A long-term trend following indicator is about to flip bearish on Bitcoin for only the fourth time in the asset’s short, eleven-year history.

However, it doesn’t necessarily mean that more downside is coming for the first-ever cryptocurrency before the next bull market and manic, FOMO-buying phase begins.Long-Term Gaussian Channel About to Flip Bearish, But Indicator Can Lag Behind Price Action

As a trader, most technical analysis done takes specific interest in shorter timeframes, such as the daily, hourly, or even 5-minute price charts. The fundamental value of the underlying asset also matters far less. But for investors, technical analysis focused on longer-term timeframes combined with fundamental analysis is the best strategy for ongoing success.Related Reading | Powerful Retail Crypto FOMO Spikes As Institutions Take Pause

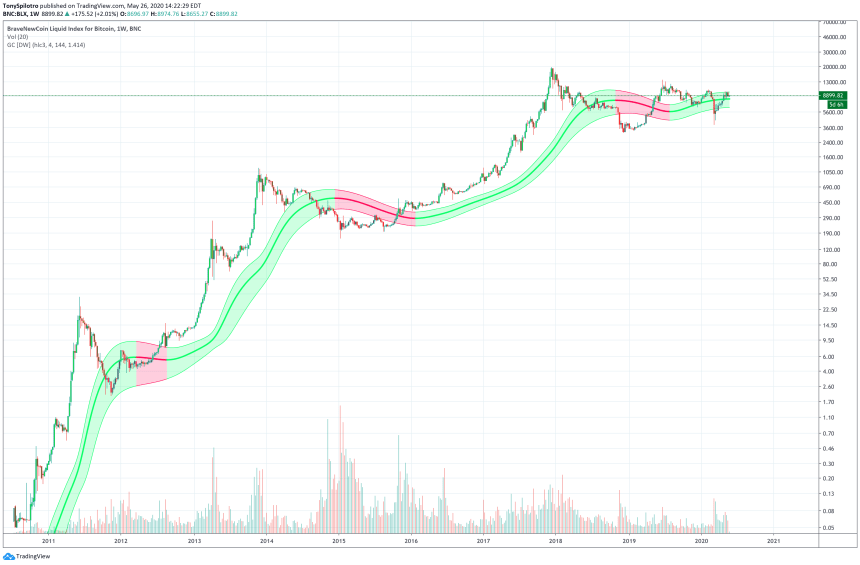

Some indicators are better suited for long term analysis, while others work best for short-term trading positions. However, many of these indicators that perform best on longer timeframes, act as lagging indicators and often show signals after the price action has taken place.One such indicator is the Gaussian Channel, and it is just now flipping bearish on Bitcoin. But given the indicator’s penchant for lagging behind price action, has the bearish trend already taken place, or is more downside ahead?

Thanks to the mini parabola, a second stretch of red on the weekly Gaussian looks likely…. — dave the wave🌊🌓 (@davthewave)

Bitcoin Price To Consolidate Throughout 2020, Crypto Mania Returns in Two Years

According to a highly accurate crypto analyst, Dave the Wave, the Gaussian Channel is about to turn bearish due to the lingering impact leftover from the “mini-parabola” in Bitcoin this past June.

The rally took place almost a year ago, but the lagging indicator is just now turning downward. If the indicator does turn red, it will mark only the fourth time that the Gaussian Channel has ever turned red on Bitcoin price charts on weekly timeframes.

Related Reading | Bitcoin Hash Ribbons Indicate Post-Halving Miner Capitulation Has Begun

A new push toward a new all-time and full-blown Bitcoin mania won’t return until 2022. The fits the prediction perfectly. If the indicator does turn bearish again, and a few more months of consolidation takes place, a break above $10,000 may not happen this year. That level being taken out is the key to triggering retail FOMO, according to top financial experts. When the cryptocurrency reclaims $20,000, however, is when the real fireworks will start.After Bitcoin price broke above its former all-time high during the last cycle, less than 12 months later it had skyrocketed from just over $1,000 to just under $20,000.

The next major peak is predicted to reach prices as high as $1 million per BTC, so the wait will be more than worth it if these lofty predictions come true.