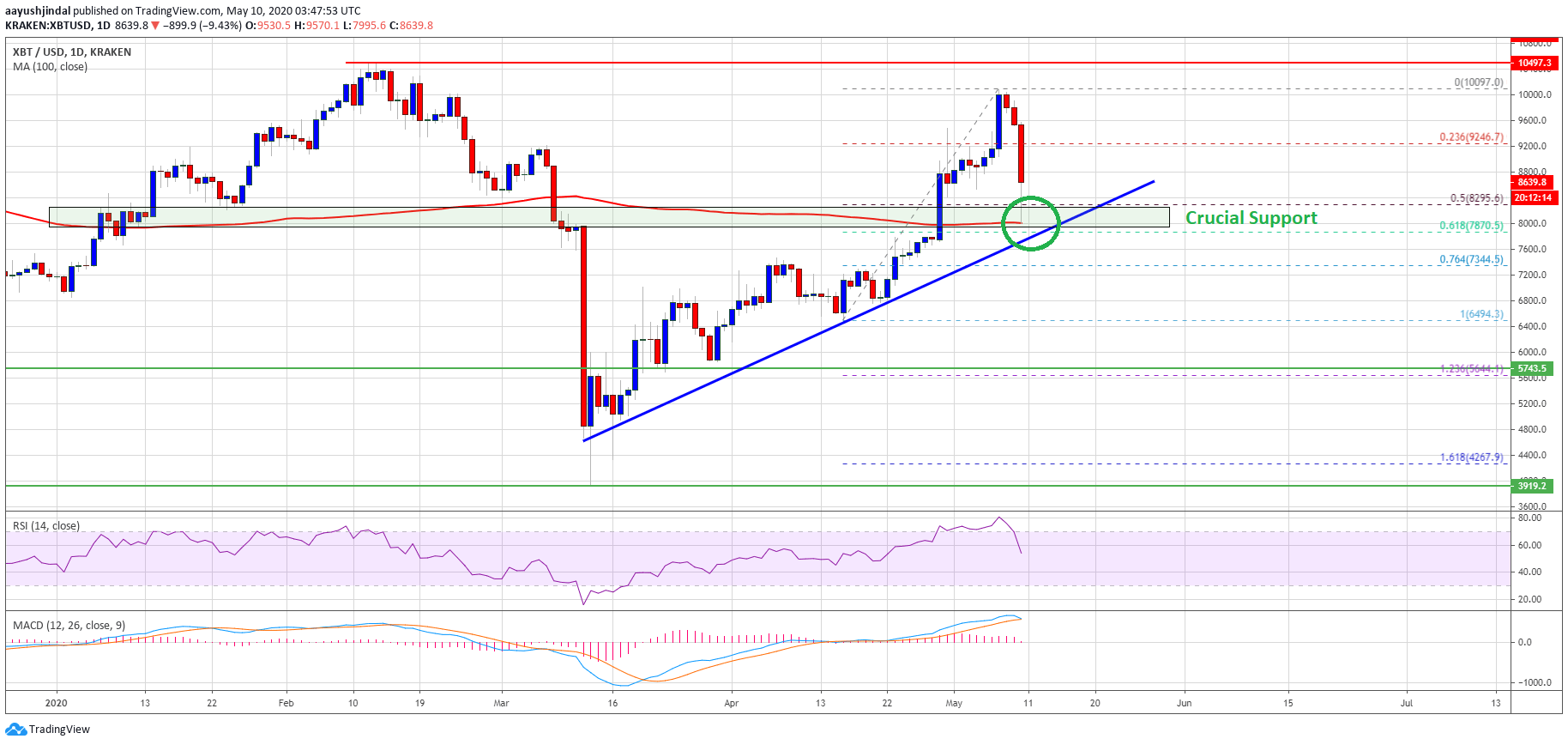

Bitcoin is down more than 10% from the $10,090 high against the US Dollar. BTC found support near the 100-day simple moving average and it could start a fresh increase.

- Bitcoin climbed to a new monthly high at $10,097 before starting a downside correction.

- The recent pre-halving dump found support near the 100-day simple moving average.

- There is a major bullish trend line forming with support near $8,000 on the daily chart of the BTC/USD pair (data feed from Kraken).

- Ethereum and ripple are also down more than 10% and both declined below key supports.

Bitcoin Dives Before Halving

This past week, bitcoin price extended its rally above the $9,200 resistance against the US Dollar. BTC price even broke the $9,500 resistance and settled well above the 100-day simple moving average.

It traded above the $10,000 level and formed a new monthly high at $10,097. It started a strong decline from the $10,097 high and broke many supports near the $9,500 and $9,200 levels.

Dump and Pump

If the 100-day SMA remains intact, bitcoin price is likely to start a fresh increase above the $8,800 and $9,000 resistance levels. The first major resistance is near the $9,200 level, followed by $9,500.

A clear break above the $9,500 resistance may perhaps open the doors for a fresh push towards the $10,000 level in the near term. Any further gains will most likely call for a strong surge towards the $11,000 and $11,200 levels. Technical indicators: