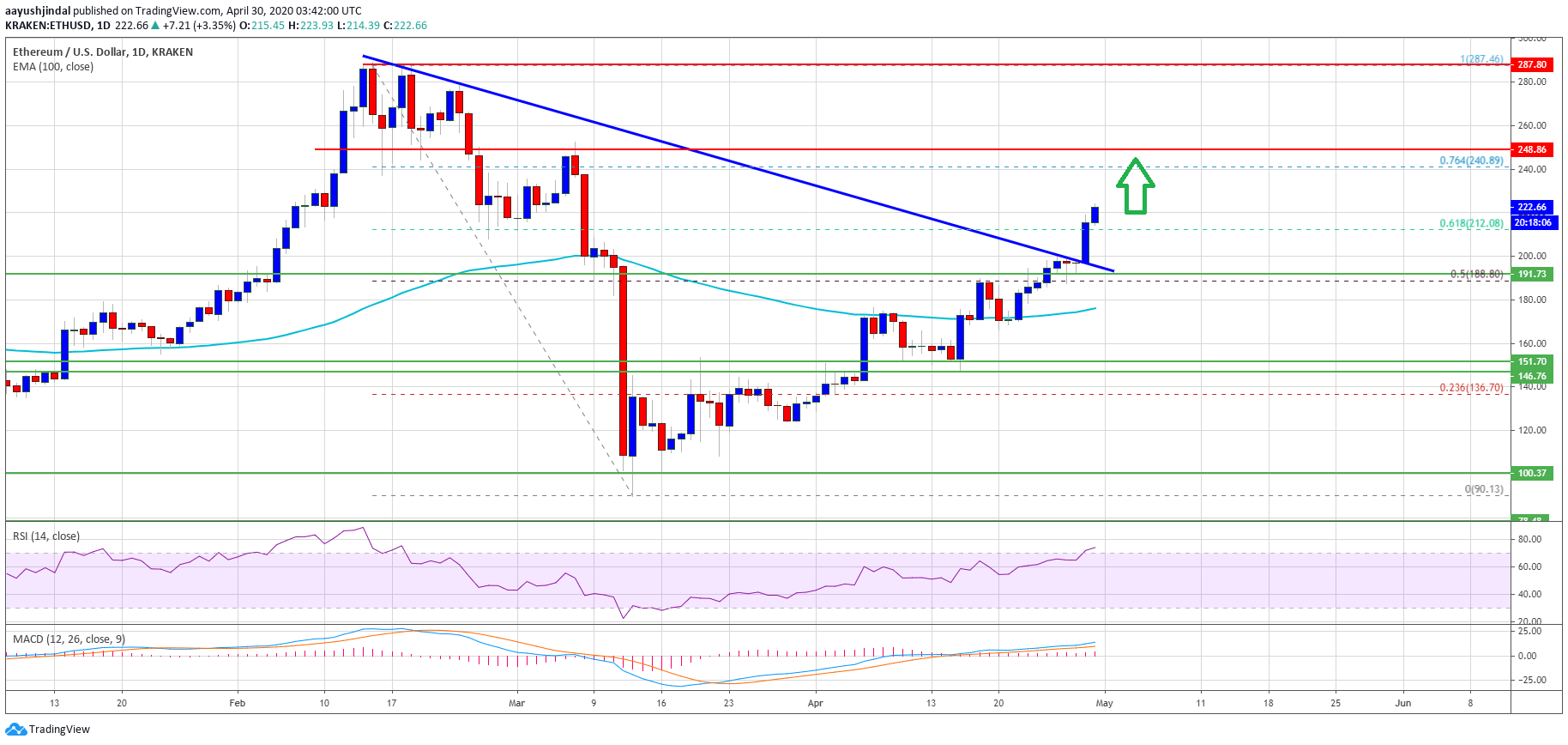

Ethereum is up more than 12% and it broke the $220 resistance against the US Dollar. ETH price is likely to continue higher and it could even test the $240 and $250 levels.

- Ethereum is surging and it recently broke the $215 and $220 resistance levels.

- The price is now trading well above the $200 pivot level and the 100-day simple moving average.

- There was a break above a major bearish trend line with resistance near $200 on the daily chart of ETH/USD (data feed via Kraken).

- The pair is likely to continue higher towards the $240 and $250 resistance levels.

Ethereum Price Primary Target Hit

Yesterday, we discussed the chances of a strong rise in Ethereum above the $200 resistance against the US Dollar. ETH price did gain bullish momentum above $200 and surged more than 12%.

Bitcoin also rallied more than 15% above $8,000 and $8,500. It sparked more upsides in Ether above the $210 level and the price tested the first bullish target of $220 (as discussed in yesterday’s post).

Chances of a Downside Correction?

If Ethereum fails to clear the $240 resistance level, there are slight chances of a downside correction. An initial support is near the $212 level. The first major support is now near the $200 level and the same broken bearish trend line. If the price fails to stay above the key $200 support zone, there is a risk of a larger correction towards $185. Technical IndicatorsDaily MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Daily RSI – The RSI for ETH/USD is currently near the overbought levels.

Major Support Level – $200 Major Resistance Level – $250 Risk disclaimer: 76.4% of retail CFD accounts lose money.