The price action seen in the time following Bitcoin’s initial break above $10,000 a few weeks ago can largely be characterized as consolidation, as it has failed to garner any decisive trend in either direction.

Until it sets fresh highs above $10,000, or lows beneath $8,100, it will be difficult to determine where it will trend in the mid-term.Bitcoin Forms Fresh Range as Traders Prepare for Major Volatility

Bitcoin could be in the process of forming a fresh trading range following the volatility seen yesterday evening.“BTC: There’s the breakdown and bounce in low $9ks. Nice wick, watching for a close back above $9550. If not, then likely a sign that this was a local top,” he noted.The lower boundary of this potential trading range does seem to sit around $9,500, with an upper boundary at just under $10,000.

Recent Volatility Sparks Mass Liquidations Amongst Traders

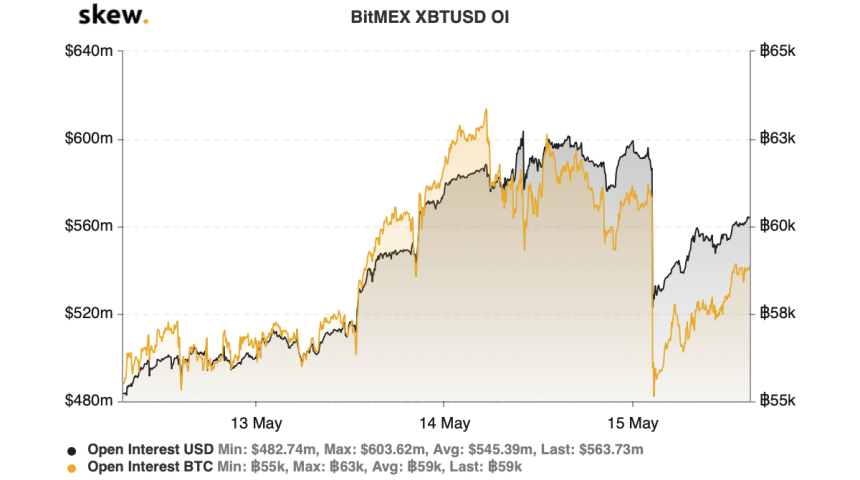

This recent decline in open interest appears to have come about as a result of a liquidation spree caused by Bitcoin’s recent rejection at $9,900. According to Skew, over $30 million in positions were liquidated yesterday as a result of this recent turbulence.

Bitcoin pushed higher before facing the harsh rejection, which in turn caused traders using high leverage on both sides to be liquidated.

The presence of high-leverage positions can prove to be negative for the market, as it makes digital assets like Bitcoin more prone to seeing large and unsustainable movements.Because these positions were largely flushed out, BTC may now be able to start seeing another steady ascent higher.

Featured image from Unplash.