The good news was that there is a bailout of Silicon Valley Bank’s (SIVB) customer funds, which means that the issuer of the USDC stablecoin, Circle, will also receive all of its funds. On the other hand, there is a coordinated shutdown of the crypto bank Signature Bank (SBNY), which is allegedly also in danger of collapse, by the Federal Reserve (Fed) and the Treasury Department in the US.

The bottom line is that this is a tough loss for the industry. In less than a week, the crypto sector’s key banking partners have been eliminated. Going forward, it is hard to imagine other U.S. banks will feel comfortable servicing this industry given the intense scrutiny they will face.Massive Buying Pressure On Bitcoin, ETH and BNB Incoming

The Industry Recovery Fund was launched by Binance after the collapse of FTX in November 2022. The fund was meant to support cryptocurrency projects facing a liquidity crisis after the FTX crash. The fund still includes $1 billion worth of Binance USD Coin (BUSD). In a surprising announcement today, Changpeng Zhao, the exchange’s CEO, stated that these funds will be converted into Bitcoin, Ethereum (ETH) and Binance Coin.All $1 trillion BUSD of the industry recovery initiative fund was transferred to Binance shortly after the announcement, to on-chain data provider Lookonchain.Given the changes in stable coins and banks, Binance will convert the remaining of the $1 billion Industry Recovery Initiative funds from BUSD to native crypto, including BTC, BNB and ETH. Some fund movements will occur on-chain. Transparency.

$1B buying pressure on , and — Ki Young Ju (@ki_young_ju)The impact of Binance’s purchase can only be speculated. Analyst Miles Deutscher did agree that Binance will not simply “buy $1 billion dollars on the market” in order to massively influence the price. Binance has high-level market makers and a very liquid exchange.

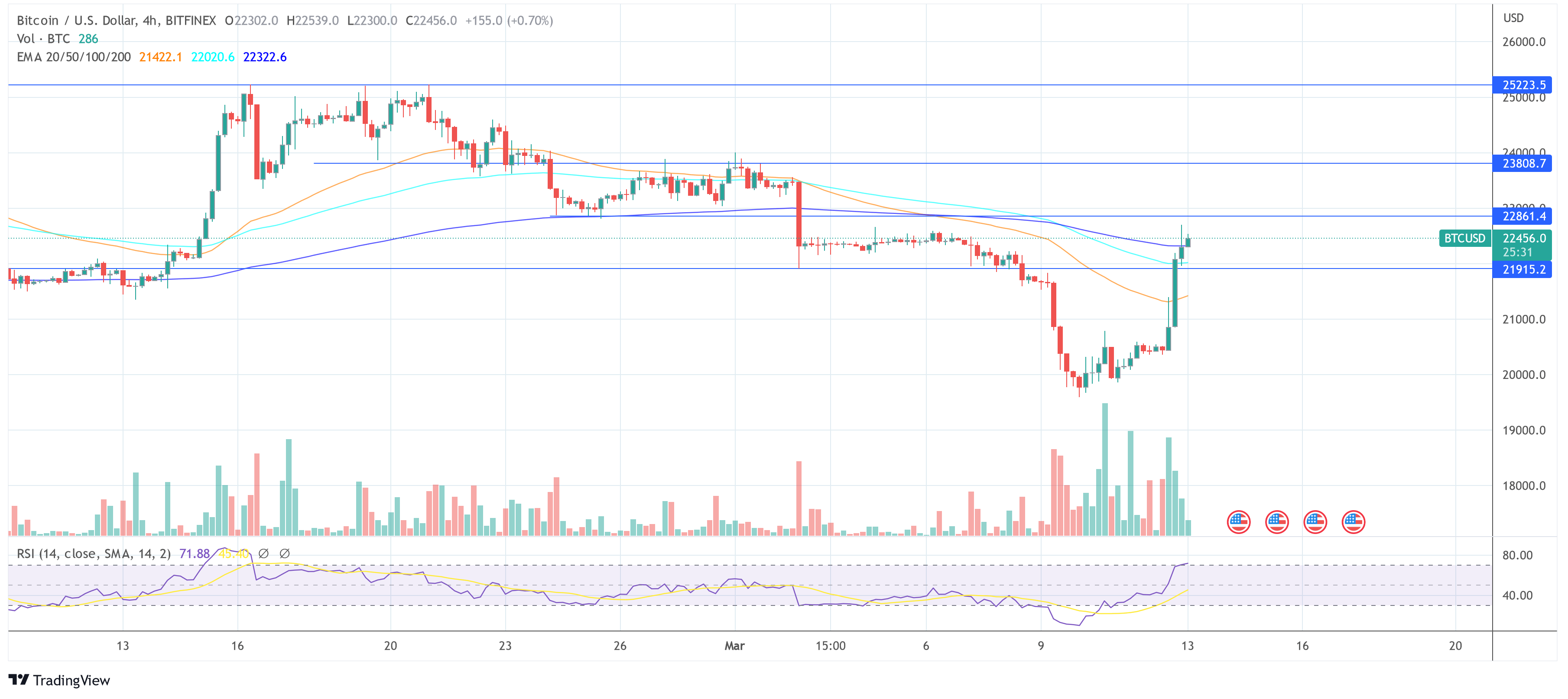

At press time, the Bitcoin price stood at $22,456, up almost 10% within the last 24 hours.Look at what Do Kwon’s LFG Bitcoin buys did to the price back in the day. Regardless, more of a sentiment shifter than anything. There’s a chance people front run.