Update (3 hours after the close): Bitcoin has closed the May candle above the crucial $9,360 level, managing to take $9,450. Analysts say this is “incredibly significant for bulls” and may show that there is more upside in the works.

This is an assertion that can be corroborated by other market factors. For instance, blockchain data startup Glassnode recently noted that 60% of all BTC in circulation “hasn’t moved in over a year, showing increased investor HODLing behavior.”

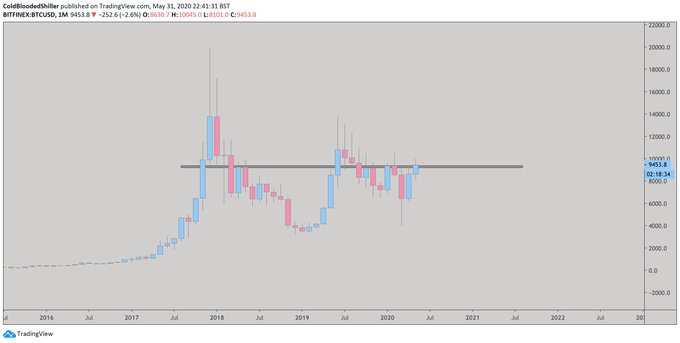

In just a few minutes’ time, Bitcoin will close May’s price candle. Analysts say that this close will be crucial for indicating in which direction the cryptocurrency market heads next. A region of importance that many analysts are eyeing is the low-$9,000s. As one analyst explained:

“We’ve not had a Monthly close above 9360 in nearly 12 months. Rejections from this level have led to tests of $6k and eventually $3k.”Indeed, when Bitcoin failed to surmount this level in February, prices dove to $3,700 during March’s capitulation. And when BTC was rejected from this level in 2018, there was a brutal bear market to $3,150 in the ten months that followed. $9,360 is also around where the downtrend formed after the $20,000 high currently sits, adding to its technical importance. Right now, things are coming down to the wire in terms of Bitcoin closing above this level. The asset trades at $9,400 as of the time of this article’s writing and the close is just a short while away,

Bitcoin Being Dragged Down by Stock Market

Bitcoin’s retracement to $9,400 ahead of the monthly candle close comes after it surged as high as $9,700 on Saturday, wrested higher by Ethereum. The underperformance of the flagship cryptocurrency seems to be related to a reversal in the S&P 500 futures, which reversed after passing 3,000 points last week. The futures market is currently down 1% during the Sunday evening trading session, which is falling in response to a number of events. This is bearish for Bitcoin because the markets are correlated. The Kansas City Federal ReserveOverall, our results suggest that the 10-year Treasury has generally exhibited safe-haven behavior, gold has occasionally exhibited safe-haven behavior, and Bitcoin has never exhibited safe-haven behavior since its introduction. Moreover, the introduction of Bitcoin does not appear to have materially changed the safe-haven properties of government bonds or gold. Instead, Bitcoin at times appears to have behaved more like a risk asset than a safe haven.

Featured Image from Shutterstock