Bitcoin took a substantial hit in trading on Monday, moving from $10,000 to $9,452, in just fourteen hours. The drop, which largely came on profit-taking sentiment, also saw Binance Futures registering one of its biggest long liquidations: worth $2 million.

The overleveraged exit order did not switch Bitcoin’s long-term bias – which remains bullish, but it still ended up leaving the market sentiment in distaste. The position showed how bulls feel threatened by the cryptocurrency’s sharp retracement from $10,500-resistance. The downside moves prompted them to close their highly-leveraged Long positions.One of the biggest liquidations so far from Binance futures. — CL (@CL207)

In this case, the market saw Binance liquidating a comparatively smaller Long order of just $2 million, which might not crash the market. For instance, the derivatives platform last month liquidated $108 million worth of bitcoin long positions within a few minutes, leading to a $900 price crash in the spot market.

Though smaller, the $2 million order left the bitcoin market under the risks of facing similar downside pressures. Overleveraged traders could take cues from the whale and mirror his/her strategy – at a time when bitcoin’s uptrend is showing signs of bullish exhaustion above $10,000.Bitcoin Funding Rate

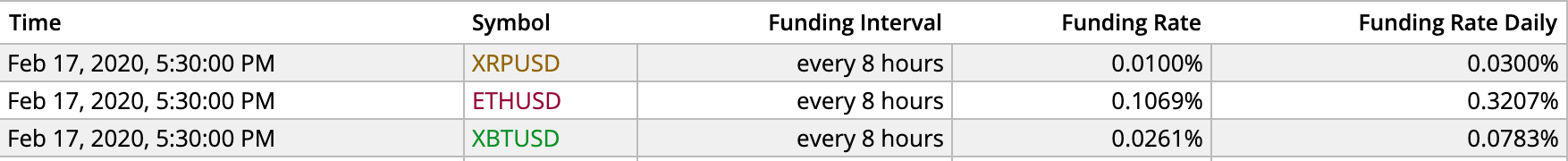

Possibilities of a Long squeeze are growing also because of funding rates. In retrospect, derivative platforms like BitMEX and Binance Futures allow traders to earn profits via holding open and leveraged Long/Short position. A positive funding rate indicates that Short pays Longs. Similarly, a negative funding rate means that Longs pay Shorts.The last recorded funding rate of XBT/USD perpetual contracts on BitMEX was 0.0261 percent. So even against a dwindling spot price, traders with opened long positions have to pay Short 0.0261 times their Long order every eight hours. That has further increased the potential of a Long Squeeze given the bitcoin price keeps falling.

Bitcoin spot rate is now targeting $9,300 as its support.