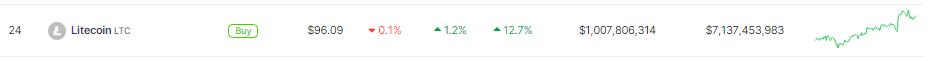

LTC maintains a strong weekly performance. Source:

Potential Litecoin Price Bump In The Offing

One key driver of optimism is the apparent breakout from a bullish triangle pattern. This technical indicator, identified by popular analyst World of Charts, suggests a potential price surge in the coming months, with some analysts even predicting a climb to $400.Breakout & Retest Has Already Confirmed Send It Towards 400$ Now — World Of Charts (@WorldOfCharts1)Further fueling the bullish sentiment are on-chain metrics like the MVRV ratio, which suggests the coin might not be overvalued yet. Additionally, a rise in Daily Active Addresses and transaction volume indicates increased investor activity and trading.

Bitcoin is now trading at $70.714. Chart:However, not all signals are green. The Network-to-Value (NVT) ratio, which indicates potential overvaluation, has also spiked alongside the price increase. This raises concerns about a possible price correction if the market deems LTC to be overvalued.

LTC Hashrate Remains Stable

Meanwhile, the hashrate, a measure of computing power dedicated to mining LTC, has remained stable, suggesting no significant changes in miner activity. However, some analysts worry that a potential drop in hashrate could hinder future growth. The overall picture for Litecoin presents both opportunities and challenges. The recent price surge and positive on-chain metrics are encouraging signs. However, potential overvaluation concerns and conflicting technical signals urge caution. Investors should closely monitor both technical and fundamental factors before making any investment decisions. The coming weeks will be crucial for LTC. If the uptrend continues and the price breaks through key resistance levels, a significant rally could be on the horizon. If overvaluation concerns materialize or the broader market takes a downturn, a price correction could occur.Featured image from Pexels, chart from TradingView

LTC maintains a strong weekly performance. Source:

LTC maintains a strong weekly performance. Source: