- A three-day rally that took the bitcoin price near $10,000 Thursday took a U-turn on profit-taking sentiment.

- The cryptocurrency fell to as low as $9,226 on Friday on US crypto exchange Coinbase, albeit sharply recovering into the European trade session.

- The price move downhill came as the U.S. stock futures slid on trade war worries, Fed’s warning about weak economic growth, and rising unemployment claims.

The benchmark cryptocurrency jumped 16.15 percent in three days to hit $9,943 on Coinbase. The level served day traders opportunities to extract short-term profits. The capitulation ensued into the European trading session Friday, taking prices to as low as $9,226.

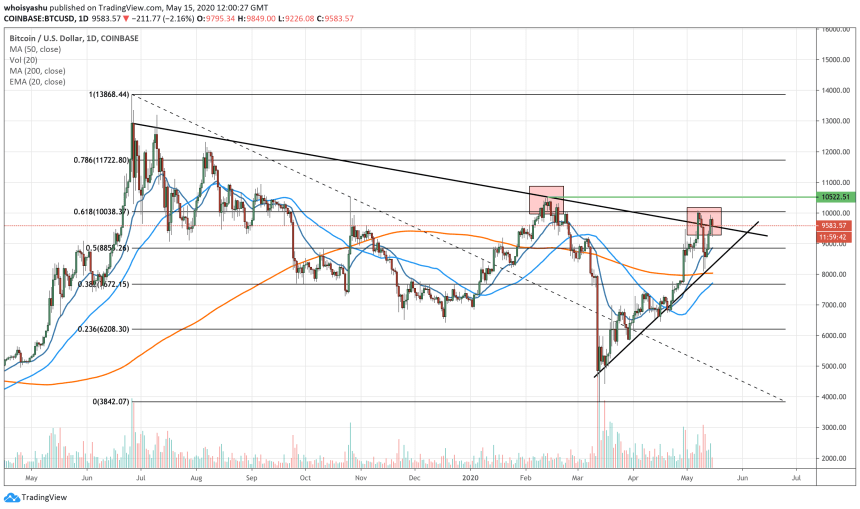

Technical readings on Bitcoin’s daily chart showed the cryptocurrency near a resistance confluence. The red bars, as shown in the chart above, represented areas with higher selling sentiment. The current block contained a long-term descending trendline that capped the price from pursuing full-fledged upside moves. It also contained $10,000, a psychological resistance level.

Fed Hype

Bitcoin’s exponential gains earlier this week came after . Trade pundits were expecting a grim market outlook, a sentiment that sent the U.S. equities lower on Wednesday. A day later, the U.S. Labor Department dropped another bad news on the market. Its latest jobless data showed that the number of unemployment claims surged to 36.5 million. Bitcoin held its gains around the announcement. The Dow Jones, the S&P 500, and the Nasdaq Composite fell, on the other hand.What’s Next for Bitcoin

Bitcoin was trading 1 percent higher into Friday, waiting to retest $10,000 as its interim resistance. But the cryptocurrency lacked volume to move beyond the descending trendline – breaking above it could declare a medium-term bull market.Meanwhile, a deeper correction in U.S. stock market could increase downside risks in the bitcoin market. That has nothing to do with correlation but investors’ tendency to sell the profitable cryptocurrency to cover their losses from traditional assets.

Photo by on