Ethereum is still struggling to clear the main $200 resistance against the US Dollar. ETH could start a short term downside correction if it continues to struggle near $200.

- Ethereum is currently trading in a range below the $200 and $202 resistance levels.

- The price is showing a few bearish signs below the $200 pivot level.

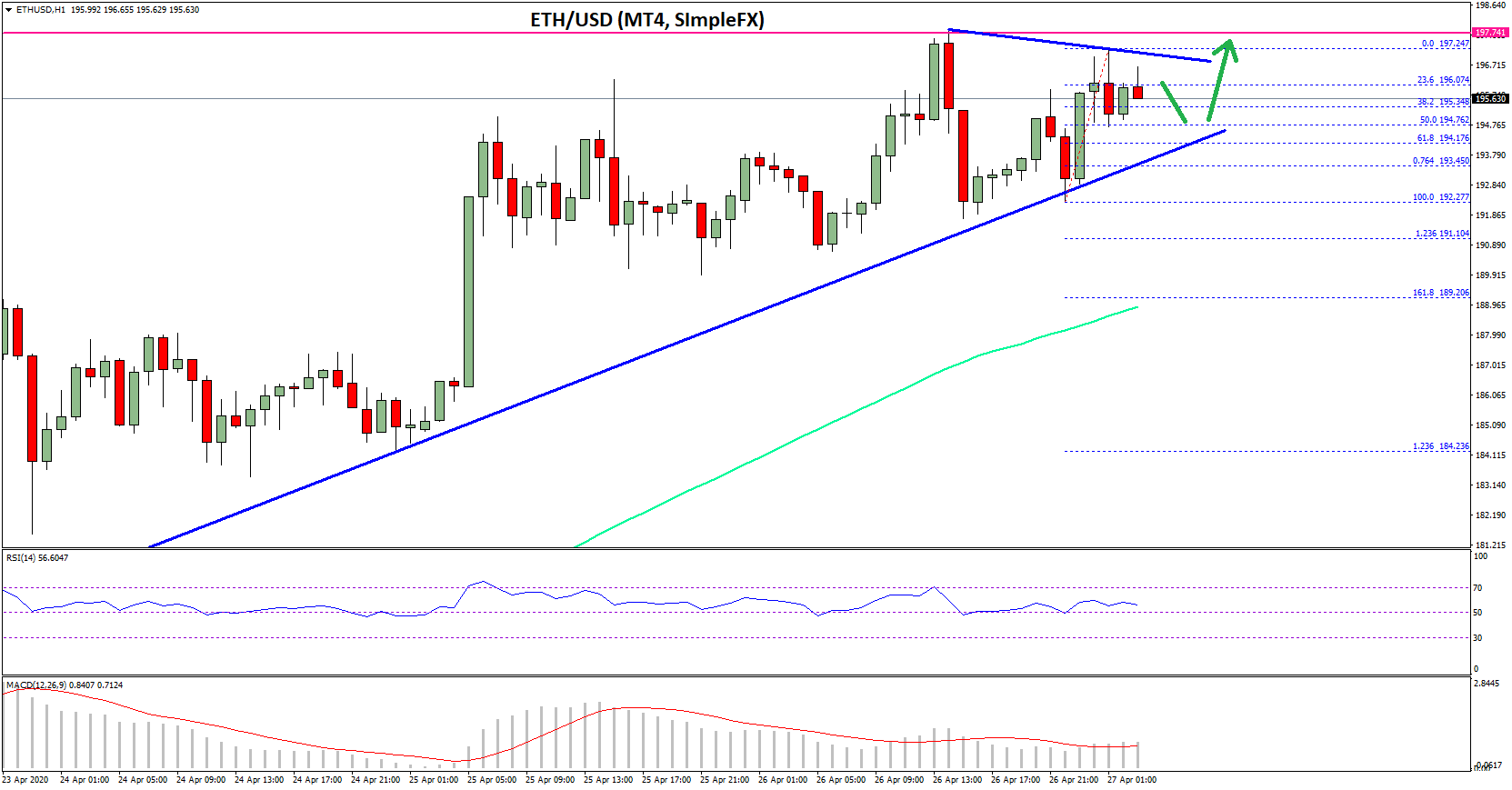

- There is a major bullish trend line forming with support near $194 on the hourly chart of ETH/USD (data feed via SimpleFX).

- The pair could either rally above $200 or start a downside correction towards the $188 level.

Ethereum Price Facing Key Resistance

In the past few sessions, there were mostly bullish moves above the $190 level in Ethereum against the US Dollar. ETH price is forming a strong support base above $190, but it is also struggling to gain momentum above the $198-$200 resistance area.

Recently, there was a fresh upward move from the $192 swing low. The price climbed above the $196 level, but it failed to continue above the $198-$200 resistance area. A high is formed near $198 and the price is currently consolidating.

On the upside, Ether buyers are facing a crucial resistance near the $200 level. A successful daily close above the $200 level is needed for a sustained upward move. The next key resistance above $200 is near $212. Any further gains could lead the price towards the $220 and $225 levels.

Downside Correction?

Ethereum is clearly facing a major hurdle near the $200 level. If the bulls continue to struggle near the $200 level, there is a risk of a bearish reaction in the near term. A downside break below the $194 support might lead the price towards the $190 level. The first key support is near the $188 level, below which it could test the $180 level. Technical IndicatorsHourly MACD – The MACD for ETH/USD is currently losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is still well above the 50 level.

Major Support Level – $194 Major Resistance Level – $200Image from unsplash