- Bitcoin price is slowly declining and recently broke the $10,000 support area against the US Dollar.

- The price is facing an uphill task and it might continue to struggle near $10,250 and $10,300.

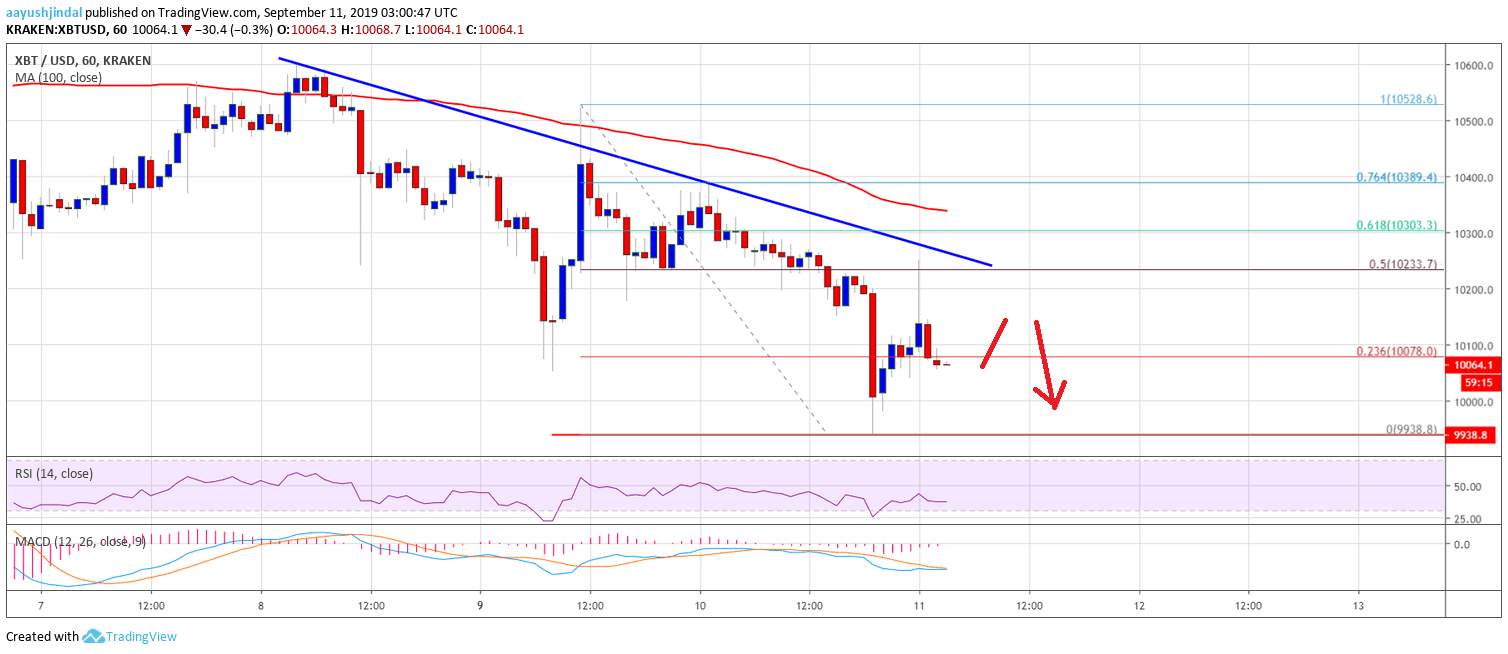

- There is a major bearish trend line forming with resistance near $10,250 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The price could continue to slide as long as it is trading below the $10,400 pivot level in the near term.

Bitcoin price is under pressure below $10,250 against the US Dollar. BTC may perhaps accelerate decline as long as there is no close above the $10,400 and $10,500 levels.

Bitcoin Price Analysis

In the last two analysis, we discussed the chances of more downsides in bitcoin price below $10,400 against the US Dollar. The price broke the $10,250 support area and the 100 hourly simple moving average. Moreover, the recent decline was such that the price broke the $10,100 support area. Finally, there was a downside spike below the $10,000 level and a new swing low was formed near the $9,938.

Recently, there was an upside correction above the $10,000 level. Moreover, the price broke the 23.6% Fib retracement level of the recent slide from the $10,528 high to $9,938 low. However, the upward move was capped by the $10,200 and $10,250 levels. There is also a major bearish trend line forming with resistance near $10,250 on the hourly chart of the BTC/USD pair.Additionally, the 50% Fib retracement level of the recent slide from the $10,528 high to $9,938 low is acting as a resistance for the bulls. Above the trend line, the next key resistance is near the $10,350 level and the 100 hourly SMA. Having said that, a successful close above the $10,400 level plus the 61.8% Fib retracement level of the recent slide from the $10,528 high to $9,938 low is needed for more gains.

On the downside, the $10,000 level is an immediate support. However, the main support is near the $9,950 level. Below $9,950, there are chances of further losses in the near term. The next key support is near the $9,800 level.