- Ethereum is declining and it recently failed to recover above the $155 resistance against the US Dollar.

- Bitcoin price is now trading well below the $7,000 level and tested the final $6,500 bearish target.

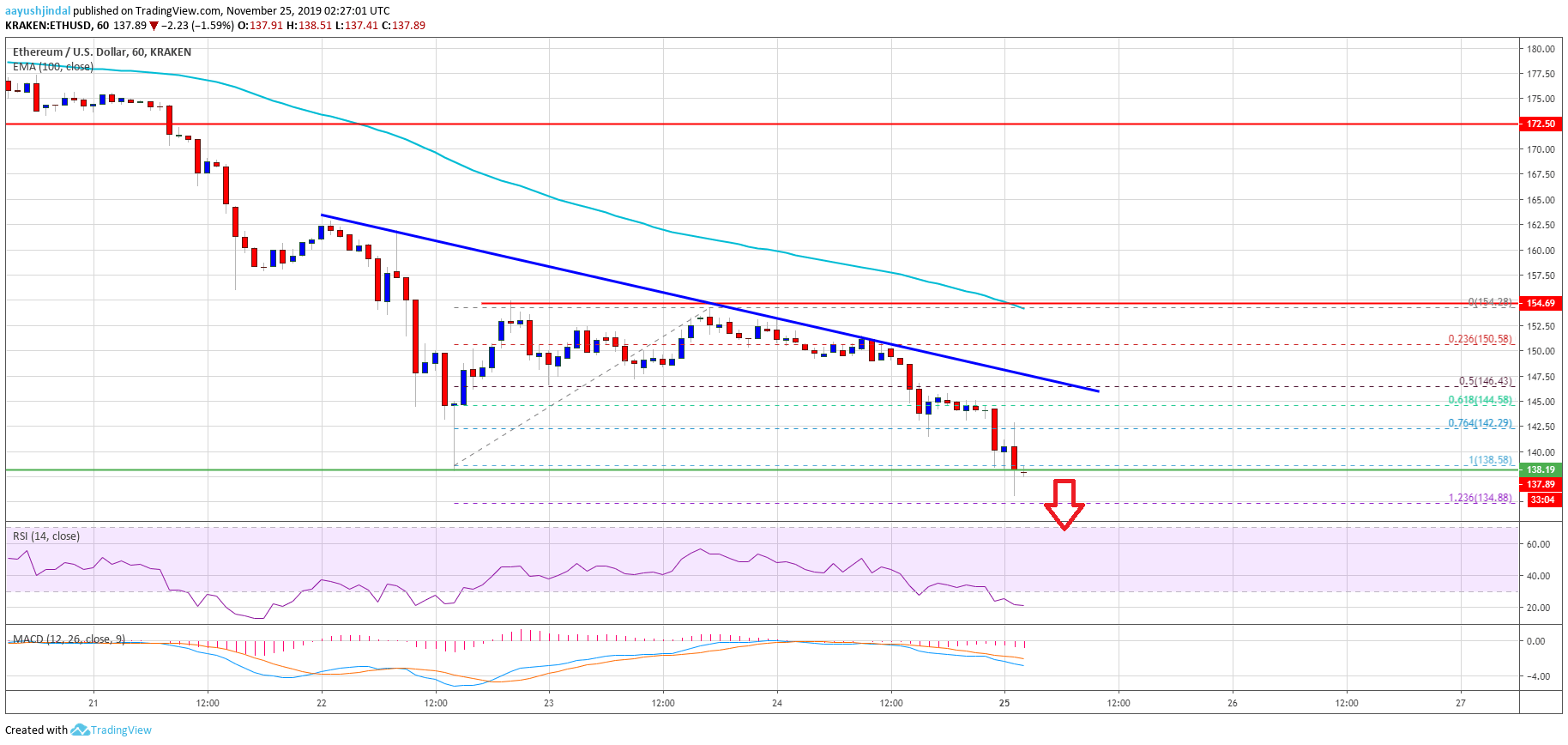

- There is a key bearish trend line forming with resistance near $147 on the hourly chart of ETH/USD (data feed via Kraken).

- The price is currently trading below $145 and it is likely to trade below the $135 support area.

Ethereum price is facing an increase in selling versus the US Dollar, similar to bitcoin. ETH remains at a risk of a drop towards the $125 support area.

Ethereum Price Analysis

In the weekly forecast, we discussed the chances of another breakdown below $145 in Ethereum against the US Dollar. ETH price remained in a bearish zone, failed to climb above the $155 resistance, and settled well below the 100 hourly simple moving average. As a result, there was a downside break below the $145 support area. The decline was such that the price broke the 76.4% Fib retracement level of the recent recovery from the $138 low to $155 high.Moreover, the price spiked below the $138 low and it is currently struggling to recover. An immediate support is near the $135 level. It represents the 1.236 Fib extension level of the recent recovery from the $138 low to $155 high.

If there are more downsides, the price is likely to test the $130 support area. Any further losses may perhaps push Ethereum towards the $125 support area in the near term. An intermediate support is near the 1.618 Fib extension level of the recent recovery from the $138 low to $155 high. On the upside, there are many resistances, starting with $142. Additionally, there is a key bearish trend line forming with resistance near $147 on the hourly chart of ETH/USD.

ETH Technical Indicators

Hourly MACD – The MACD for ETH/USD is currently gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is currently declining and it is well near the oversold levels.

Major Support Level – $135 Major Resistance Level – $147