- Bitcoin price is currently declining and is trading well below $8,000 against the US Dollar.

- The price is struggling to recover and it looks set to decline further towards the $7,500 support.

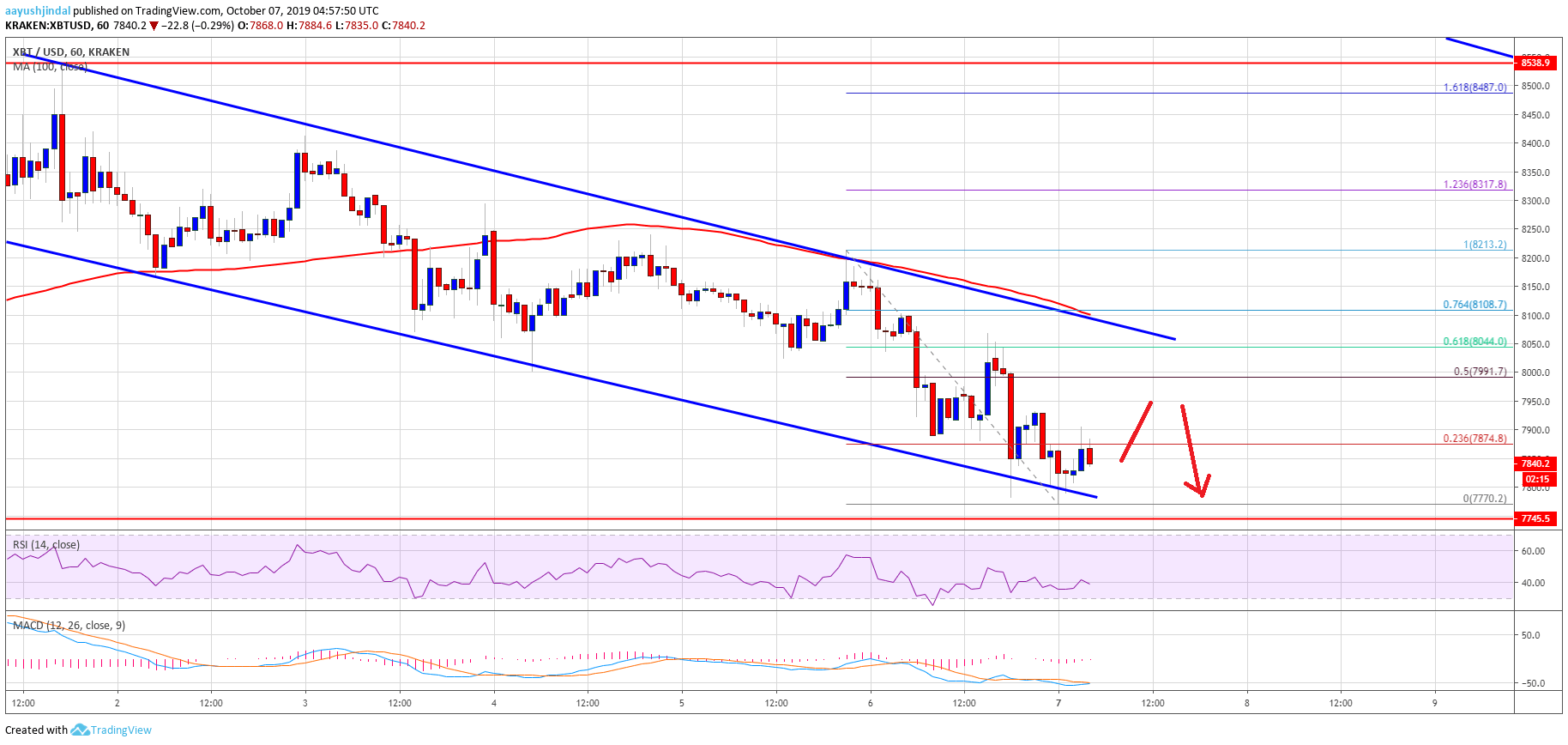

- There is a crucial declining channel forming with resistance near the $8,050 level on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The price is likely to accelerate decline below the $7,800 and $7,750 levels in the near term.

Bitcoin price is showing bearish signs below $8,000 against the US Dollar. BTC remains at a risk of an extended decline towards the $7,500 weekly target.

Bitcoin Price Analysis

In the past few days, there was a steady decline in bitcoin from the $8,500 resistance against the US Dollar. The BTC/USD pair broke many supports near $8,300 and $8,200 to enter a bearish zone. Moreover, there was a close below the $8,200 level and the 100 hourly simple moving average. Recently, the bears gained traction and they were successful in pushing the price below the $8,000 support area.

A new weekly low was formed near $7,770 and the price is currently consolidating losses. An immediate resistance is near the $7,850 level. It coincides with the 23.6% Fib retracement level of the recent decline from the $8,213 high to $7,770 low. On the upside, there are many important hurdles forming for bitcoin near the $8,000 and $8,050 levels. Besides, there is a crucial declining channel forming with resistance near the $8,050 level on the hourly chart of the BTC/USD pair.An intermediate resistance is near the $7,990 level. It represents the 50% Fib retracement level of the recent decline from the $8,213 high to $7,770 low. Additionally, the channel resistance at $8,050 coincides with the 100 hourly simple moving average. Therefore, if there is an upside correction towards the $8,000 and $8,050 levels, the price could face strong selling interest.

On the downside, an immediate support is near the $7,770 low. If there is a downside break below $7,770 and $7,750, the price could accelerate losses. Besides. the main target for the bears could be $7,500 (as discussed in the past few analyses).