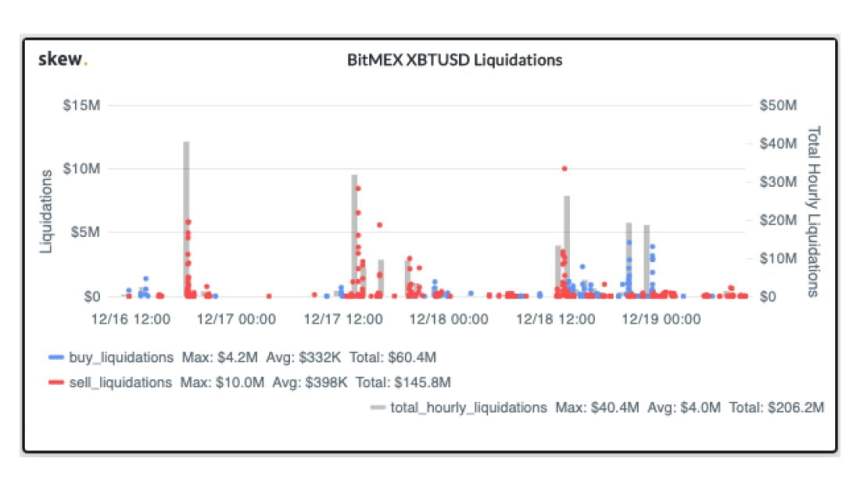

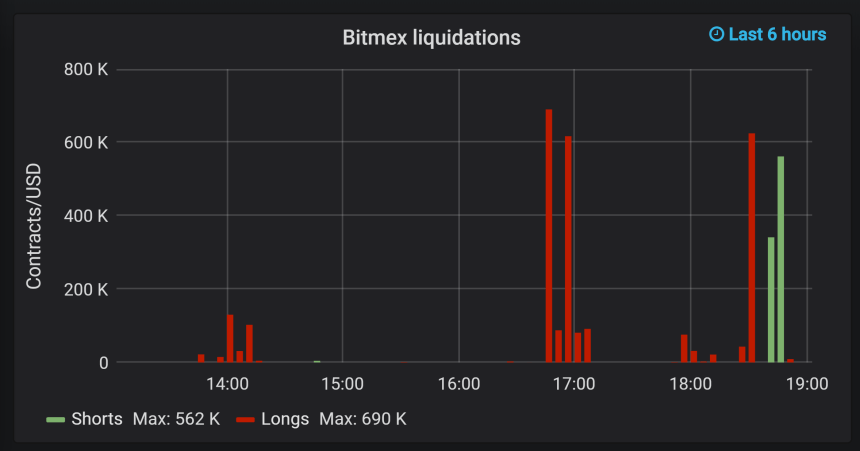

70% of liquidations were shorts

According to Skew Research, the overwhelming majority of bitcoin contract liquidations on BitMEX were shorts. The research firm said:“Not that many buy liquidations despite bitcoin jumping nearly $1,000 yesterday 70% of liquidations were SELL in last three days despite bitcoin price unchanged! Longs seem more leveraged than shorts.”

Why did bitcoin shorts stack up?

At one point, rumors spread that a well-known Chinese scam is preparing to dump almost $100 million worth of Ethereum as reported by NewsBTC.

If the price of a major cryptocurrency such as Ethereum plunges in a short period, it will naturally affect bitcoin and other large market cap cryptocurrencies.

In the short-term, the momentum gained by bitcoin through the overnight rally to $7,490 could set the dominant cryptocurrency up for an actual relief rally following a 50 percent drop since July.

In mid-2019, the price of BTC was hovering at $13,900 and the price has halved since.