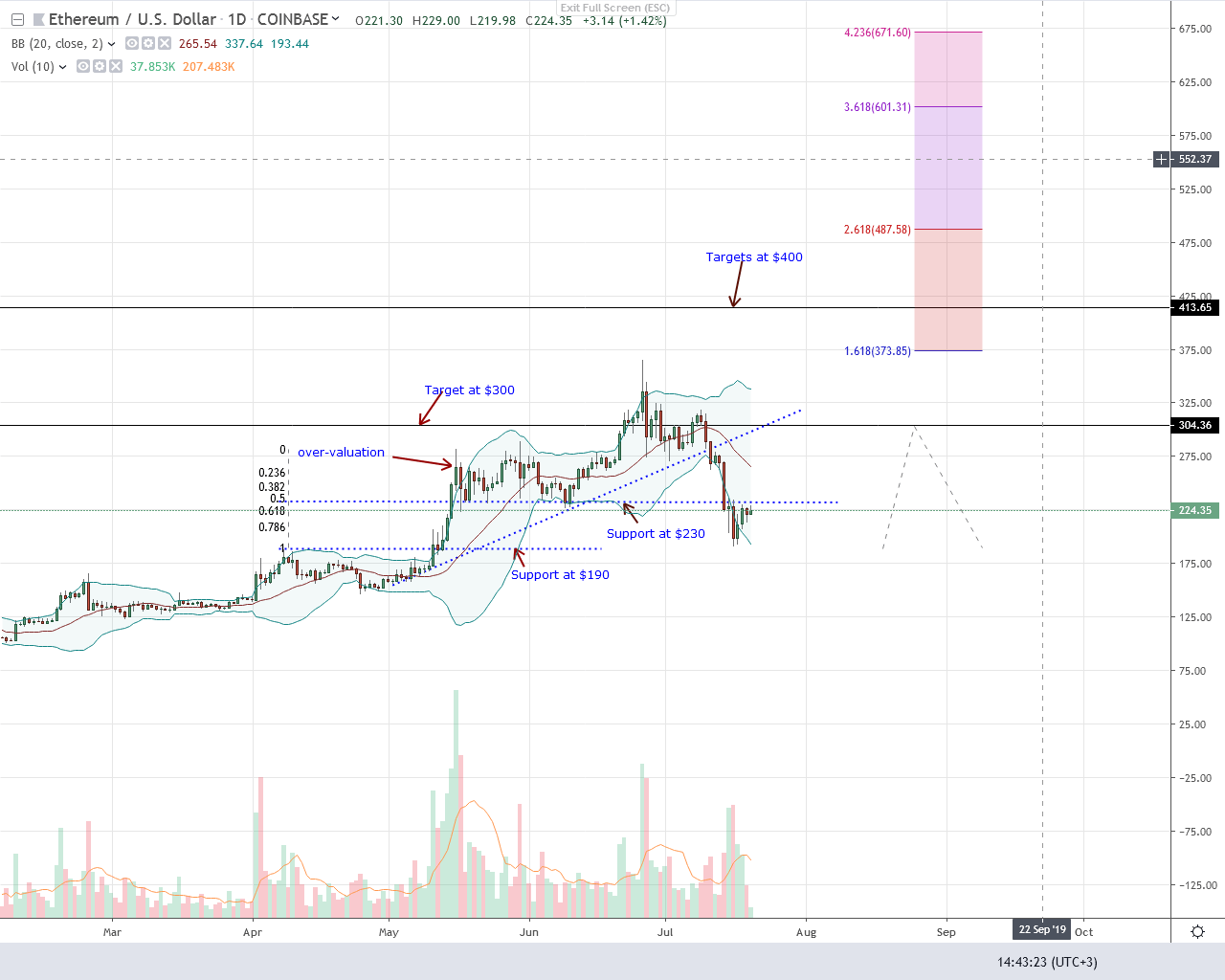

Down 18.2 percent in the last week, ETH is bearish. Because of this, the recent pullback is but another opportunity for savvy traders to unload ETH at better prices. Despite the attractive and supportive fundamental opportunities, the path of least resistance as per candlestick arrangement is southwards.

Visible, ETH is trading within a bear break out pattern following steep losses of early July. Therefore, according to breakout rules, every retracement towards previous support-at $230, is but a selling opportunity. The first target will be $190 and later $150 depending on the accompanying momentum. On the other hand, if prices surge past $230 and the previous support, now resistance, trend line, that as well could be the foundation for $365 invalidating this trade plan’s projection.Technical Indicators

From above, whether buyers flourish is heavily reliant on the level of participation. If trading volumes spike, exceeding 554k of June 26 subsequently lifting prices above June high then bulls of May will be in control. However, suppose prices tumble with equally high trading volumes then ETH could end up sliding to $150 or $100 in coming weeks.courtesy of Trading View. Image Courtesy of Shutterstock