- Bitcoin price extended losses and traded below the $3,720 and $3,700 supports against the US Dollar.

- The price traded as low as $3,671 and it is currently consolidating above the $3,700 level.

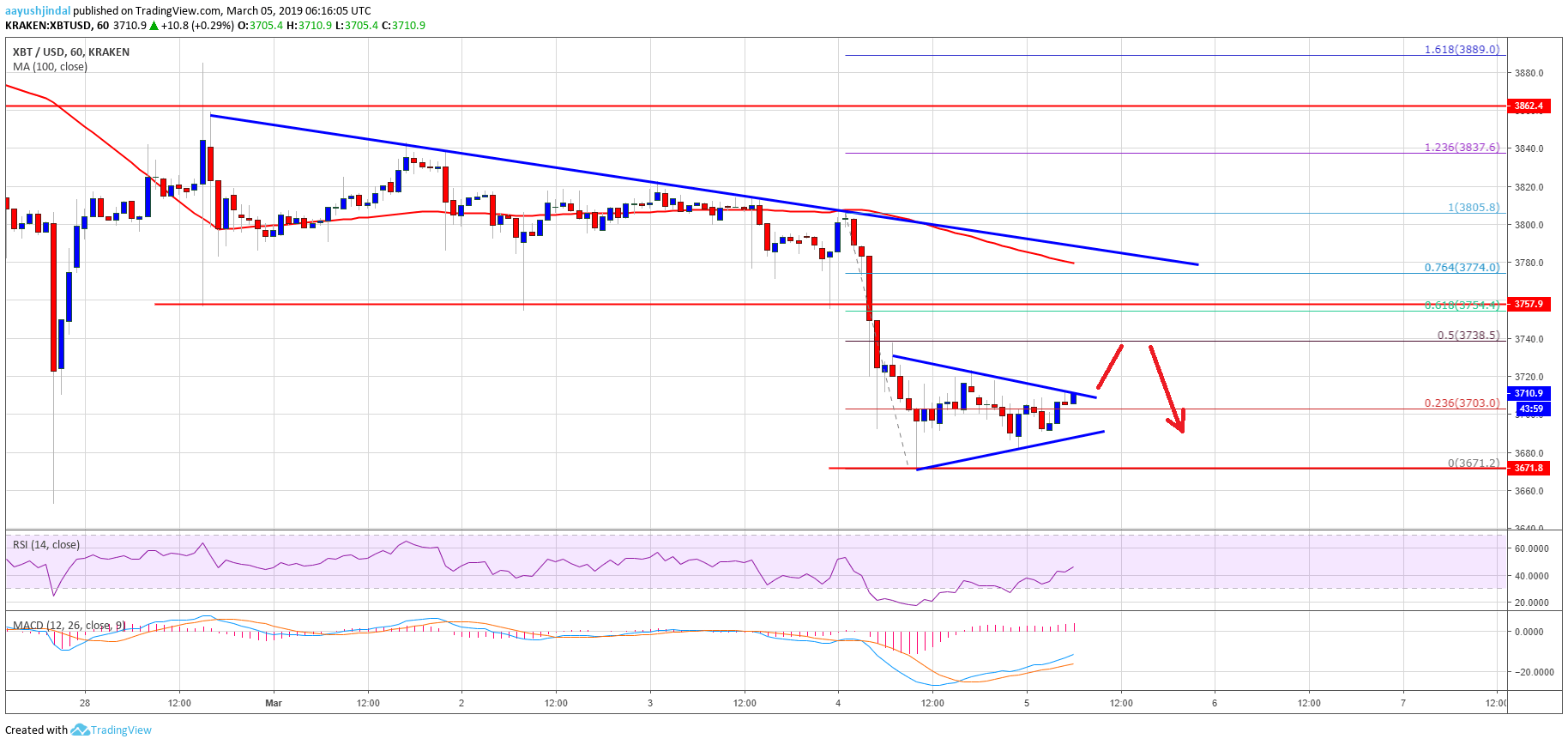

- There is a crucial bearish trend line formed with resistance at $3,775 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could correct higher, but it is likely to struggle near the $3,740 and $3,760 resistance levels.

Bitcoin price is trading with a bearish bias below $3,800 against the US Dollar. BTC remains at a risk of more losses as long as it is trading below $3,760 and $3,800.

Bitcoin Price Analysis

This week, there was a downside extension below the $3,800 support in bitcoin price against the US Dollar. The BTC/USD pair declined below the key $3,760 and $3,720 support levels to move into a bearish zone. There was even a close below the $3,760 level and the 100 hourly simple moving average. Finally, the price spiked below the $3,700 level and traded to a new monthly low at $3,671. Later, it started consolidating losses and traded in a range above the $3,700 level.

The price climbed above the 23.6% Fib retracement level of the recent drop from the $3,805 high to $3,671 low. However, there are many hurdles on the upside near the $3,760 and $3,775 levels. At the outset, there is a contracting triangle in place with resistance at $3,715 on the hourly chart of the BTC/USD pair. If there is an upside break, the pair could correct towards the $3,740 level. It represents the 50% Fib retracement level of the recent drop from the $3,805 high to $3,671 low.The main resistance is near the $3,760 level, which acted as a strong support earlier. Moreover, there is a crucial bearish trend line formed with resistance at $3,775 on the same chart. The 100 hourly SMA is also near the trend line and $3,775. Therefore, there are many hurdles for buyers near the $3,760 and $3,775 levels. Above $3,775, the price could climb above $3,800 and $3,820 in the near term.