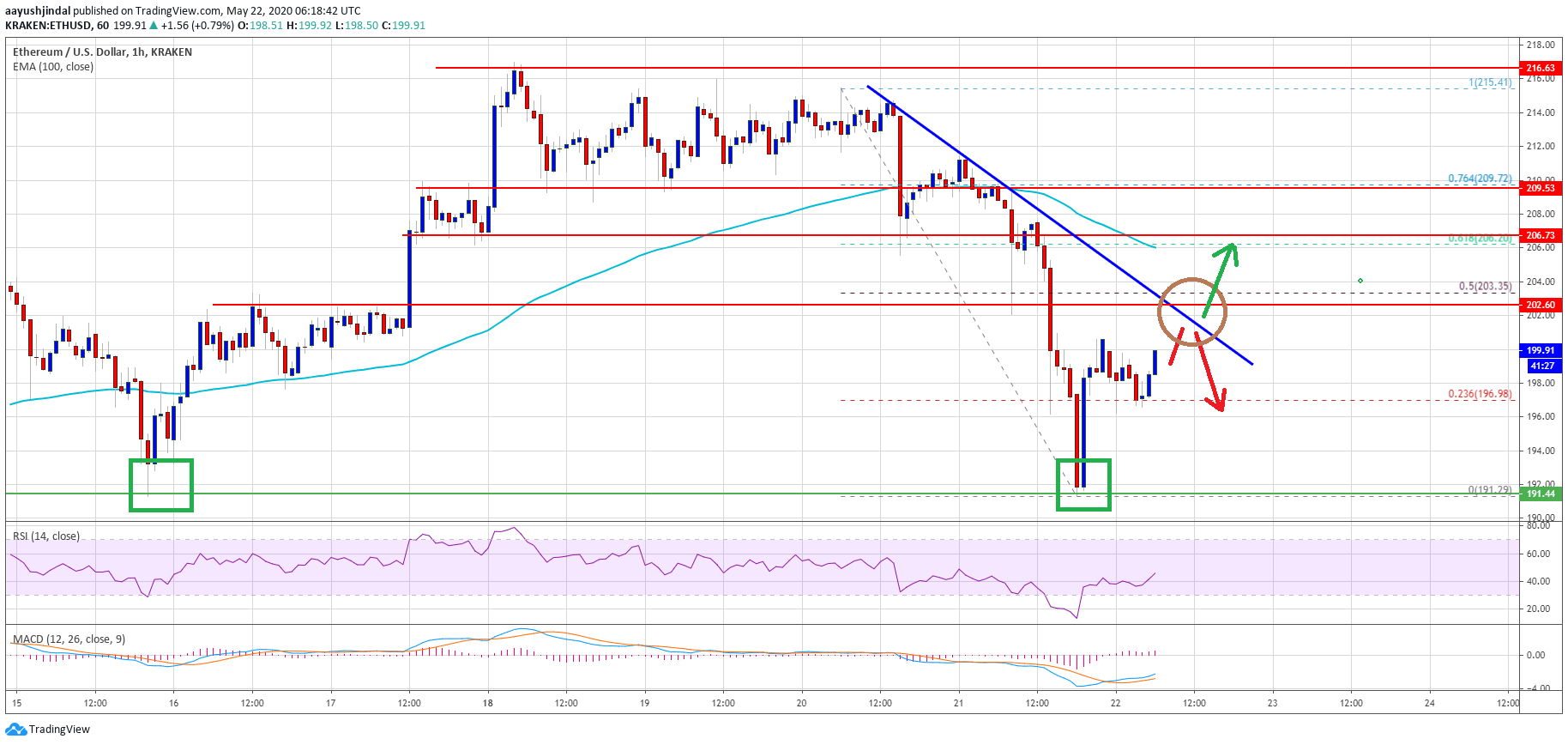

Ethereum nosedived below the $202 support zone against the US Dollar. ETH price revisited the $192 support and it seems like there is a key double bottom pattern forming near $192.

- Ethereum declined more than 5% and it tested the main $192 support zone.

- It seems like there is a double pattern forming near the $191-$192 zone.

- There is a key bearish trend line forming with resistance near $202 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could either fail near $202 or start a major upward move towards the $210 level.

Ethereum Price Could Recover Sharply

The past few sessions saw a sharp rise in selling on Ethereum and bitcoin against the US Dollar. BTC price dropped below the $9,250 support level and ETH price nosedived below the $200 handle to move into a bearish zone.

The recent decline was such that ether even broke the $195 level and settled below the 100 hourly simple moving average. However, the main $191-$192 support zone acted as a strong buy zone.

Another Failure?

If Ethereum fails to clear the $202 and $204 resistance levels, there could be another decline. An initial support on the downside is seen near the $195 level. The main supports are near the $192 and $191 levels. If the bulls fail to protect $191, the price is likely to decline sharply towards $182 and $180.Hourly MACD – The MACD for ETH/USD is slowly gaining pace in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now recovering nicely towards the 50 level.

Major Support Level – $192 Major Resistance Level – $204 Risk disclaimer: 76.4% of retail CFD accounts lose money.