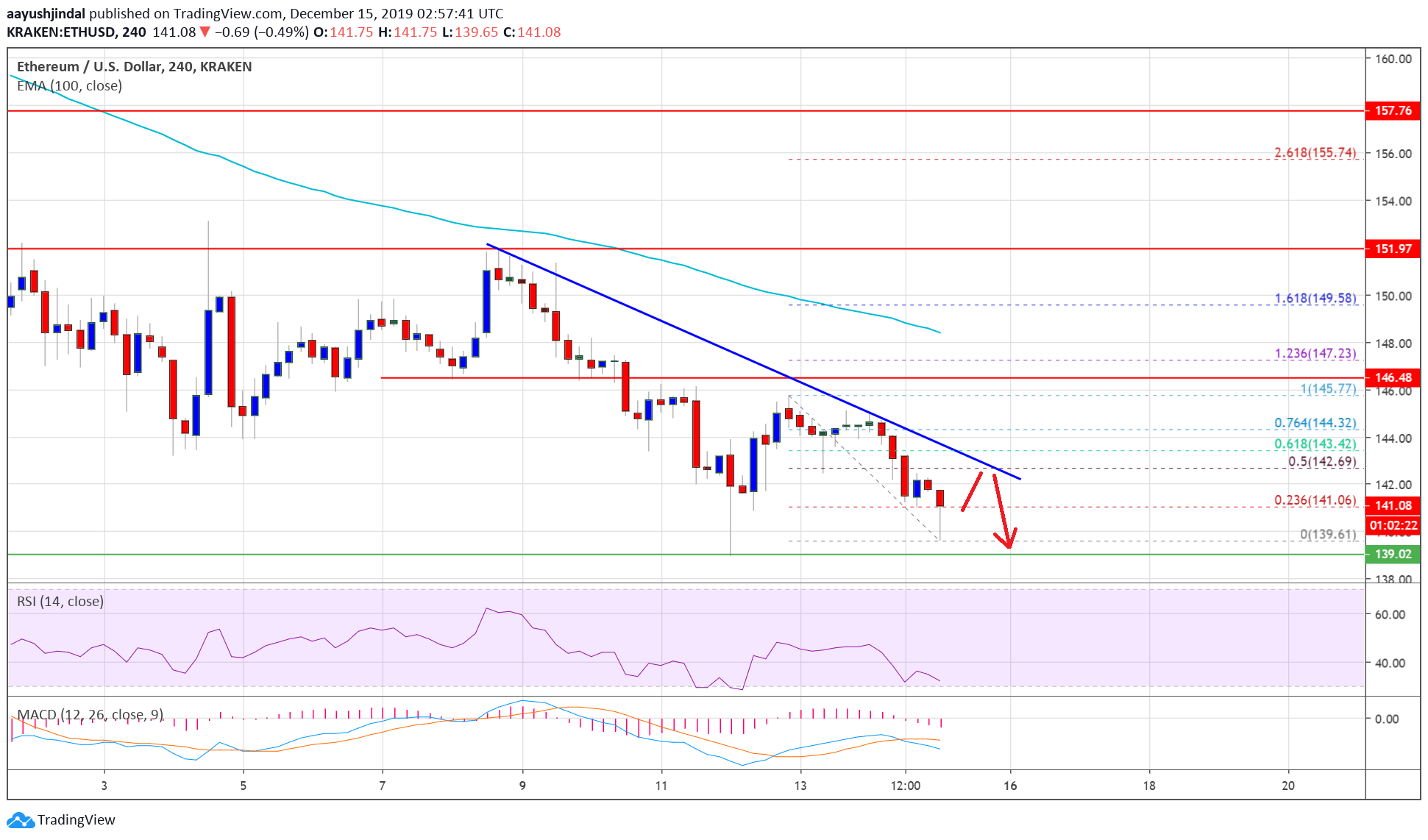

- ETH price is trading in a bearish zone below the $142 and $146 resistance levels against the US Dollar.

- The price is declining and it seems like it could continue to drop below $140.

- There is a major bearish trend line forming with resistance near $142 on the 4-hours chart of ETH/USD (data feed via Kraken).

- The pair is likely to face a lot of selling interest as long as it is below $146.

Ethereum price is struggling to recover and correct higher against the US Dollar, similar to bitcoin. ETH price remains at a risk of more downsides below $140 and $136.

Ethereum Price Weekly Analysis

This past week, Ethereum declined below the $144 and $142 support levels against the US Dollar. ETH price even spiked below the $140 support and a new monthly low was formed near $139. Later, there was an upside correction above the $142 resistance level. However, the upward move was capped by the $145-$146 resistance zone. A high is formed near $146 and the price is currently declining.It is trading near the $140 support area and remains at a risk of more downsides. An initial resistance is near the $141 level, which is near the 23.6% Fib retracement level of the recent decline from the $146 high to $140 low.

On the upside, there are many hurdles near the $142 and $144 levels. Besides, there is a major bearish trend line forming with resistance near $142 on the 4-hours chart of ETH/USD. Additionally, the trend line also coincides with the 50% Fib retracement level of the recent decline from the $146 high to $140 low. Therefore, a clear break above the $142 resistance is needed for a decent recovery.