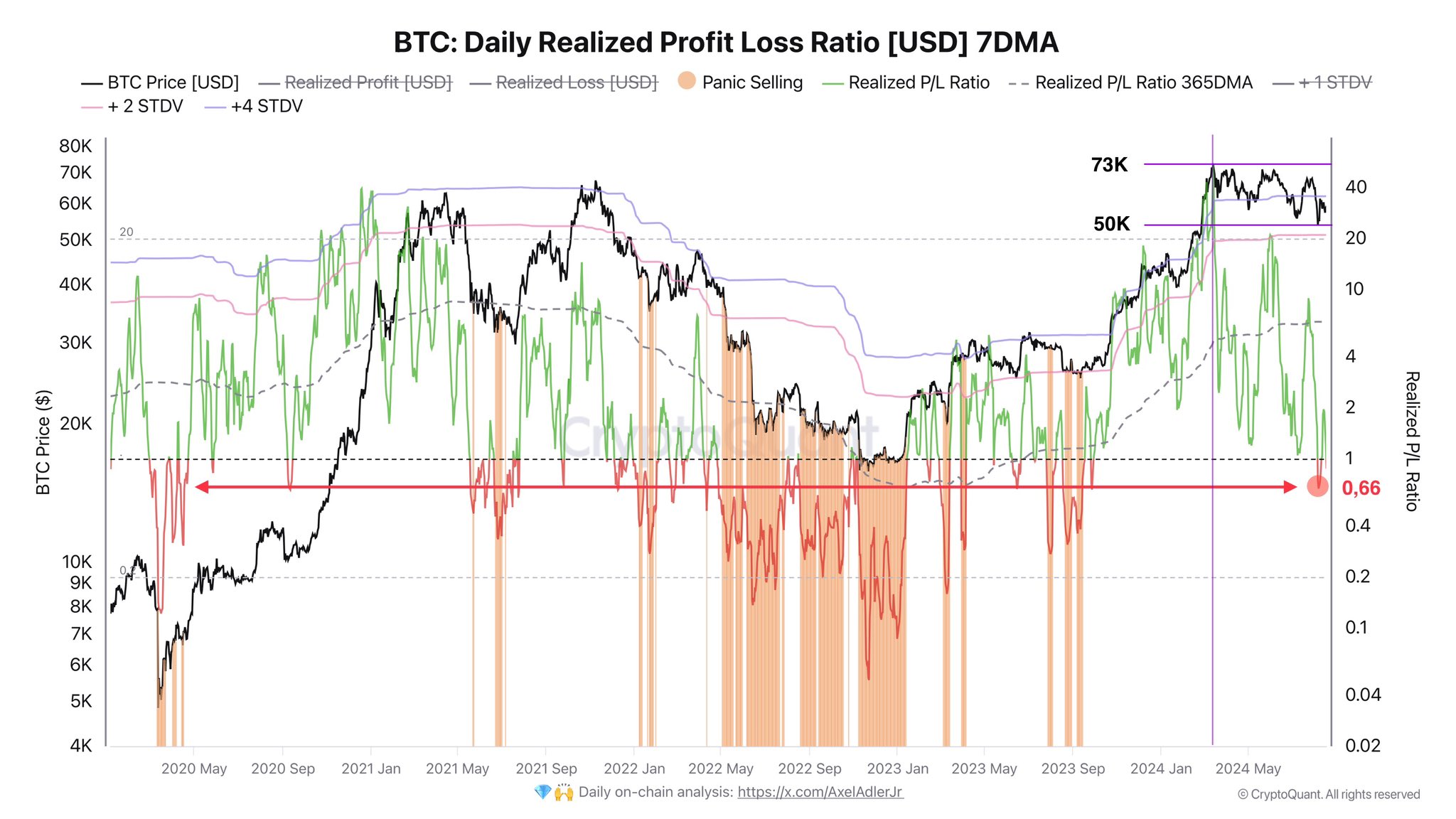

Bitcoin Daily Realized Profit Loss Ratio Has Dipped Below 1 Recently

As explained by CryptoQuant author Axel Adler Jr in a new on X, realized losses have started to exceed profits recently. The on-chain metric of interest here is the “Daily Realized Profit Loss Ratio,” which, as its name suggests, tells us about how the Bitcoin investors’ profits compare against the losses. The metric works by going through the transaction history of each coin sold to see what price it was moved at before this. If this previous selling price for any coin was less than the current spot price, then that particular coin is being moved at a profit.

The reason behind this is the appreciation the BTC price has enjoyed during this period. From the chart, it’s visible that peak profit-taking coincided with the all-time high (ATH) in March, as would be expected.

Interestingly, profit-taking still massively outweighed the loss-taking in the months that followed the ATH, where BTC price consolidated inside a range. It would appear that this appetite for taking profits has run out recently, a potential result of the sideways trajectory showing no signs of ending.The ratio has now started to flip the other way, with losses taking center stage. The analyst has noted that such a shift towards loss-taking generally occurs at the end of consolidation periods.

So far, the lowest the ratio has gone is 0.66, which is not too low compared to past loss-taking events. Thus, the capitulation may deepen before Bitcoin can start a fresh rally.