PCE Slightly Impacts Bitcoin Price

These expectations were not met. As reported by the Bureau of Economic Analysis, core PCE came in at 0.3% on a monthly basis, as expected. On an annual basis, core PCE fell to 4.6%, also delivering the expected number.BREAKING: US PCE data is out! Headline y/y 4.2% vs 4.1% expectation Headline m/m 0.1% vs 0.1% expectation Core y/y 4.6% vs 4.58% expectation Core m/m 0.3% vs 0.3% expectation — Markets & Mayhem (@Mayhem4Markets)

In a prank call with a fake Zelenskyy Jerome Powell, Chairman of the Federal Reserve, admits at least 2 more upcoming interest rate hikes followed by a long period of high rates with significant negative effects on the US economy and the US labor market. — Kim Dotcom (@KimDotcom)

What Will The Fed Make Of The Data?

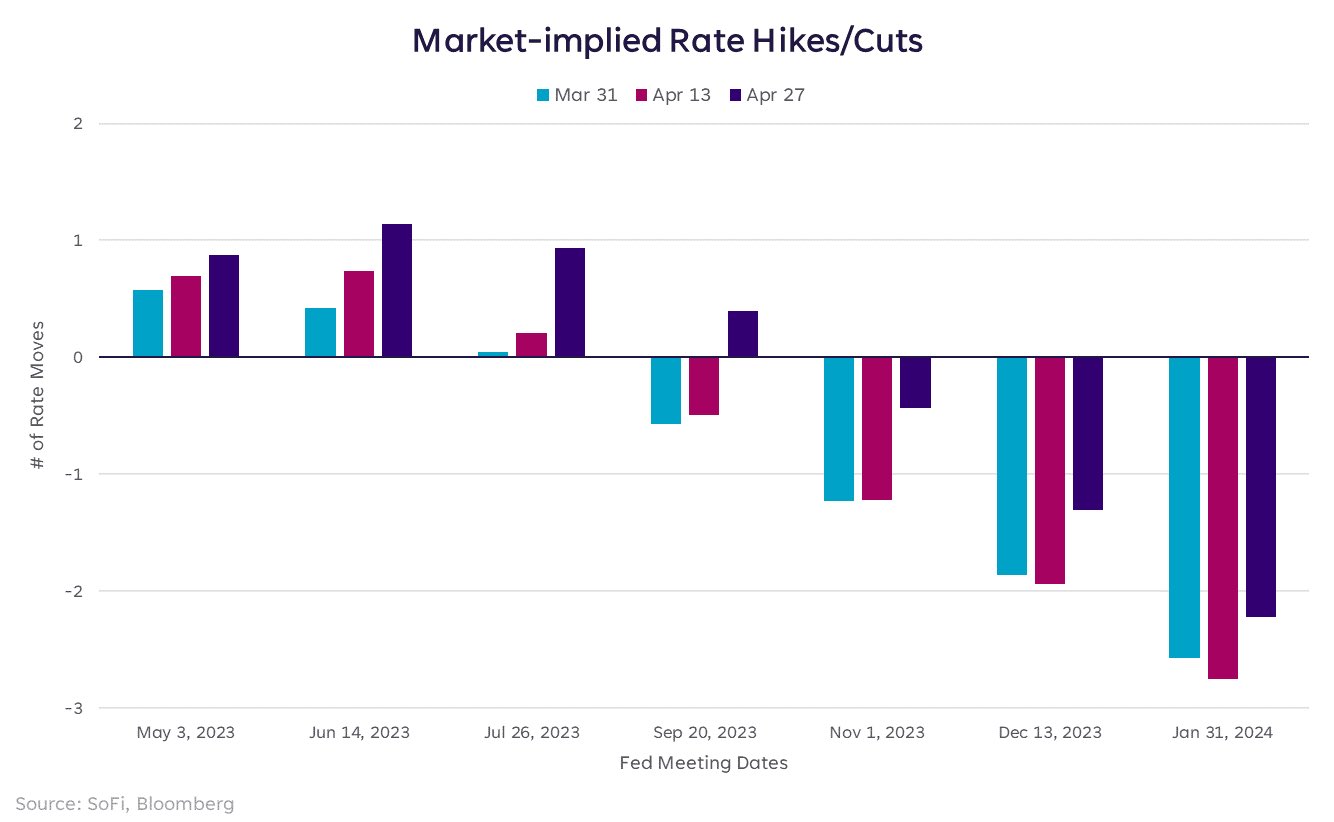

After the latest macro data, Fed Funds Futures traders expect a probability of more than 80% for a 25 basis points (bps) rate hike next Wednesday. The probability according to the CME FedWatch Tool was at 88% before the release of the PCE and remained at this level afterwards. Still, the market is calling Powell’s bluff. Liz Young, head of investment strategy at SoFi shared the chart below and prior to the PCE release:Market pricing implies 88% odds of a rate hike next week, up from earlier in the month. Some traders are starting to bet on a hike in June as well, but that’s less certain. Either way, markets still think we’re going to get multiple cuts later in 2023 & early 2024.

Today’s release is not expected to change this. On the other hand, a second wave of bank failures is currently brewing in the US. Higher interest rates are likely to push more regional banks to their limit. Bitcoin could once again be the beneficiary, as the Fed can’t hike as high as they would want to.

At press time, the Bitcoin price stood at $29,314.Featured image from iStock, chart from TradingView.com