Bitcoin has experienced extremely strong price action over recent days. At the highs of the rally on Monday, the leading cryptocurrency traded as high as $11,500 on leading margin exchanges.

There remain signs that BTC could undergo a strong retracement after surging as high as $11,500. This comes in spite of the fact that BTC is already down by approximately $700 from the local highs as of this article’s writing. The following are three signs that BTC could retrace as shared by analysts.Related Reading: Crypto Tidbits: Ethereum Surges 20%, US Banks Can Hold Bitcoin, DeFi Still in Vogue

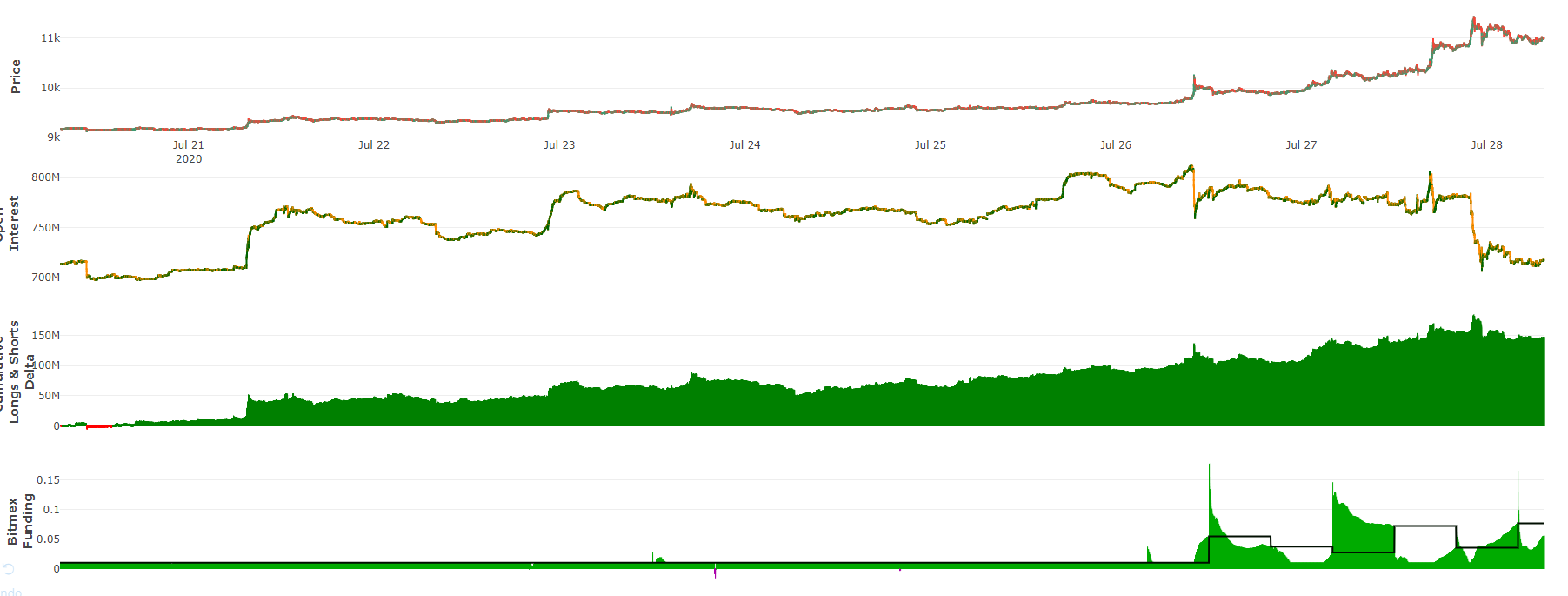

#1: A Potentially Overextended Bitcoin Futures Market

What some analysts see as the most tell-tale sign that Bitcoin could drop from here is the state of BTC futures. Below is a chart from a cryptocurrency trader who predicted BTC would hit the $3,000s months before it did. It shows that long positions on BitMEX have built up massive positions over the past week, resulting in a spike in the funding rate.Chart from trader il Capo of Crypto (@CryptoCapo_ on Twitter)

The extremely high funding rates and positive long-short delta suggests that Bitcoin buyers may be overleveraged. Data from another source, which aggregates the funding rates of the top crypto futures platforms, also indicates this.

#2: A CME Futures Gap In the High-$9,000s

Due to Bitcoin rallying on the weekend, it has formed a CME futures gap in the $9,600-9,900 range. Analysis has found that 77% of all CME Bitcoin gaps fill within the week after they are formed. With this gap where it is, there is a high chance by historical standards that BTC revisits the high-$9,000s in the coming days.The issue is that Bitcoin doesn’t have to fill in the CME gap. As one trader recently

“CME Gapped up leaving a $285 gap. Most of the time the narrative is a gap fill before continuation but we also need to keep in mind that this could very well be a breakaway gap. Breakaway gaps often occur early in a trend and show conviction in the new trend direction.”

#3: A TD Sequential “9” Candle on BTC’s Daily Chart

Finally, there remains a sell signal on Bitcoin’s one-day price chart. The signal is a Tom Demark Sequential “sell 9,” which is a candle formation often seen near or at the top of an asset’s trend.

Chart of BTC’s price action over recent months with the TD Sequential. Chart by a Telegram channel tracking TD Sequential signals; chart fromTraders have not seen any recent success with using this indicator — the chart above shows few TD “9” candles. Yet the creator of the indicator, Tom Demark, said in a Bloomberg interview that it managed to catch Bitcoin’s macro bottom at $3,150 and the 2019 highs near $14,000.

Related Reading: On-Chain Metric Signals the BTC Market Isn’t Overheated: Why This Is Bullish

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from These 3 Signs Indicate Bitcoin Could Drop After 20% Explosion to $11.5k