In this morning’s bitcoin price watch piece we welcomed a return to our intraday strategy, and outlined the levels that we would be keeping an eye on during the European session on Tuesday. We suggested that – if we got a break of in term support – we could see a continuation of the recent volatility and the overarching bullish momentum we have seen throughout the latter half of last week and over the weekend. The bitcoin price action has now matured throughout the day, and we did in fact see the action we were hoping for. A break through in term support put us long towards an immediate upside target of 245 flat, which we took out about an hour ago (CET). So, with this said, what are the levels we are keeping an eye on today, and where will we look to get in and out of the markets according to our intraday strategy this evening? Take a quick look at the chart.

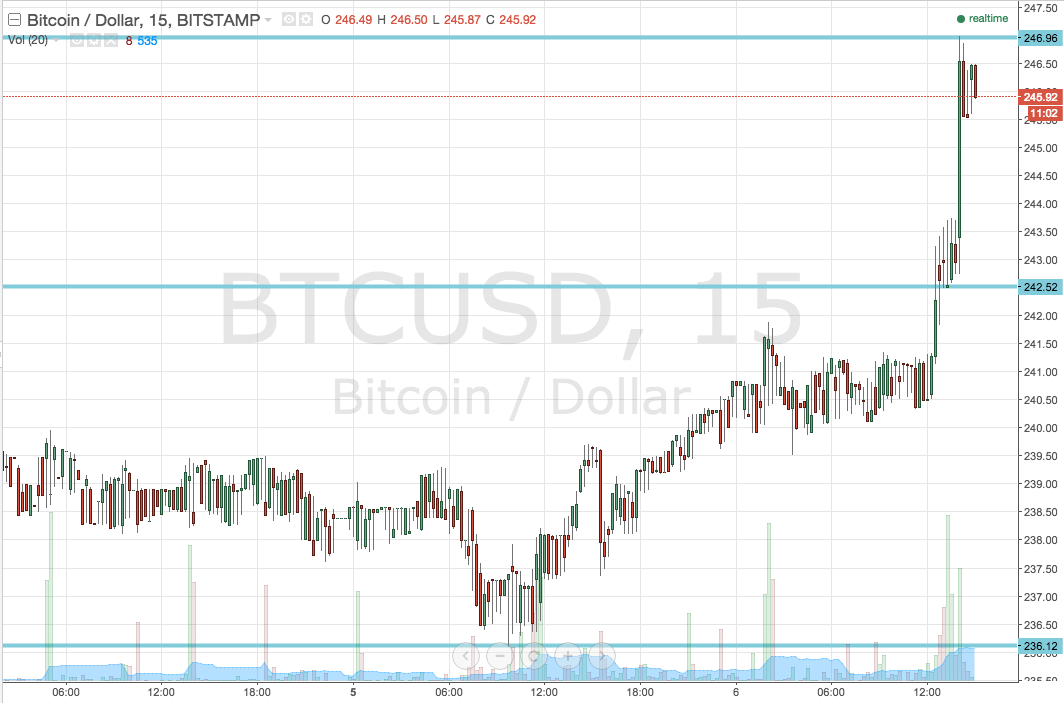

As the chart outlines, 242.52 now serves as in term support for the Asian session tonight, while in term resistance comes in at 246.96 – just ahead of the day’s highs. These are the levels to watch tonight.

A break above in term resistance, and a close above this level on the timeframe we are look at (15 min candlesticks) would put us long once again towards an upside target of 250 flat. This one is very similar from a risk perspective as our long this morning, with a stop loss somewhere around 245.5 weighing off nicely against the 4-5 dollars worth of reward on offer.

Looking short, a break below 242.52 would bring 238 in to play to the downside. On this one, a stop loss a dollar or two above in term support will help to keep things attractive from a risk management perspective – somewhere close to 244 flat.

Charts courtesy of