#1 Derisking Before Today’s FOMC Meeting

Anticipation and anxiety are high in financial circles as the Federal Open Market Committee (FOMC) is set to announce its interest rate decision later today. This event is crucial as the crypto market, notably Bitcoin, has grown increasingly reactive to macroeconomic signals.

Recent data, reflecting a slowdown in GDP growth coupled with persistent inflation, has significantly reduced expectations of interest rate cuts by the Federal Reserve. “Bitcoin and other risk assets are currently feeling the pressure from a stagflationary environment, geopolitical tensions, and seasonal liquidity variations,” Ted from TalkingMacro.#2 Cyclical Bitcoin Correction Phase

Following an exceptional rally since the year’s start, the market is undergoing a natural correction phase. Prior to the price crash, Charles Edwards, founder of Capriole Investments, noted: “We are a day short of breaking the record set in 2011 for days without a meaningful dip [-25%],” emphasizing the extraordinary nature of Bitcoin’s recent performance.

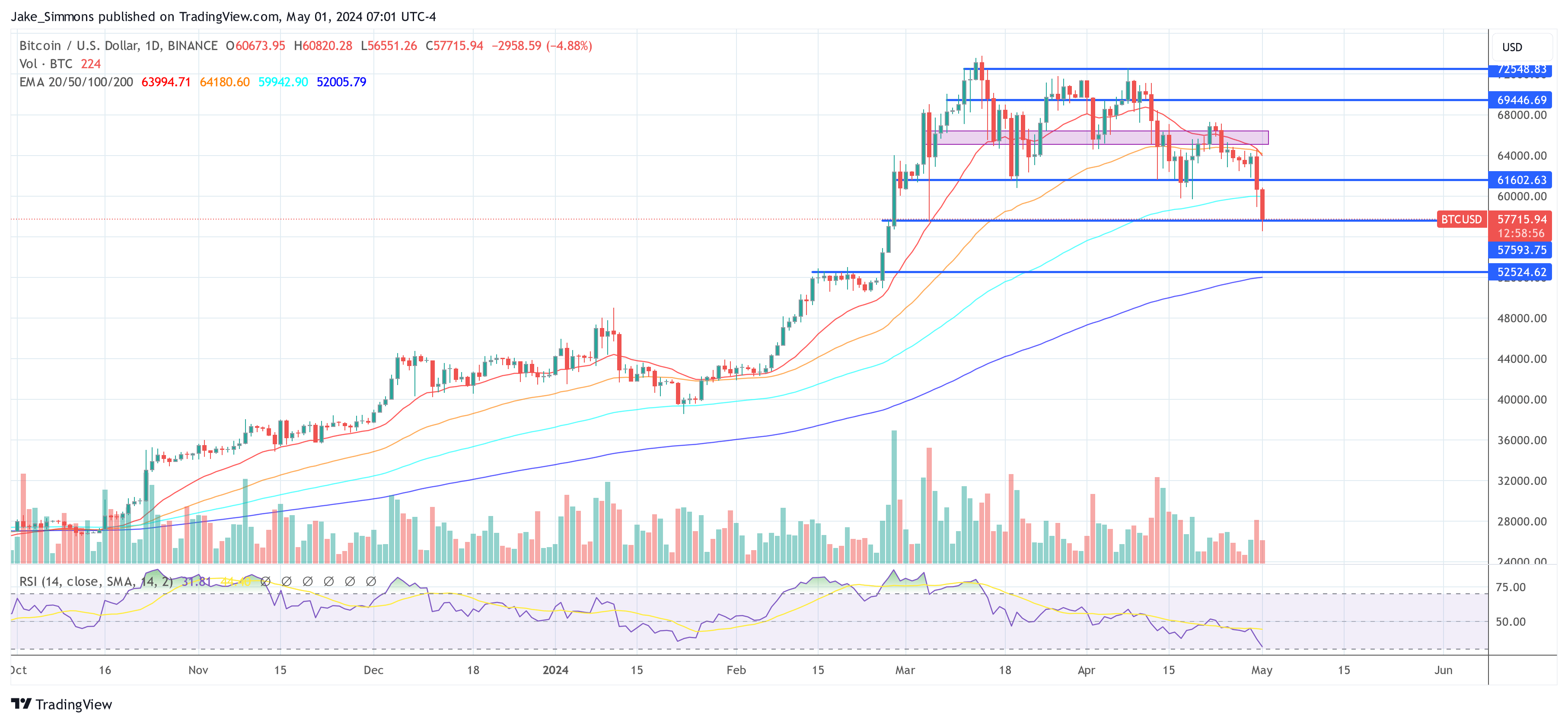

Daily Broke and retested range lows as resistance. Nothing but air until around $52,000 on the chart. My biggest concern I have been discussing for months (in newsletter) is that RSI never made the trip to oversold. Almost there now, all lower time frames oversold. This… — The Wolf Of All Streets (@scottmelker)

#3 Profit-Taking

Traditional finance markets and seasoned investors are seizing the opportunity to take profits following substantial gains. “TradFi/Boomers are taking profits: CME Open Interest is decreasing rapidly, April 29th 135,6k coins, April 30th 123,9k coins, topped around 170.4k coins (March 20th),” explained crypto analyst RunnerXBT.

This trend confirms a broader profit-taking strategy post significant events like the ETF approval and the anticipation around the Bitcoin halving. “That […] confirms my thesis that a lot of these guys longed in October 2023 because of ETF approval and BTC halving, trade played out and now they are taking profits (yes they are still up a lot), because they longed BTC not dead altcoins.”

TradFi/Boomers are taking profits ✅CME Open Interest is decreasing rapidly

Topped around 170.4k coins (March 20th) That at least for me confirms my thesis that a lot of these guys longed in October 2023 because of ETF approval… — RunnerXBT (@RunnerXBT)

April 29th 135,6k coins

April 30th 123,9k coins

#4 US ETF Flows And Hong Kong Disappointment

The dynamics surrounding spot Bitcoin ETFs have shown significant strains, evidenced by recent activities in both US and Hong Kong markets. In the United States, Bitcoin exchange-traded funds (ETFs) faced substantial outflows, indicating a cooling investor sentiment. According to recent , the total outflows from US spot Bitcoin ETFs amounted to $161.6 million. Notably, the Grayscale Bitcoin Trust (GBTC) experienced outflows of $93.2 million, while Fidelity and Bitwise registered outflows of $35.3 million and $34.3 million, respectively. BlackRock had zero net flows once again. These numbers suggest a retreat in institutional interest, which has traditionally been a bulwark against price volatility.Parallel to the US, the debut of Bitcoin ETFs in Hong Kong also faltered significantly below expectations. Six newly launched ETFs, intended to capture both Bitcoin and Ethereum markets, collectively reached just $11 million in trading volume, starkly underperforming against the anticipated $100 million. The spot Bitcoin ETFs accounted for $8.5 million in trading volume. This was markedly lower than the launch day volumes of US-based spot Bitcoin ETFs, which had reached $655 million on their first day.

#5 Long Liquidations

The market has also been impacted by substantial long liquidations, with a total of $451.28 million liquidated in the last 24 hours alone. The largest single liquidation was an ETH-USDT-SWAP on OKX valued at $6.07 million, but Bitcoin-specific liquidations were significant as well, totaling $143.04 million, according to from CoinGlass. These liquidations have amplified the selling pressure on Bitcoin. At press time, BTC traded at $57,715.