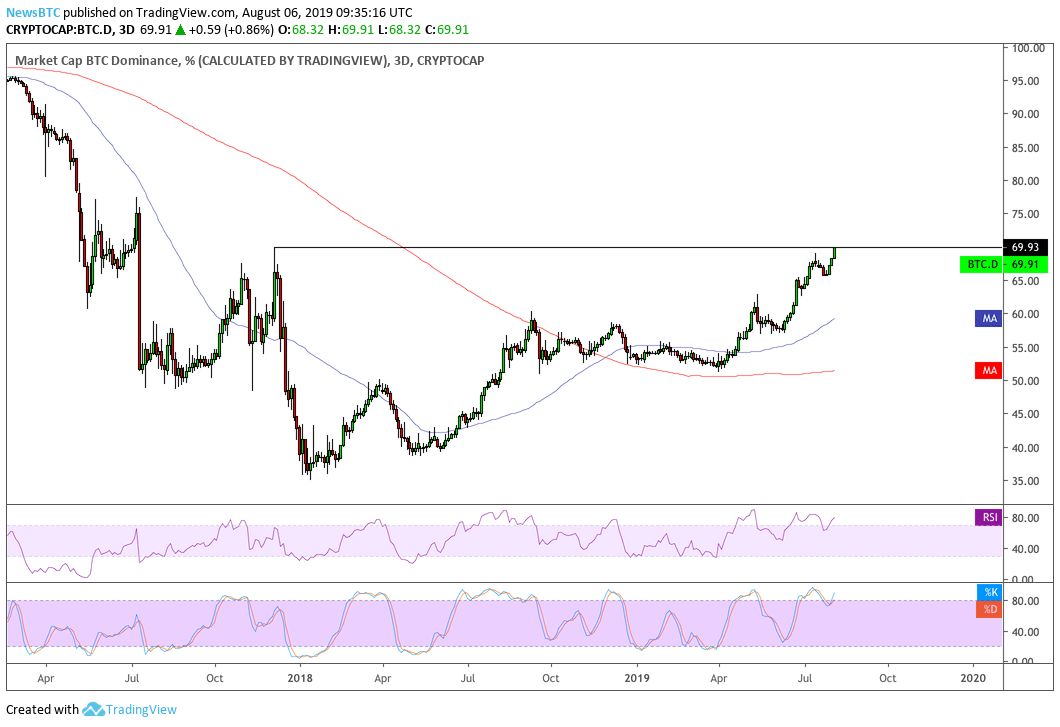

The bitcoin dominance rate on Tuesday inched towards 70 percent for the first time since December 2017.

At circa $217.91 billion, bitcoin’s market capitalization now covers 69.93 percent of the total cryptocurrency market. At its lowest, the world’s leading cryptocurrency was covering only 36.68 percent of the overall market in January 2018.

Bitcoin More Attractive to Investors

This time, the fundamentals that are appearing to support bitcoin are macroeconomic. The Fed rate cut, US-China trade war, capital control in China, economic sanctions on Iran and Turkey, as well as hyperinflation in Zimbabwe and Venezuela are some factors that are prompting investors to speculate on bitcoin, a non-sovereign asset.

On the other hand, mainstream financial firms are building services to cater to growing bitcoin trading clientele. Fidelity Investments and TD Ameritrade, for instance, are launching bitcoin trading solutions on their platforms. Swissquote, Switzerland’s most prominent stockbroker, has also introduced a similar service just recently. Bakkt, a digital asset platform launched by the Intercontinental Exchange, has recently tested the world’s first physically-settled bitcoin futures contracts. Investors look at bitcoin over other cryptocurrencies because of its real-world potential. Atop that, they are bullish because of its scarcity – bitcoin’s supply will be cut to half next May – which would make it a rare asset to hold in the future.Price Reflecting Interest

Bitcoin’s 70 percent dominance in the cryptocurrency market also comes in the wake of its strong bullish bias. The asset in the last seven days has surged by more than 30 percent – from $9,371 to as high as $12,320. The surge, in turn, followed Donald Trump’s to impose 10 percent tariffs on $300 billion worth of Chinese imports. In retaliation, the People’s Bank of China intentionally reduced the price of Chinese Yuan to less than seven dollars a unit, its lowest in the last eleven years. History shows a close inverse relationship between yuan and bitcoin. Earlier in May, bitcoin surged by as much as 58 percent while yuan dropped by 2.5 percent. Analysts believe investors in China, who remain under tighter capital controls, hedged into bitcoin as safe-haven.Notice the narrative change? 2017: "Bitcoin is a bubble, only used by criminals and terrorists" Today: "Bitcoin surging as a possible safe haven while trade war escalates" The price is the same as it was before. We are just seeing bitcoin go mainstream. — Rhythm (@Rhythmtrader)At the same time, all the altcoins are losing value against bitcoin, shows data recordings from the last 24 hours. Ethereum, for instance, is 2.23 percent down against bitcoin. The XRP/BTC instrument is also weak after dropping more than 5 percent in over a day.