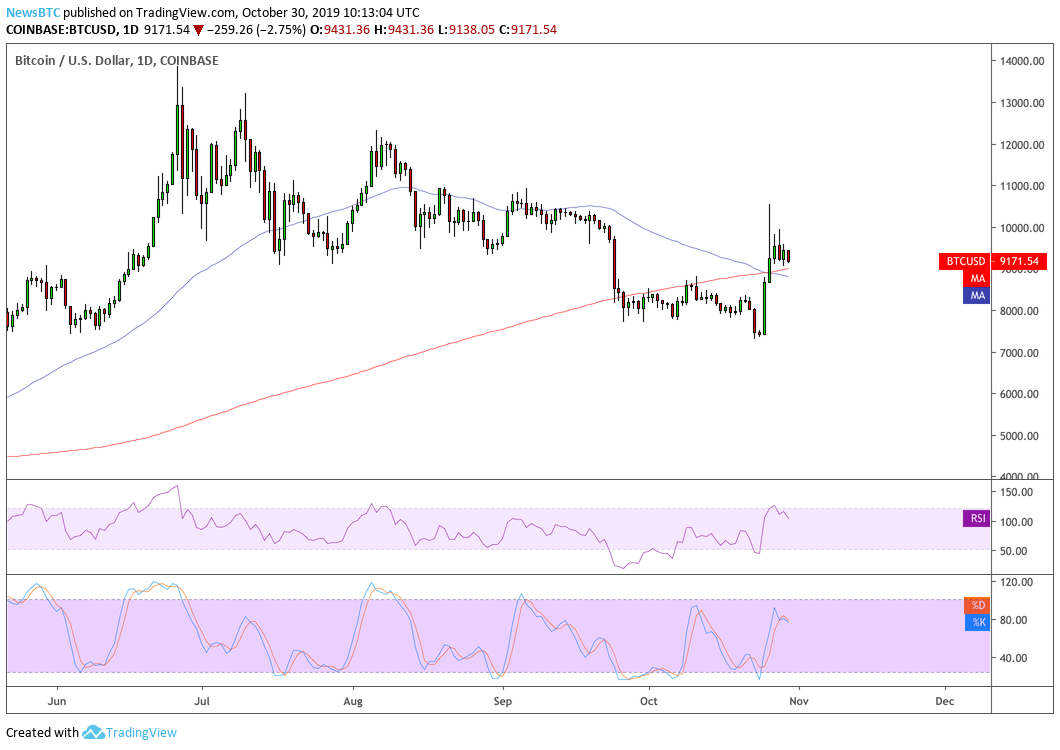

The benchmark cryptocurrency was trading at $9,171.54 as of 10:13 UTC, down 2.75 percent from the market open. At its session high, bitcoin attracted a bid of $9,431.36 on the San Francisco-based Coinbase cryptocurrency exchange. That was still more than 10 percent lower than bitcoin’s weekend high of $10,540.59, showing that the market – at best – has digested the bullish sentiments arising from China’s President Xi Jinping’s encouraging comments on the blockchain technology last Friday.

95% of Economists Predict Rate Cut

The US central bank will likely introduce a third consecutive rate cut after concluding today’s Federal Open Market Committee’s meeting, says 95 percent of the economists surveyed by Bloomberg. The sentiments predict a 25bps slashing in the benchmark lending rates, with a focus on similar moves by the Fed before December 31. The S&P 500 index on Tuesday turned back from its record highs and closed 0.1 lower. The US Dollar Index also dropped 0.06 percent on Wednesday and yield on the 10-year US Treasury Bond also fell 0.38 percent to 1.834. Bitcoin, on the other hand, showed an interim correlation with the equity market, looking similarly steadier as investors expected a rate cut from the Fed.Tomorrow, the Fed will:– Buy ~$2bn of T-bills permanently

Bitcoin is a non-sovereign, hardcapped supply, global, immutable, decentralized, digital store of value. — Travis Kling (@Travis_Kling)

– Buy up to $120bn of Treasuries & MBS overnight

– Cut the Fed Funds Rate 25bps for the 3rd consecutive time

“Investors need to prepare for today’s challenges by building portfolios that can provide true diversification against highly correlated risks present across many asset classes,” said Michael Hasenstab of Franklin Templeton in . “Despite extraordinary market conditions, we see an opportunity to invest in potential hedges against global risks while aiming to build a portfolio that is truly uncorrelated to general market risk.”

Fed is cutting rates tomorrow. Bitcoin keeps going. — Jason A. Williams (@GoingParabolic)

Quantitative Easing

A similar cash flow is coming into the European markets this week as the central bank goes ahead with its plan to acquire €20 billion bonds every month. According to Alex Krüger, a prominent market analyst, the move would bring bitcoin before the regional investors as a potential safe-haven asset. Excerpt from his statement:“QE would push longer interest rates lower and thus push some investors out the risk curve, i.e., seeking riskier investments to achieve desired returns. One can theorize some of that money would end in Bitcoin, adding upward pressure to prices.”