Related Reading | TA: Bitcoin Key Indicators Suggest Upside Continuation To $62K

Bitcoin Gets Stronger As The Bulls Take Over

Data provided by analyst William Clemente in a by Blockware Intelligence paints a bullish picture for Bitcoin. Less than 1% of BTC’s supply has been move above current levels.

Related Reading | Bitcoin Futures ETF Is Coming, No SEC Opposition

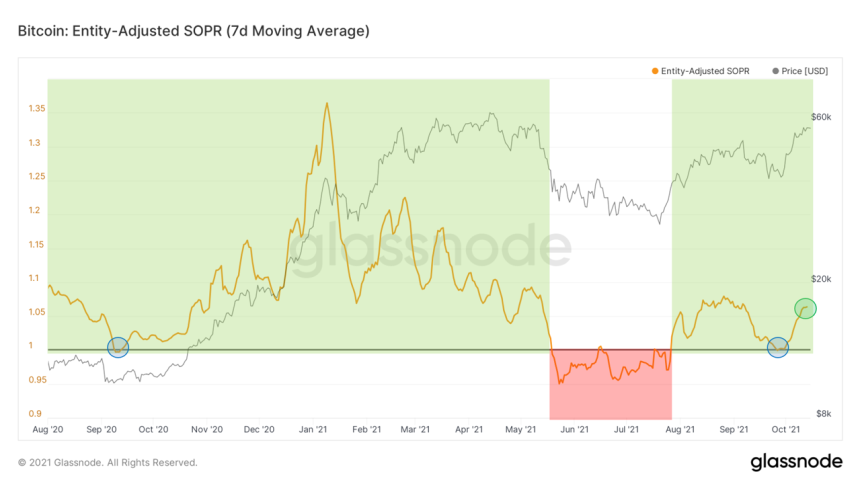

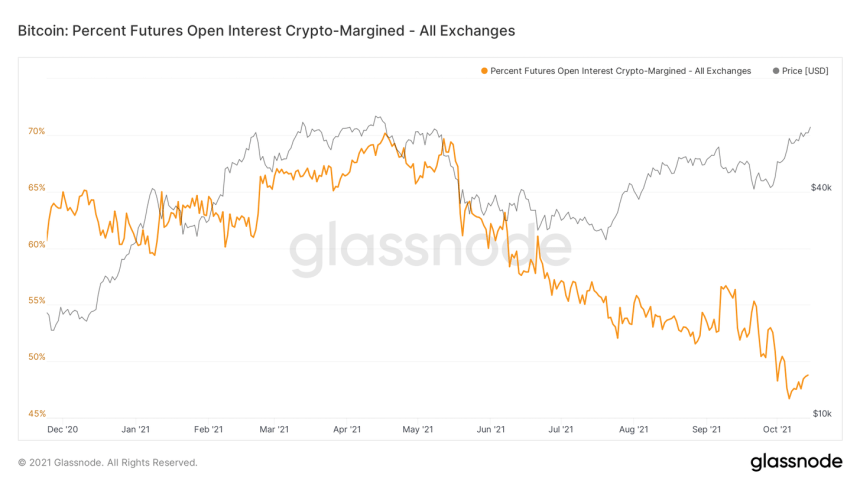

The report expects that the BTC ETF approval to create new opportunities for institutional investors to enter the crypto market, suggesting fresh capital coming in, to take a “non-directional position in the Bitcoin market”. Thus, institutions will be able to profit from the arbitrage created between the spot and futures market. In addition, the Futures Annualized Rolling Basis indicates more upside pressure, as the report said:This means less convexity to the downside and shorts are more likely to be squeezed as they no longer have an inadvertent hedge via their collateral. I suspect that this will reverse once breaking all time highs but we’ll keep an eye on it.

Bitcoin Whales Drive The Trend

On-chain activity has followed the bullish momentum in Bitcoin with an increased in large transactions and trading volume over the past 30-days. A quick look at explorer mempool.space shows a rise in transactions fees over the past 24 hours.Related Reading | Why Bitcoin Could Extend Its Market Dominance As It Approaches $60K

However, as the analyst said, whales are dominating the market as suggested by the lack of rise in google searches related to cryptocurrencies and on-chain metrics, the report said:(…) we’ve actually seen the 100-1K cohort offset their selling by over 1,000 BTC in that time period. Overall, conclusion is that large buyers have indeed been active in the market