Derivatives Watch Over the Crypto Market

By way of design, derivatives are complex financial contracts having their value based on that of the underlying assets. These contracts not only provide added convenience to the traders by allowing them to hedge the risks involved in the process but also ensures that the markets undergo self-correction with respect to the price of underlying assets. The increased trader activity in the crypto derivatives exchange platforms, where the asset prices are set considering the average price on multiple platforms ensures that the price of any cryptocurrency is not driven just by the dynamics of one particular platform catering to a specific geography or volumes but considers the global market sentiment in entirety to decide a fair value of that particular asset.Derivatives Trading Picks Up Pace

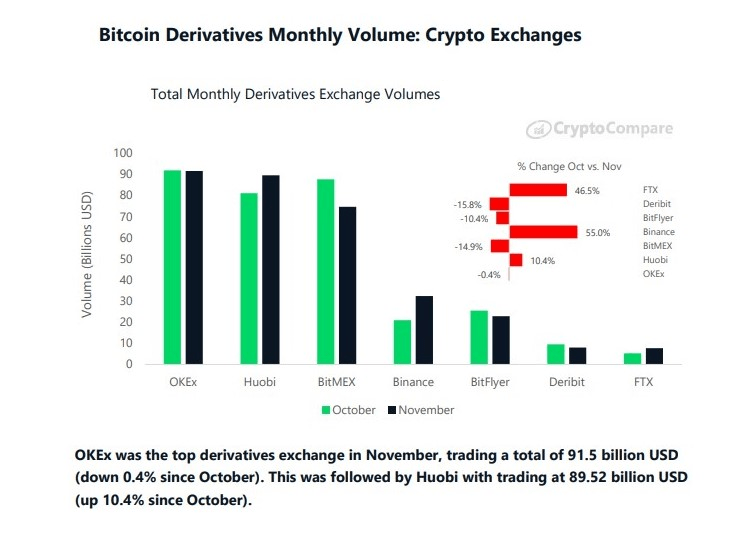

The crypto derivatives trading segment has been garnering huge volumes in the recent months, with monthly numbers crossing the $325 billion mark in the last month. The latest Monthly Exchange Report published by CryptoCompare – a leading crypto industry resource that monitors the markets and provides high-quality real-time data to institutional and retail investors shows that the four top derivatives trading platforms managed over 88% of the total trade volumes, while smaller exchanges put together registered the remaining 12% of trades. The top four platforms include OKEx (28%), Huobi (27%), BitMEX (23%) and bitFlyer (10%).

Image: CryptoCompare Monthly Exchange Review (Nov 2019)

Being one of the largest crypto derivatives trading and exchange platform in the world, has been consistently staying on top of the list, with huge volumes. It has the highest reach, spanning over113 countries while supporting an extensive list of 100+ supported tokens. OKEx has further strengthened its position in the market by continually adding new products to meet the requirements of its strong userbase. The platform has also implemented enhanced risk management features like Mark Price, Tiered Maintenance Margin Ratio (TMMR) and Forced Partial Liquidation that has found the community’s favor. The Perpetual Swap trading is also another welcome addition that helps traders to continue making profits without having to reopen new positions by paying extra transaction fees.OKEx Introduces Options Trading

The latest addition to the OKEx product portfolio is the OKEx Options Trading feature, which is now live following the successful completion of its simulation run that began on December 12, 2019. This new platform is built from scratch by the company’s competent technical team, and it incorporates a faster, more robust trading infrastructure. The Options Trading feature on OKEx allows users not just to buy but also write options for enhanced trade flexibility and transparency concerning trade prices that reflect actual market trends. It also comes with a stringent anti-manipulation system for fair settlement price based on an average of spot data from multiple exchanges. It determines the options mark price in real-time using the Black-Scholes pricing model.Big day yesterday across the board in BTC Futures – note that despite a new record in terms of volumes, Bakkt still struggled on a relative basis! — skew (@skewdotcom)With the launch of the Options Trading feature, OKEx has now become the first crypto exchange to offer C2C, Spot, Futures, Perpetual Swap and Options Trading on a single platform.

Read CryptoCompare’s full

OKEx Options Trading is . It will open to public access from January 9, 2020.