According to data, yesterday saw the largest long liquidation event this year. — ted (@tedtalksmacro)Every dip was bought by traders with leverage in anticipation of a bounce to the range high. This unhealthy market behavior needs to be flushed out of the market to create a sustainable price rise (as before) through spot buying.

Bitcoin And Crypto Continue To Be In The Danger Zone

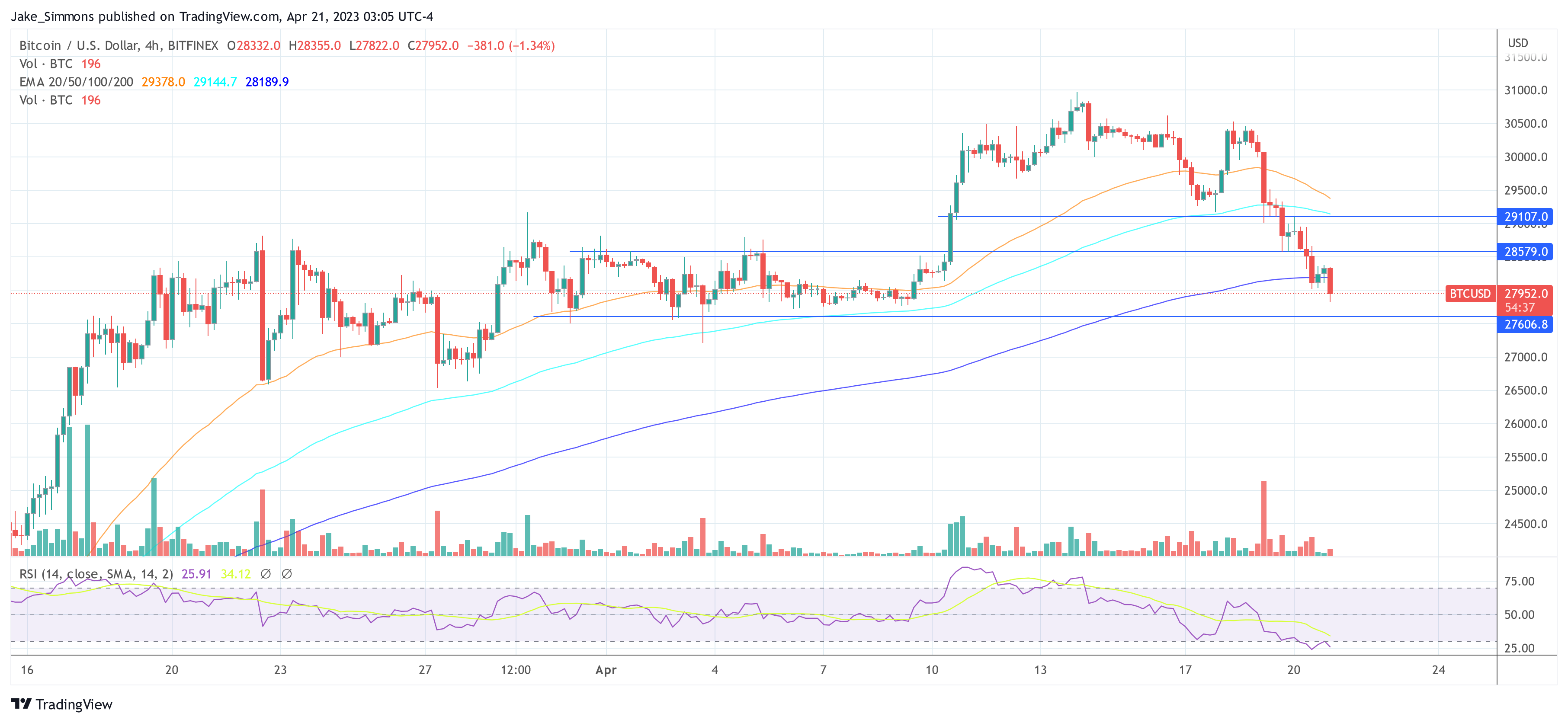

Technical analyst and founder of Eight Global, Michaël van de Poppe, believes Bitcoin is not out of the danger zone yet because the price is currently exhibiting weakness:From an on-chain perspective, the price level at $28,300 might be crucial as Bitcoin’s Realized Price – UTXO Age Bands (1 week to 1 month) is located here. As analyst Crazzyblockk writes via CryptoQuant, the level can be considered as a psychological level for people looking for short-term gains. The reaction to this area could be instrumental in judging the strength or even weakness of the bulls. “If Bitcoin receives a reaction from the short-term at these levels, it will be a sign of renewed interest in holding and entry by these people, and if this level breaks, these players will continue to sell,” the analyst predicts.Bitcoin is currently showing weakness. Broke back in the range, lost one of the crucial levels. Final crucial level is at $27,600. Could take liquidity below, but needs a fast recovery. If not, and no break of $28,800, then I suspect we’ll see $26,200.

Traders should also keep an eye on the US dollar index (DXY), as US dollar strength will be a headwind for the crypto space. As we reported in previous market updates, the DXY could initially gain strength in the coming weeks before writing new lows – as Glassnode’s co-founders expect.

While this does not change the overall bullish chart picture for Bitcoin and crypto this so far, soon key levels could come into focus. As renowned analyst Pentoshi stated today, the $25,000 area becomes crucial for a higher low on the larger time frames. //twitter.com/Pentosh1/status/55949056 Moreover, things could become problematic for risk assets if the US dollar continues its rally in the coming weeks and months. Remarkably, according to Bloomberg, hedge funds are on a significant rise in the US dollar for the first time in over a year. At press time, the Bitcoin price was trading at $27,952, continuing the downward trend of the last two days.