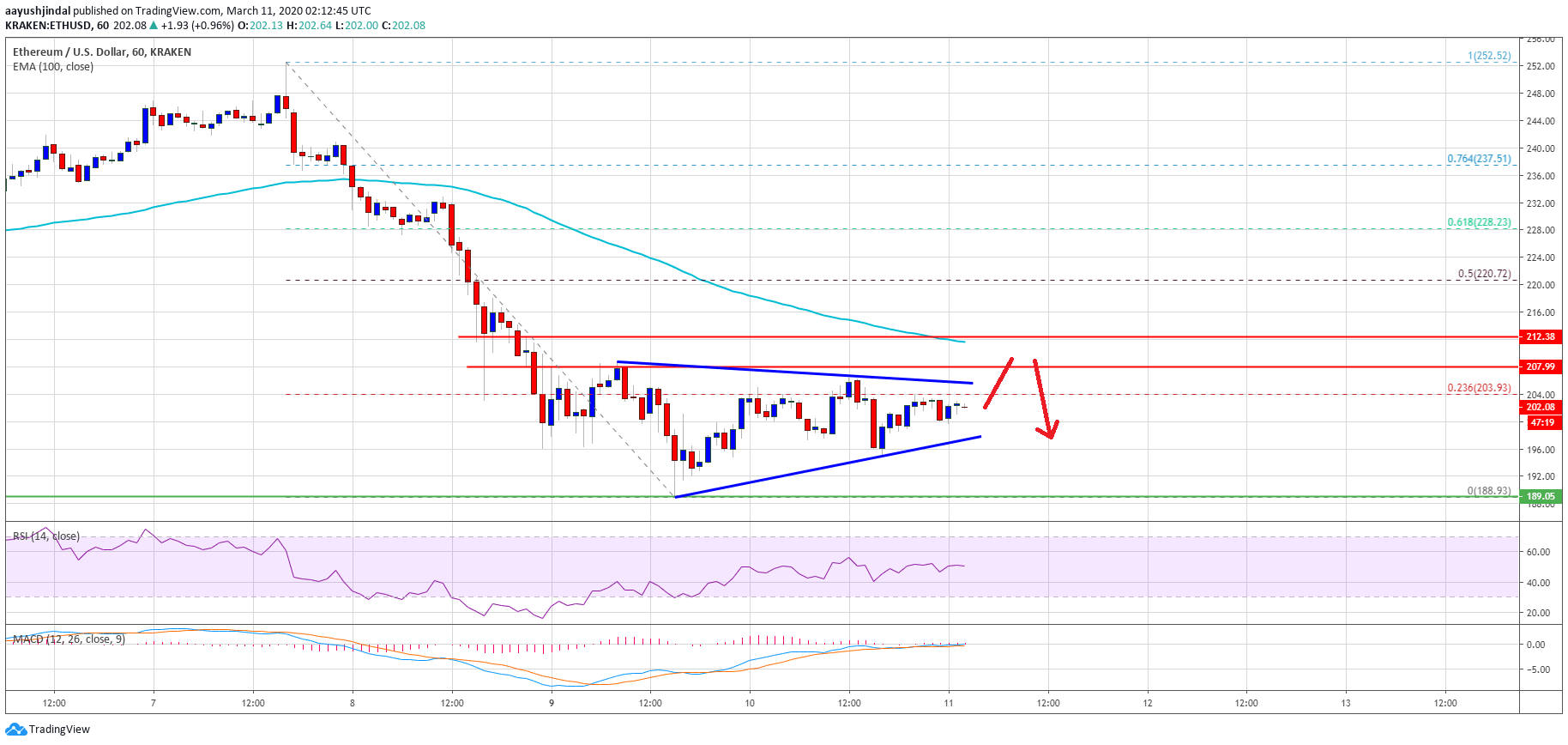

Ethereum is currently consolidating losses above the $190 zone against the US Dollar. ETH price is facing many hurdles on the upside such as $208, $212, and the 100 hourly SMA.

- Ethereum is not showing any major bullish signs above the $200 level against the US Dollar.

- The price is likely to struggle near the key $208 and $212 resistance levels.

- There is a short term contracting triangle forming with resistance near $205 on the hourly chart of ETH/USD (data feed via Kraken).

- Bitcoin price attempted a recovery above $8,000, but it failed to gain momentum.

Ethereum Price Consolidating Losses

After trading as low as $188, Ethereum started a minor upside correction against the US Dollar. ETH price traded above the $190 and $195 levels, but it remained well below the 100 hourly simple moving average.

It seems like the price is consolidating losses above the $190 and $195 levels. On the upside, an initial resistance is seen near the $205 level. The 23.6% Fib retracement level of the key drop from the $252 high to $188 low is also near the $205 zone.

Fresh Decline?

If Ethereum continues to face hurdles near the $205, $208 and $212 resistance levels, it is likely to resume its decline. A downside break below the triangle support and $195 might spark a fresh decline. An initial support is near the $190 and $188 levels. The main support is still near $185, below which there is a risk of a sharp decline towards the $165 level in the coming days. Technical IndicatorsHourly MACD – The MACD for ETH/USD is showing no major bullish signal.

Hourly RSI – The RSI for ETH/USD is currently just below the 50 level, with a bearish angle.

Major Support Level – $195 Major Resistance Level – $212