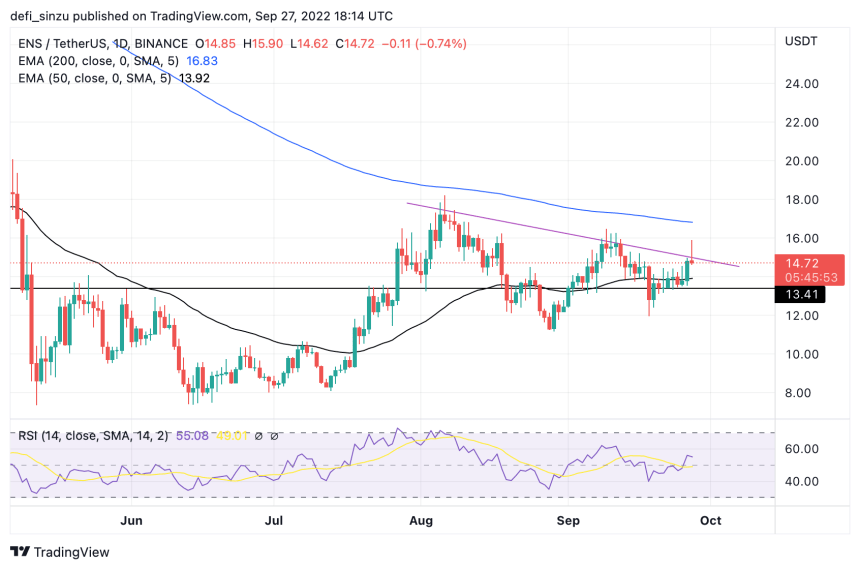

- ENS price ranges break above 50 EMA on the daily timeframe.

- ENS price gets rejected as price attempts to break out of an asymmetric triangle.

- The price holds above daily support and could retest daily resistance for a possible break.

Ethereum Names Service (ENS) price showed bullish strength recently, but the price has struggled to break above key resistance against tether (USDT). With Ethereum Name Service (ENS) facing resistance to breaking above $16, acting as a tough resistance area, the price of ENS continues to trade above daily support as the price aims to break key resistance. (Data from Binance)

Ethereum Name Service (ENS) Price Analysis On The Weekly Chart

After bouncing from its weekly low of $9 as a price rally to a high of $17 before facing a stip rejection, the price of ENS has recently declined, and the price has continued to struggle to rejuvenate its bullish trend. The price of ENS remains above a critical support level of $14, acting as a good demand zone for buy orders. For ENS to have a chance to trend higher, the price must break through its weekly resistance of $16.Weekly resistance for the price of ENS – $16-$17.

Weekly support for the price of ENS – $14.

Price Analysis Of ENS On The Daily (1D) Chart

A break and close above $16 could see the price of ENS retest a high of $20.

Daily resistance for the ENS price – $16.

Daily support for the ENS price – $14.

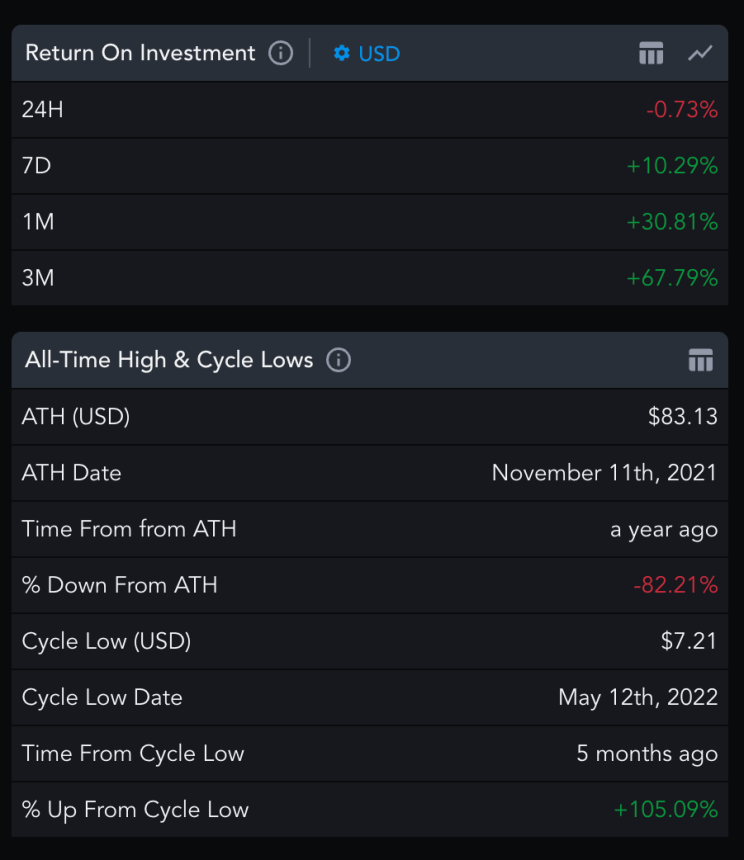

Onchain Analysis Of ENS

Featured Image From zipmex, Charts From Tradingview and Messari