Bitcoin as a Hedge Against Uncertainty

MicroStrategy hit the headlines in August 2020 as the first public listed firm to buy significant Bitcoin quantities as part of its treasury strategy.

The firm outlined its reasons for doing so in a . In it, they say the approach intends to maximize long-term value for shareholders. But more than that, Saylor spoke of the benefits of Bitcoin over cash as a response to macroeconomic factors.“MicroStrategy spent months deliberating to determine our capital allocation strategy. Our decision to invest in Bitcoin at this timewas driven in part by a confluence of macro factors affecting the economic and business landscape that we believe is creating long-term risks for ourcorporate treasury program ― risks that should be addressed proactively.”Since then, Saylor has become an evangelist for Bitcoin, promoting the cause on numerous fronts. More recently, Saylor gave an in which he gave a price prediction of $15 million per token. He believes this is possible if the flood of capital from all other sectors, such as real estate, stocks, etc., makes its way into the leading cryptocurrency.

Not Everyone Agrees With Saylor’s Assessment

Business analyst applauded MicroStrategy’s move to use its piles of cash, especially in a zero-interest market. But she questioned why the firm didn’t invest in new product lines or upgrade existing ones, rather than splurge on BTC. She also raised the issue of cash flow risk by going Bitcoin heavy. To add, holding significant quantities of BTC may be cause for consideration that MicroStrategy is an investment company or perhaps a de facto Bitcoin exchange-traded fund. The implications of which may have legal and regulatory ramifications. This issue is perhaps the biggest stumbling block in terms of CEOs jumping on board with Bitcoin. And Saylor is aware of the issue. In a to promote the virtual seminar, he said:Day 1 of the event includes a discussion on the companies face when buying Bitcoin. Feedback indicates that the seminar has been a smash hit. Saylor says an “avalanche” of firms will make the move from cash into Bitcoin within the next 12 months.“If you are interested in the legal considerations firms face while integrating into their corporate strategy, you are not alone. We have professionals from more than 1400 firms joining us tomorrow for this discussion. There is still time for your legal team to attend.”

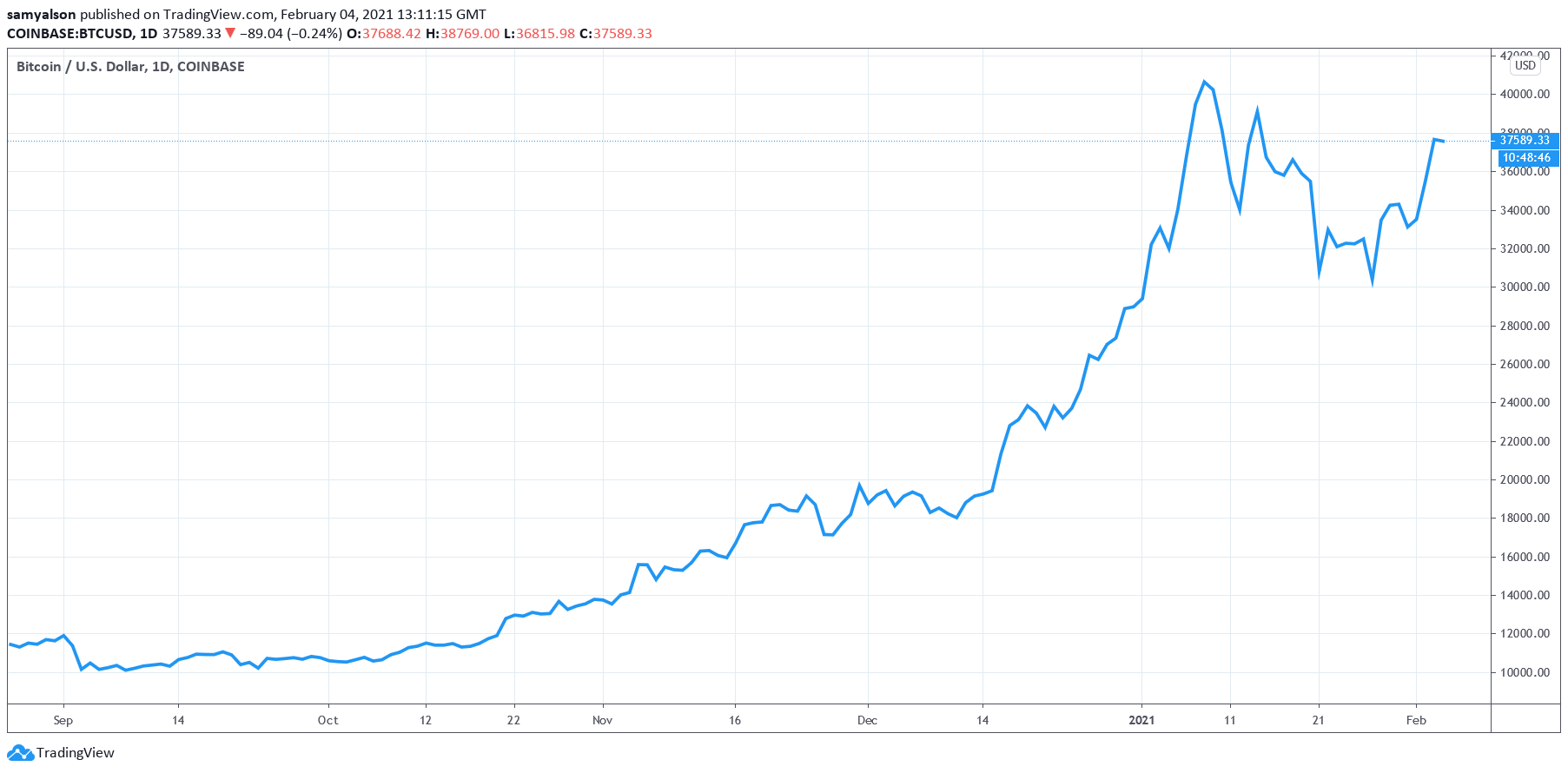

Source: