Ethereum was trading in a positive area this Wednesday after rising about 5 percent on a 24-hour adjusted timeframe.

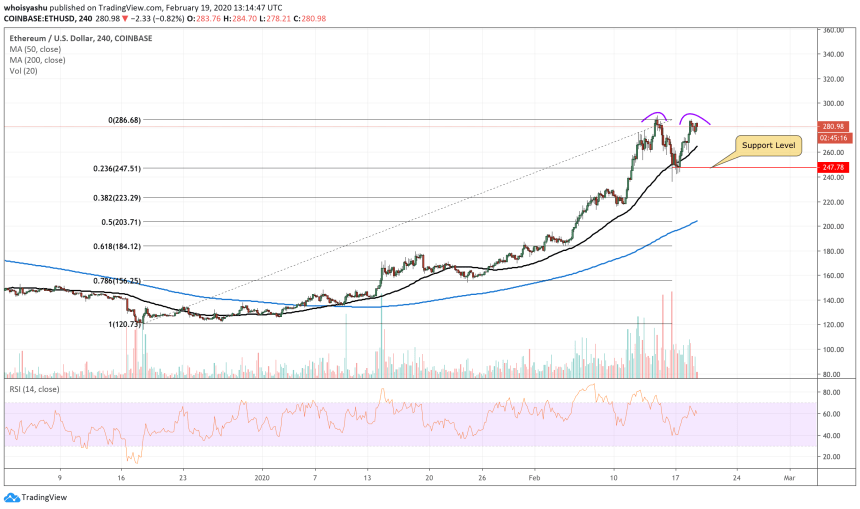

The second-largest cryptocurrency settled a new intraday high at circa $286, becoming one of the top-performing assets in the wake of a market-wide upside recovery. At its lowest, Ethereum was trading at $256 earlier this week, according to data fetched from US crypto exchange Coinbase.

/ Crossed over ~275$ on quite straight up movement since mid january w/ increasing volume (levels back to '19 bullrun that lead to $300 mark😏) Looking here for a potential retest & R/S flip as entry & signal confirmation of a new leg up w/ target at $300+ — Nico (@CryptoNTez)The jump also led market expert Alex Krüger to say that traders are actively tokens over the past week. The economist noted that the crypto’s average trading volume in the past seven days was four times larger than that recorded in the second half of 2019, adding:

“Somebody has been buying a lot of ETH.”

Double Top

Ethereum’s jump to $286 also led to the possibilities of a Double Top formation. It is an extremely bearish technical reversal pattern that occurs when an asset reaches a local top two consecutive times with minor declines in between. So it appears, Ethereum’s price action this week was somewhat similar.

Ethereum 1D Chart

The interim drop could still sustain Ethereum’s medium-term bias – which is bullish. The crypto is up by more than 140 percent after it bottomed out near $118 in December last year, which is likely to continue owing to the booming DeFi craze.