Bitcoin Miner Reserve Has Been Going Down In Recent Days

As pointed out by an analyst in a CryptoQuant , the BTC miner reserve has now hit new yearly lows. The “miner reserve” is an indicator that measures the total amount of Bitcoin currently sitting in the wallets of all miners.

When the value of this metric rises, it means miners are adding more coins to their wallets right now. Such a trend suggests this cohort is interested in accumulating BTC currently. Miners are an important part of the market and their HODLing the coin can be a positive sign for the price.

The value of the metric seems to have been trending down in recent weeks | Source:

As displayed in the above graph, the Bitcoin miner reserve has been moving on a downward trajectory since the latest rally in the asset’s price started. This means that these chain validators have been looking at the price surge as a profitable exit opportunity.

Normally, the reason why miners sell their coins is because of the fact that they always have to pay continuous running expenses like electricity bills. Particularly large selloffs, however, can be a sign that they are struggling more than usual right now. After the initial plunge in the indicator (which was when the rally had only just ramped up), the metric had gone stale for a while. Recently, however, the miner reserve has noticed some fresh decline.BTC Price

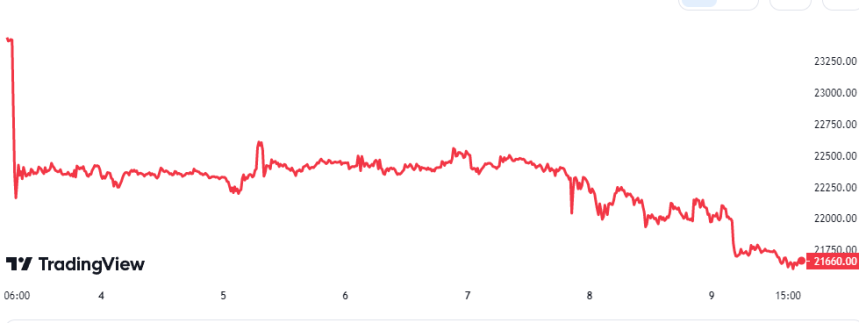

At the time of writing, Bitcoin is trading around $21,600, down 7% in the last week.

Looks like the value of the asset has gone stale in the last few days | Source: