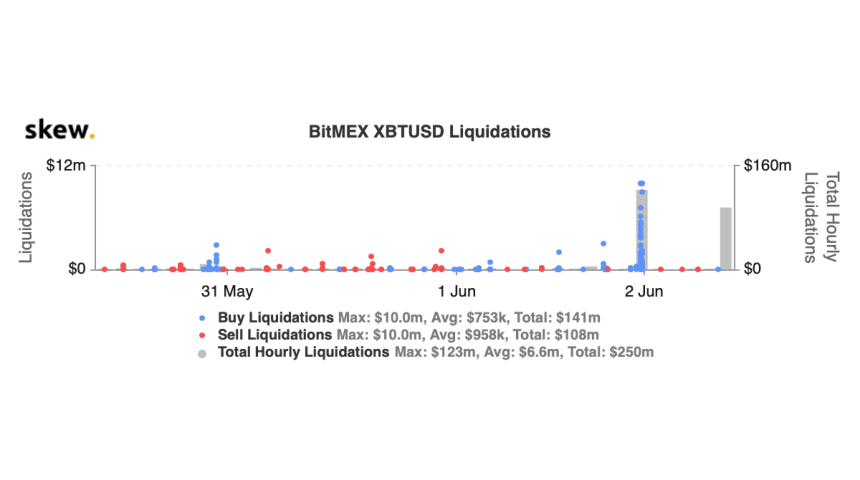

The overnight rally from lows of $9,400 to its recent highs left a trail of destruction in its wake, causing the crypto to see its largest daily buy-side liquidation of the year, with over $100 million being liquidated.

The plunge from this level seen today added to this number, with another $100 million in positions being liquidated.Bitcoin Sees Massive Volatility as $200 Million in XBTUSD Positions Get Liquidated

Bitcoin saw a notable overnight rally that led it to highs of $10,400. This movement was sharp and led many traders to grow incredibly bullish on the benchmark cryptocurrency.

It’s rally into this price region was short-lived, however, as this morning it incurred a sharp influx of selling pressure that led it back into the lower-$9,000 region.One incredible byproduct of this latest movement was that over $200 million in positions on trading platform BitMEX were liquidated.

Here’s Where BTC May Go Next

This latest rejection could mark a confirmation of a bearish triple-top formation that leads Bitcoin to see notable downside. One popular cryptocurrency analyst is that he believes the crypto is well-positioned to decline towards $7,000 in the days and weeks ahead.“BTC update: Almost… We now got a triple top in play. That makes the support areas I outlined even more attractive as a buy,” he explained while pointing to the chart seen below.

Featured image from Shutterstock.BTCUSD, XBTUSD, BTCUSDT