Stone Ridge purchased the Bitcoin via subsidiary firm , one of the few companies with a BitLicense issued by the New York State Department of Financial Services (NYSDFS).

Stone Ridge becomes the latest high profile corporation to announce a move into Bitcoin.MicroStrategy broke the internet last month when it announced a change in its treasury policy to include Bitcoin. To date, it has converted $425 million of cash into BTC.

Not to be outdone, Jack Dorsey’s Square soon followed. They announced spending $50 million in making the switch.

The U.S Economy is on the Ropes

It doesn’t take a genius to know that the macroeconomic picture looks bleak. In response to the downturn, the Federal Reserve has come out, all guns blazing, by adding a total of to the money supply.

Source:The knock-on effects of an out of control balance sheet have yet to be fully felt. But critical metrics, including debt-to-GDP, give insight into what is coming.

Source:As such, Bitcoin is starting to gain wider public attention on the grounds of it being a deflationary and scarce asset.

Bitcoin Hailed as the Answer to Dire Economic Woes

A ballooning Fed balance sheet and high debt-to-GDP ratio are facts that have not escaped the attention of corporate America.On that, MicroStrategy CEO Michael Saylor spoke candidly about his inflation concerns. But more than that, during these uncertain times, Saylor simply sees Bitcoin as better than cash.

What’s more, with no solution in sight, Saylor believes the floodgates have opened, and more corporations will eventually make the move into Bitcoin.“MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.”

As the trillions of dollars on the balance sheets of banks, asset managers, insurance firms, endowments, & family offices begin their migration to the universe, they will need firms like NYDIG to guide them. $1 billion down, more to go. — Michael Saylor⚡️ (@saylor)MicroStrategy was the first listed firm to buy BTC with corporate funds. Although some shareholders voiced their concerns with that, the market did not. MicroStrategy shares are up 20% since the Bitcoin bombshell was dropped last month. As the macro picture continues to deteriorate, it’s hard to believe that boardrooms of cash-rich firms are not discussing Bitcoin right now.

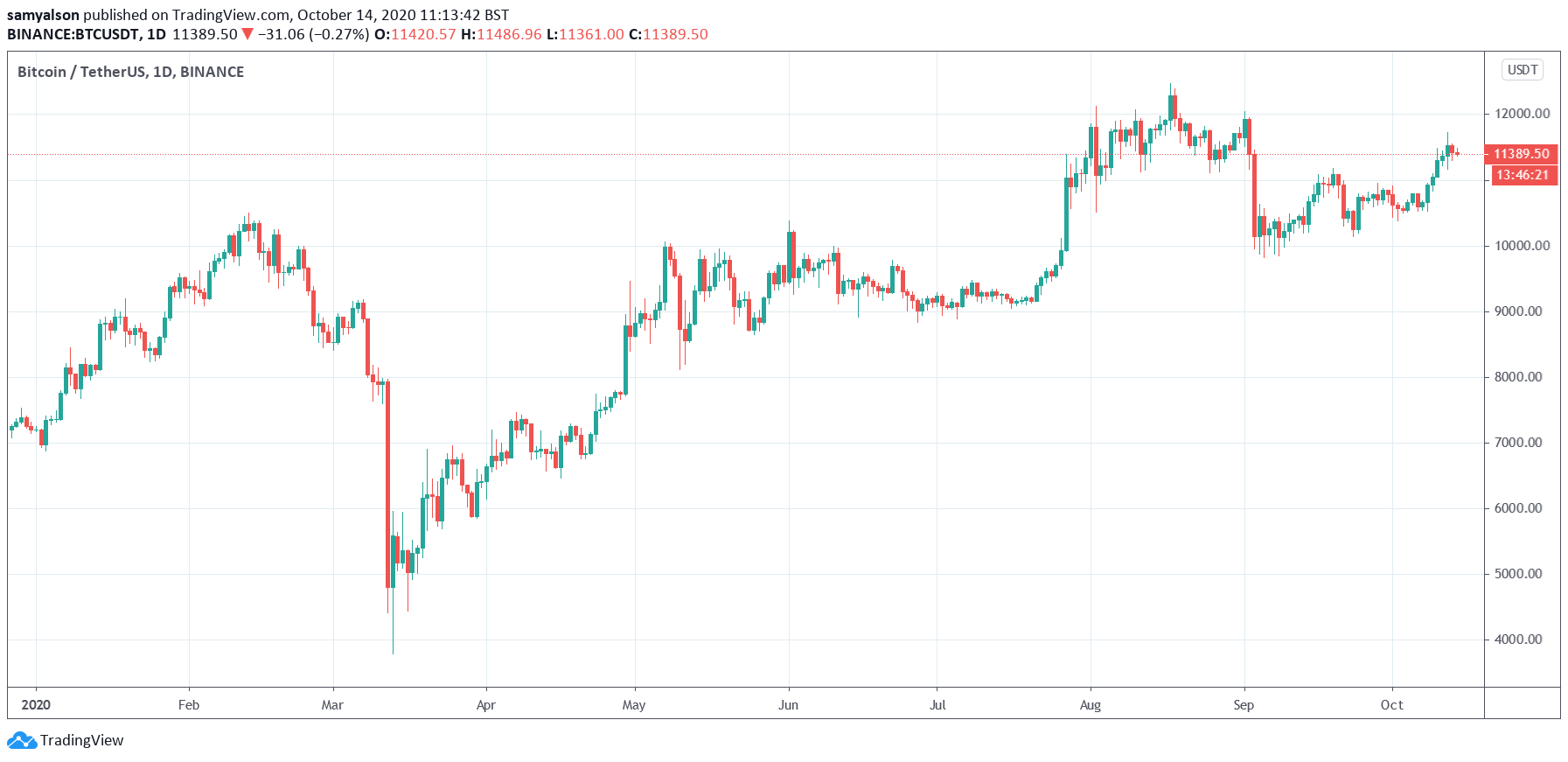

Source: