Reason #1: On-Chain Outlook Still Bearish for Bitcoin

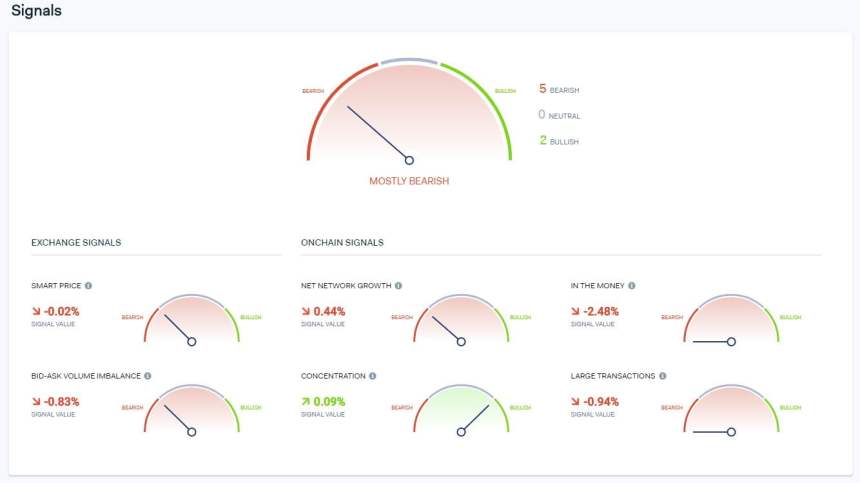

— a blockchain intelligence firm — the on-chain and order book outlook for Bitcoin is currently “mostly bearish.” Five out of seven of the firm’s proprietary indicators — including bid-ask imbalance, in the money, and large transactions — are currently in bearish territory, corroborating the downtrend that began last week.

“The GNI dropped 13 points this week and with $BTC no longer testing $10k, we may be seeing a regression back into bearish territory if Bitcoin’s on-chain activity and overall market health continue to decline.”

Reason #2: Miner Capitulation On the Horizon

Adding to the bear trend, there’s an ongoing miner capitulation event, which has been caused by the 50% reduction in block rewards. Miners with tight margins due to high electricity costs and older mining machines have been forced to turn off their machines in the wake of the halving, driving hash rates lower.On Monday morning, they confirmed a bearish cross — a sign seen just weeks before BTC crashed from $6,000 to $3,150 at the end of the 2018 bear market. Bearish crosses in the Hash Ribbons have also preceded previous drops in the Bitcoin price, suggesting the same could happen this time around.

Featured Image from Shutterstock