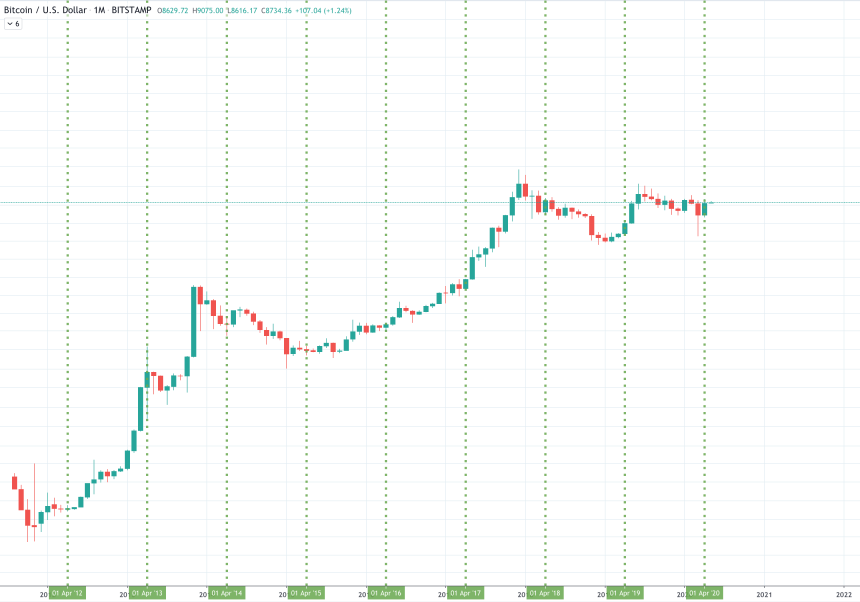

Today is a new month, and that means that last night’s daily close also market the April candle close on Bitcoin monthly price charts.

Last night’s close marked the first-ever cryptocurrency’s best April performance since 2013, even easily besting the April 2019 rally that took Bitcoin to over $13,000. Is this a sign that the next peak will be even higher?Bitcoin April Monthly Close Was Most Bullish Since 2013

Bitcoin price exploded from an April low of $6,100 to as high as $9,500 at the peak.

's performance in April was the best since 2013. As shown by the violin plot, also has a relatively high average return during May (the 3rd largest after April & November). What do you think is in store for May 2020? Bullish or Bearish? — jholme5.lens (@JHolme5)

Related Reading | Sell Bitcoin in May and Go Away? Ominous June Event Could Cause Crash

Also depicted on the chart, during the following month in May also has been historically bullish, suggesting that more upside is ahead.

These Factors Stand in the Way of a New Crypto Bull Run

The April monthly candle closed with an over 35% rise from the bottom of the candle shadow, to the body close. The price closed above the previous red candle, forming a bullish engulfing candle.These candlestick formations often signal a short-term reversal, but top market experts warn that any reversals are often short-lived and result in a further downtrend.

Related Reading | Top Technical Analyst Claims Latest Bitcoin Engulfing Candle Isn’t Bullish

Bitcoin has to face many other challenges as well. While the halving is seen as a bullish event, it could cause miners to further capitulate as the cost of production grows.

There’s also Mercury in retrograde coming this June, which could cause prices to tank starting in the next month.

Finally, there’s a saying across financial markets, to. This would have worked decently in Bitcoin last May, as the asset topped out the next month and fell into a downtrend yet again.The thought is that markets are cyclical and even seasonal, and such recurrence has led to the belief that assets perform the worst during the summer months, then pick up again around October for what is called the Halloween effect.

Of course, Bitcoin‘s halving and the expected impact on supply and demand could prove to be far too bullish for bears to keep the price of the cryptocurrency down any further, as is evident by the amount of liquidates short positions this week.

Featured image from Pixabay