- Bitcoin (BTC) slide 10.9 Percent

- Bitstamp sees a large sell order that caused a market imbalance, overpricing BTC

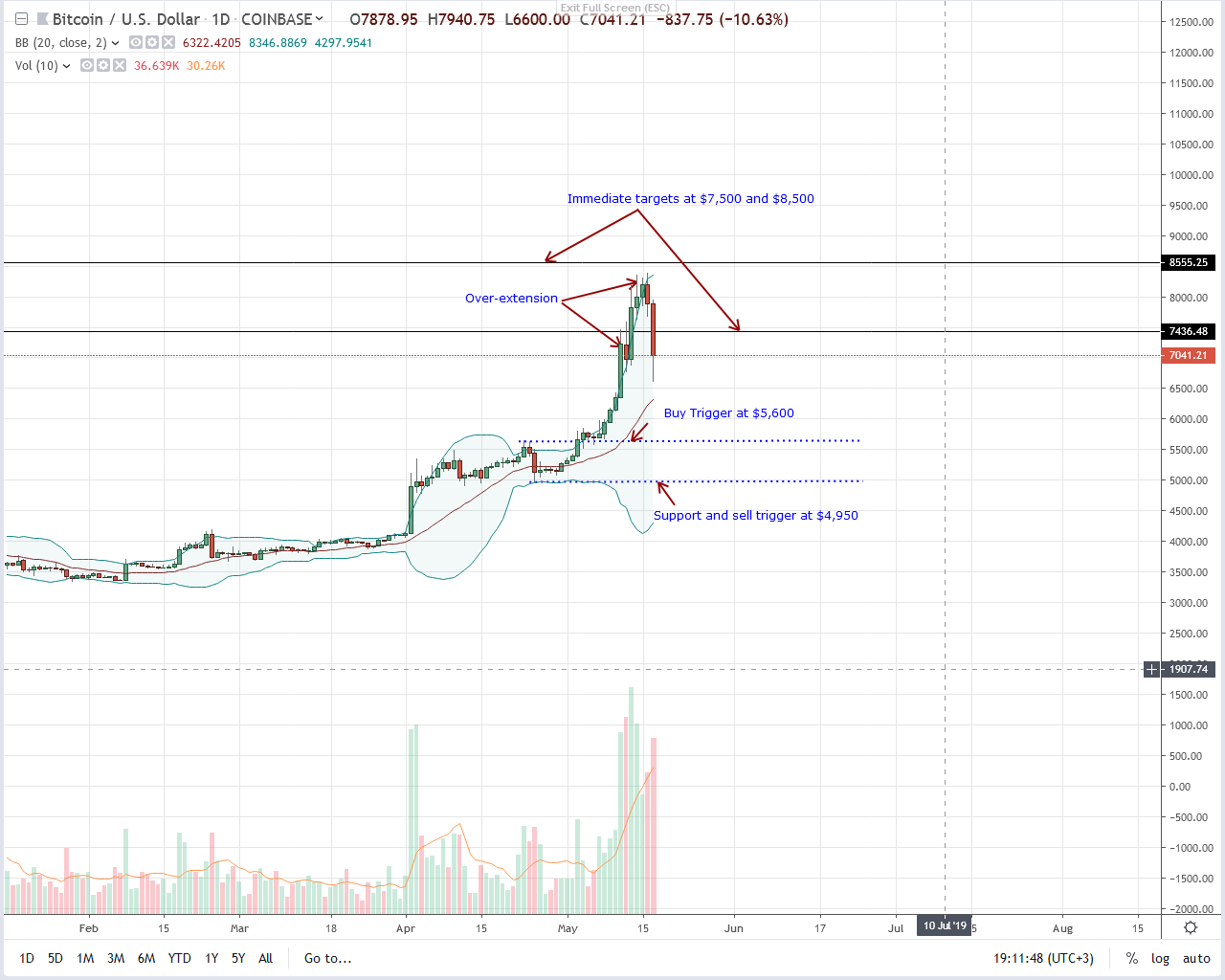

Not surprising, Bitcoin (BTC) prices are under pressure, dropping 10.9 percent in the last day, at the time of writing. Analysts attribute this to a large sell order from Bitstamp that forced prices to fall as supply exceeded demand.

Bitcoin Price Analysis

Fundamentals

In a day marked by chaos and investors jostling to liquidate Bitcoin (BTC) at market rates, the asset price dropped by $1,340. By sliding from intra-day highs of $7,940 to lows of $6,600, the dip is the largest in more than a year.

Nonetheless, today’s slip is but a minor blip mainly because the candlestick arrangement favors buyers. This is thanks to increasing transaction volumes and general awareness of what BTC represents. Coincidentally, the drop is two days after keen observers noted a sharp increment in the number of retail investors/traders owning more than one BTC.

Candlestick Arrangement

Already, what we have is a double bar bear reversal pattern. Because of today’s losses, May 16th bears are back. As such, in days ahead, the path of least resistance will likely be southwards. In that case, risk-off traders can exit their longs, fade the primary trend, and aim for Apr-2019 highs of $5,600 in line with our last BTC/USD trade plan.

Technical Indicator

Our anchor bar is May 13th with 47k against 21k averages. However, because of BTC overvaluation in the last few days, BTC prices will likely dip below May 13th lows as sellers flow back albeit with light volumes. That will correct the over-extension with probable support at the 20-day moving average on the upper end or $5,600 on the lower end.courtesy of Trading View. Image Courtesy of ShutterStock