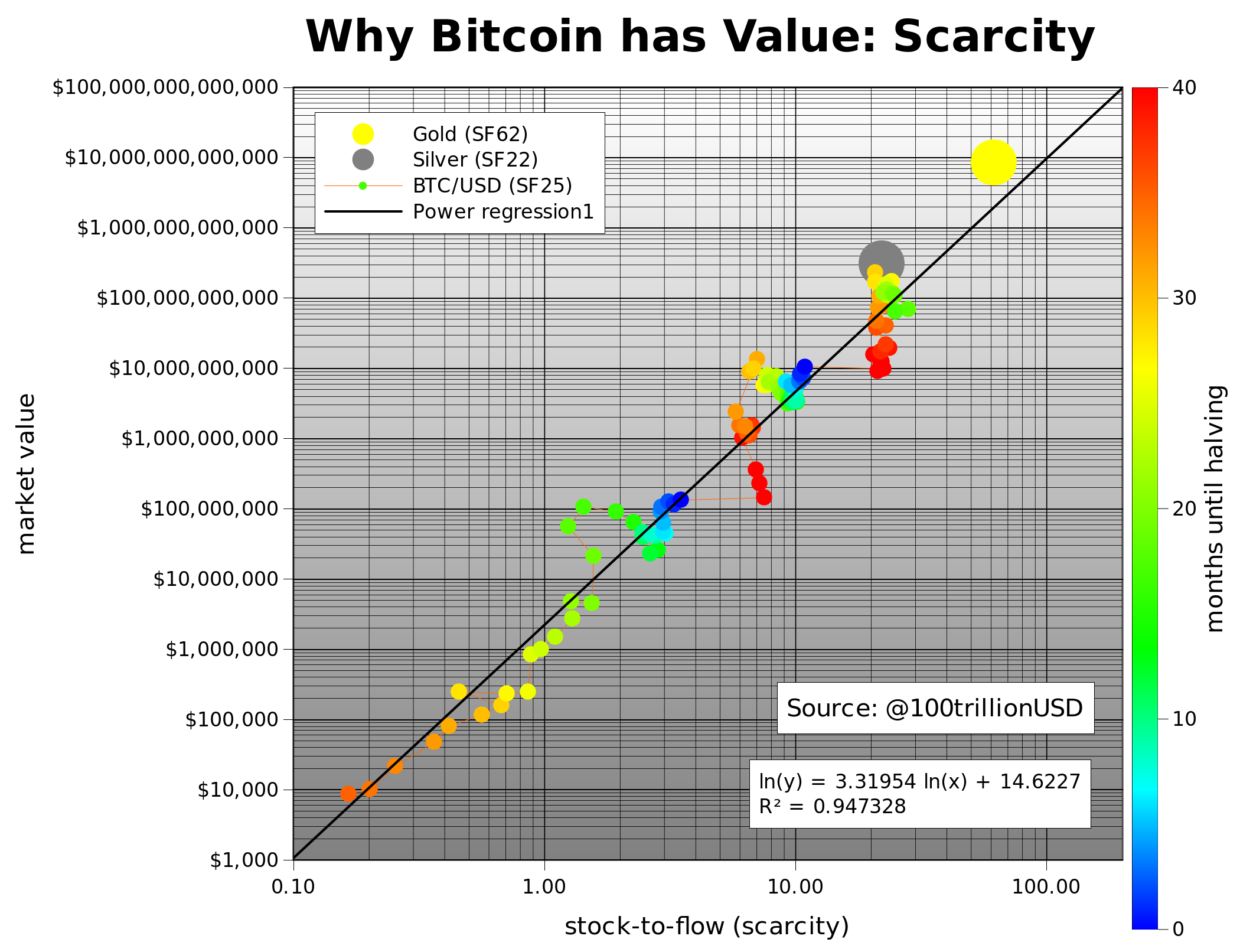

The noted economist called Bitcoin’s Stock-to-Flow Model (S2F) “massively overhyped” as he criticized it for not assessing certain crucial parameters. In retrospective, S2F is a ratio of a commodity’s stock (the units in circulation) and its flow (the amount produced in a year). That said, the model specifically puts weight on the supply factors without dwelling aggressively on the demand side.

“A statistically significant relationship between stock-to-flow and market value exists. The likelihood that the relationship between stock-to-flow and market value is caused by chance is close to zero.”

The Core Flaw

Krüger differed with PlanB in the way the latter stressed hugely on the supply-side factors but completely ignored the role the demand-side plays.

“Bitcoin is a demand-side story,” he said in a tweet. “Supply is fully deterministic. There are no supply-side shocks. Fixed total supply and diminishing supply growth are crucial because these drive demand. It is that simple. Demand is what matters most.”

Amazing how so many bring up S2F these days whenever anyone mentions bitcoin supply. I did not have S2F in mind when I wrote this tweet, and no, I don't think it is very important, it is massively over-hyped. — Alex Krüger (@krugermacro)

In his paper, PlanB briefly describes how bitcoin could attract $1 trillion into its market. Speculatively, he mentions that investors with exposure in gold, silver, or assets belonging to countries that are in socio-political and economic crisis, would more likely move their capital into bitcoin. Moreover, central banks’ dovish policies, such as rate cuts and quantitative easing, would further prompt investors to seek safety in safe-havens like bitcoin.

“The Stock to Flow model is to bulls, what the Tether Manipulation paper is to bears. Both based on fancy looking statistical models (more so the latter). Both are flawed. Doubt whoever believes in these extremes will change their minds. The mind believes what it wants to believe.”

Bitcoin S2F 99.6% Accurate So Far

Past performances do not predict future price actions. But that has not deterred S2F supporters from making a case in favor of it. One of the respondents to Krüger’s opinion pointed out how the bitcoin price has so far followed the PlanB’s model with 99.6 percent accuracy. Halving, a four-yearly event that cut bitcoin’s supply rate by half, also served as the biggest reason why the S2F model works as planned in the long run.

“S2f model is in my humble opinion very important since it indirectly reflects miners’ capacity to stay profitable,” said Maros Hajduk, president of BlockYard – a digital asset management fund. “Unprofitable miners=dead network=nothing else matters. There’s direct pressure on [the] price to rise because of the halving events.”