Ethereum price is trading with a positive bias above the $180 and $185 levels against the US Dollar. ETH is likely to continue higher towards $200 or $220 in the near term.

- Ethereum is trading in a bullish zone above the $180 pivot area against the US Dollar.

- The price climbed higher recently and revisited the $194-$195 resistance area.

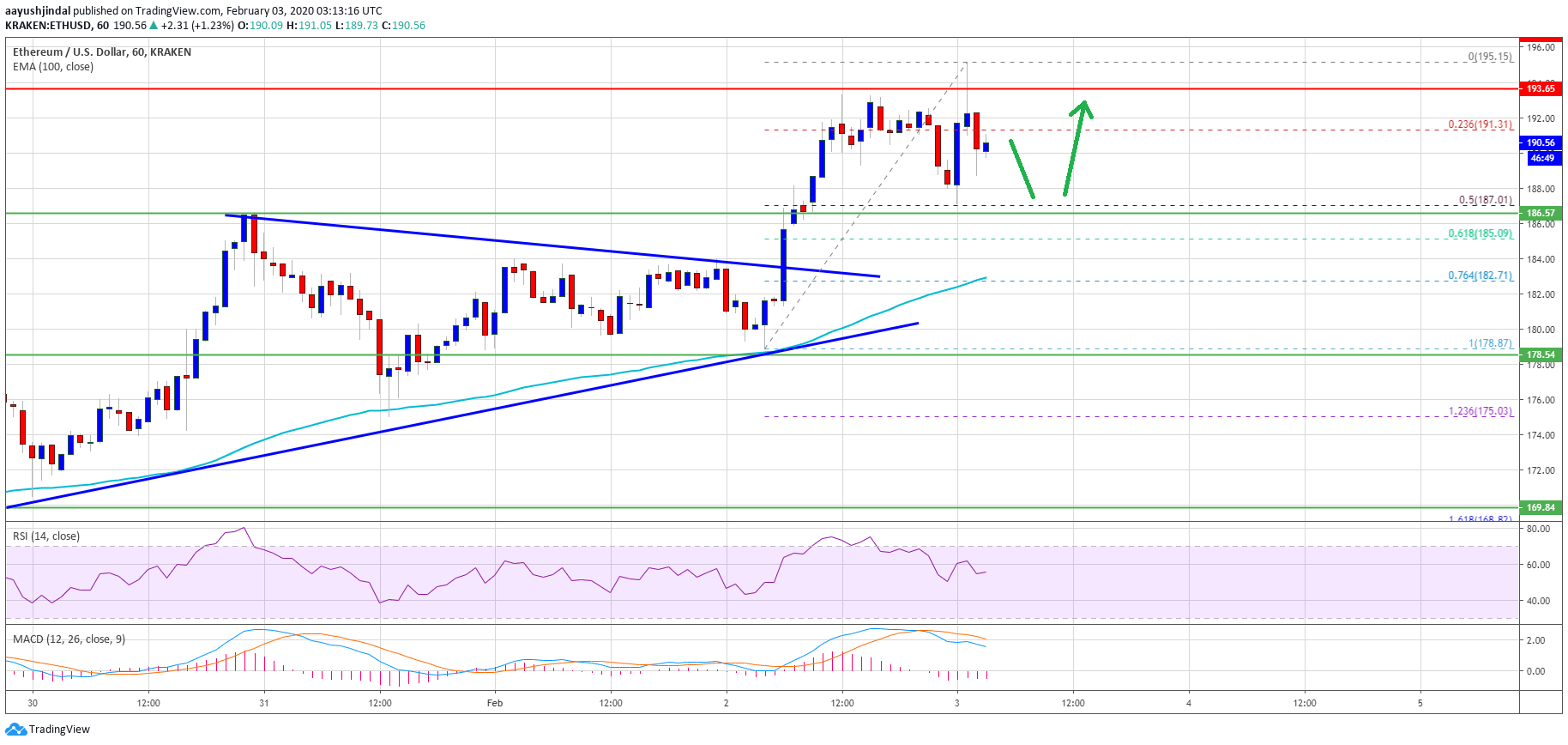

- There was a break above a major contracting triangle with resistance near $182 on the hourly chart of ETH/USD (data feed via Kraken).

- Bitcoin price is still struggling to stay above the $9,500 resistance level.

Ethereum Price Could Continue To Rise

In the past three sessions, there were mostly bullish moves in Ethereum above the $180 level against the US Dollar. ETH price formed a strong support base above $180 and the 100 hourly simple moving average.

As a result, there was a strong increase above the $185 resistance area. Moreover, there was a break above a major contracting triangle with resistance near $182 on the hourly of ETH/USD.

It opened the doors for a break above the $190 resistance area. Finally, the price traded to a new 2020 high at $195 and it is currently consolidating gains. Ethereum traded below the 23.6% Fib retracement level of the recent surge from the $179 low to $195 high.

On the downside, there are many supports, starting with the $188 and $187 levels. Besides, the 50% Fib retracement level of the recent surge from the $179 low to $195 high is also near the $187 level.

If there is a clear break below the $187 support, the price could start an extended downside correction towards the $185 support. The next major support and buy zone is near the $182 level and the 100 hourly SMA. Any further losses may perhaps lead the price towards the $178 support area.

Bullish Targets for ETH

On the upside, an initial hurdle for Ethereum is near then $195 level. A successful close above the $195 resistance might set the pace for a break above the $200 barrier.

In the mentioned case, there are high chances of a sustained upward move towards the $220 level in the coming sessions. An intermediate resistance is seen near the $212 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is slowly moving in the bearish zone.

Hourly RSI – The RSI for ETH/USD is currently correcting lower towards the 50 level, with a few bearish signs.

Major Support Level – $185

Major Resistance Level – $195