Last cycle we saw coin hit $88.8 billion market cap & hit $40 billion. I think we’ll see memes as an asset class hit close to $1 trillion market cap this cycle — Davinci Jeremie (@Davincij15)Currently, the market capitalization of meme coins has surged to $58 billion, although still behind other up-and-coming crypto sectors such as AI-based tokens and real-world asset cryptos, but still a solid amount nonetheless.

The Current Status Of Meme Coins

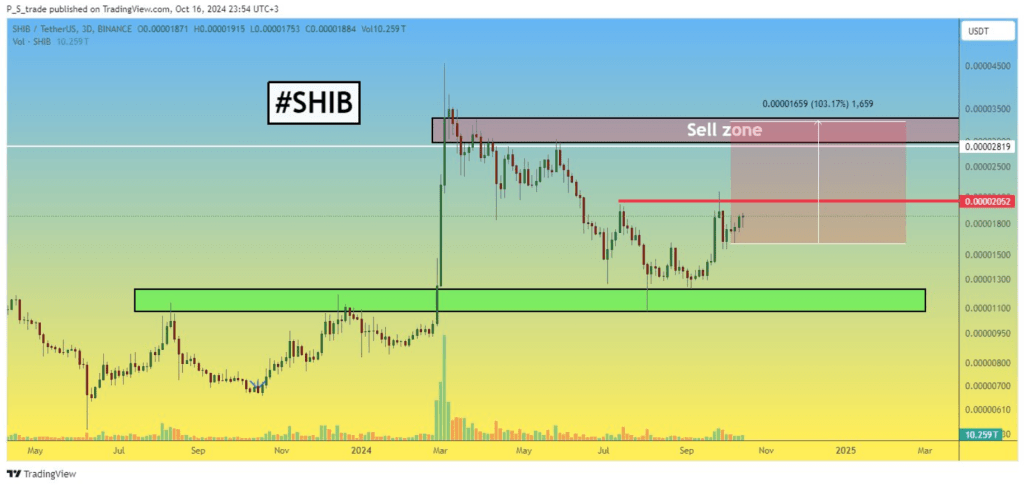

It might have ended its global trend reversal and gone off a prior downtrend but do not count it out yet since during the late parts of September 2024, saw a huge spike as it recorded an all-time high at $0.00002135. This peak successfully broke two strong resistance levels which can only mean good for the coin and other meme coins. From the technical analysis from PS Trade, there is a high resistance point that is at $0.00002052 where around 83.75 trillion tokens are kept at this price level.— PS trade (@PStrade2)

Although the price of is still not rising very confidently on the 3-day timeframe, the global downward trend reversal structure is complete. Therefore, our target for this cryptocurrency is 100% growth.

Shiba Inu: Technical Indicators And Market Challenges

Large-position institutional investors pushed SHIB back below $0.000018. As the CMF is still negative at – 0.22, this presents selling pressure from the large holders. Meanwhile, the StochRSI has revealed that SHIB was already entering into an overbought position due to its values oscillating between 71 and 57. That makes it important that the oscillators and charts begin to show signs of short-term volatility and further corrections if the selling pressure continues. However, given the strong bullish setup, a further rally is quite possible. Investors need to keep an eye on key resistance levels as well as technical indicators for further movements in SHIB.Featured image from CNBC, chart from TradingView