There is nothing new in Wall Street

Jesse Livermore was once considered the greatest trader of all time. In his biography titled Reminiscences of a Stock Operator, which is one of the best-sellers on investment, Livermore told us how he felt about Wall Street when he first arrived there: “Another lesson I learned early is that there is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.” Repeatedly, history proved that this statement is right. What is interesting is that when Livermore, one of the richest traders in the world at the time, committed suicide, he had liabilities greater than his assets.

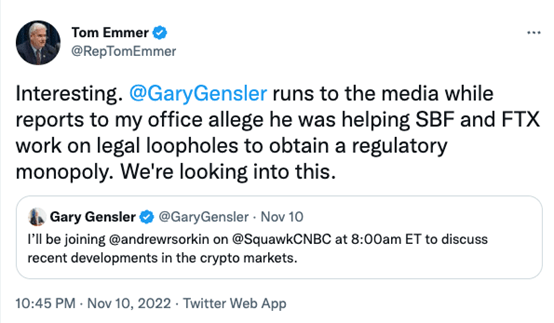

What happened with FTX is nothing new in Wall Street. For instance, Lehman Brothers, which had $613 billion in debt, also sought bailouts from many institutional investors, but the Wall Street executives refused its request after going through the accounts of this legendary investment bank. Ultimately, Lehman Brothers had no choice but to file bankruptcy protection.

SBF: Guardian or Betrayer?

After the Luna meltdown, many reports suggested that FTX offered help to many institutions hurt by the incident, though many acquisitions did not actually take place. As the media painted SBF as a crypto savior, the man was lobbying U.S. regulators in an attempt to pass the

The ultimate solution for crypto

Judging from the ultimate collapse of FTX, crypto is not the best choice for SBF. Under his leadership, FTX was the judge in a game in which market maker Alameda was a player. Apparently, the former Wall Street genius regarded crypto as a way to hoard wealth through speculation while ignoring the crypto principles of decentralization and transparency. Crypto advocates equality for all, which is the exact opposite of the tenets of Wall Street. As a long-term believer in crypto assets and blockchain technology, CoinEx has always prioritized technology and product while striving for transparency, ease of use, and reliability. It is also one of the first crypto exchanges that promised to process all withdrawals in time and never misuse users’ assets. Furthermore, always aiming to offer ease of use, CoinEx has worked to eliminate the restraints of conventional finance by providing user-friendly crypto products and services that transcend all language barriers and geographical restrictions. The exchange aims to offer services to more retail users planning to trade crypto worldwide, thereby making crypto trading easier. As one of the leading CEXs, CoinEx has worked to push for crypto progress, instead of confining itself to its own interests. Mining pools, DEXs, wallets, and public chains are all indispensable parts of the crypto ecosystem. ViaBTC Group, CoinEx’s parent company, provides a wide range of services that span multiple fields, covering the mining pool, decentralized wallet, public chain, and capital investment. In addition, ViaBTC also offers tech and funding support to many DeFi and NFT projects, including DEXs, to meet different user demands, ensure reliable protection for its assets, and facilitate the joint progress of all players in the crypto industry. FTX’s fall does not represent the failure of crypto. Sure, it is one of the iconic crypto companies built by traditional financial practitioners, but this is not the first time a Wall Street elite failed, and it won’t be the last time either. Obviously, if Wall Street elites still wish to “conquer” crypto, the traditional banking model of fractional reserves and misusing user assets would no longer work. The FTX incident showed that the crypto community still has a long way to go. Despite that, CoinEx is confident that blockchain and crypto technologies will start a revolution in finance. FTX’s fall also reminded us that the crypto space should be a party of Wall Street elites, and crypto companies can only achieve real success by focusing on the demand of the general public. For CoinEx and many other crypto believers, the best crypto solution is to clear away financial barriers, eliminate the information gap between retail investors and institutional investors, and allow every single person to enjoy accessible, transparent crypto services.Source: Internet[/vc_column_text][/vc_column][/vc_row]