Bitcoin Net Unrealized Profit And Loss Plunged Down Recently

As explained by an analyst in a CryptoQuant , the NUPL past trend may suggest that current values could be favorable for a rebound in the crypto’s price.The “net unrealized profit and loss,” or NUPL in brief, is an indicator that’s defined as the difference between the current Bitcoin market cap and its realized cap, divided by the market cap.

Related Reading | Bitcoin Selling Pressure Continues As Long-Term Holder SOPR Spikes Up

Naturally, the metric being exactly equal to zero suggests the investors as a whole are just breaking even currently. Now, here is a chart that shows the trend in the Bitcoin NUPL metric over the last few years:

It seems like the value of the metric has touched into the green zone recently | Source:As you can see in the above graph, the quant has marked the different zones of the Bitcoin NUPL indicator with different colors.

It looks like the ratio has observed some decline recently, and its value has now plunged down into the “green” zone for the first time since the COVID-19 crash.

Related Reading | More Stress For El Salvador As Bitcoin Dips To $29,000

In the history of the crypto, there have been multiple instances where shortly after the indicator has touched into this zone, the price has seen an upwards turn. However, there is also the example of 2018, where the Bitcoin NUPL kept moving sideways in the green zone for a long while, until finally the value of the coin observed a sharp plummet, taking the market into loss. It now remains to be seen whether this time the crypto will follow the pattern of a rebound, or if it will show a trend similar to that in 2018.BTC Price

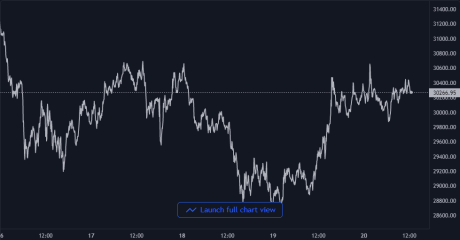

At the time of writing, Bitcoin’s price floats around $30.2k, down 1% in the past week.

Looks like the price of the crypto has been moving sideways around $30k recently | Source:

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com