Bitcoin And Ethereum NVT Ratios Are Both Bearish Right Now

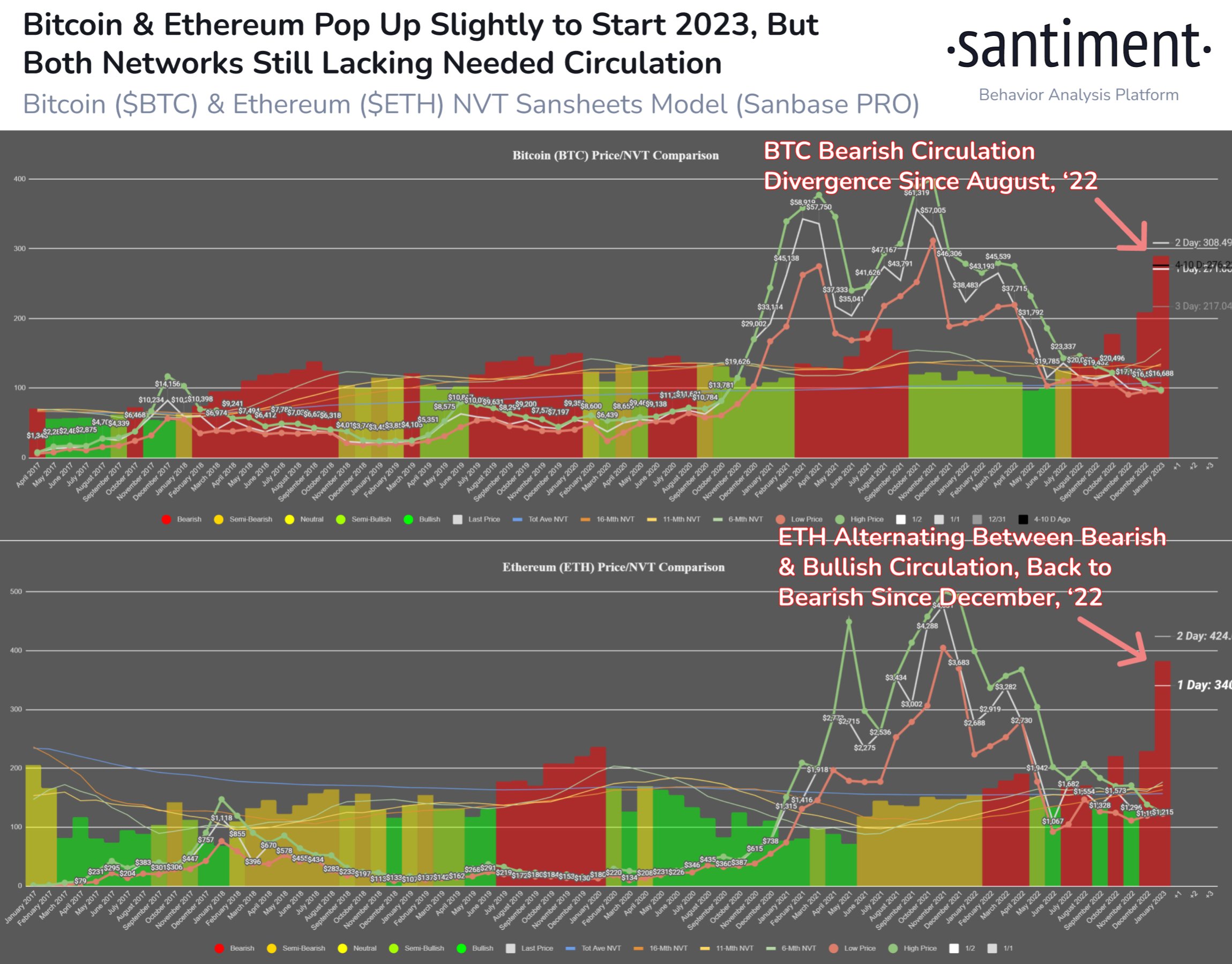

According to the on-chain analytics firm , both the bitcoin and ethereum networks will need to see a pickup in activity this year. The relevant indicator here is the “Network Value to Transaction” (NVT) ratio, which measures the ratio between the market cap of any crypto and its transaction activity.

Usually, the trading volume is considered as the transaction activity of a coin, but Santiment’s NVT ratio works differently. Instead of dividing the market cap by the volumes, this version of the metric makes use of the “daily circulation,” a measure of the total number of unique coins that have seen some movement in the past day.

The value of the metric seems to have been bearish for both the coins recently | Source:As the above graph shows, the NVT ratio has been bearish for Bitcoin since August 2022. This means that in the last few months, the circulation on the BTC network has remained pretty low when compared to the market cap of the crypto. For Ethereum, the indicator’s value had been switching between bearish and bullish throughout 2022, but the coin seems to have ended the year being overvalued as the circulation was bearish in December.

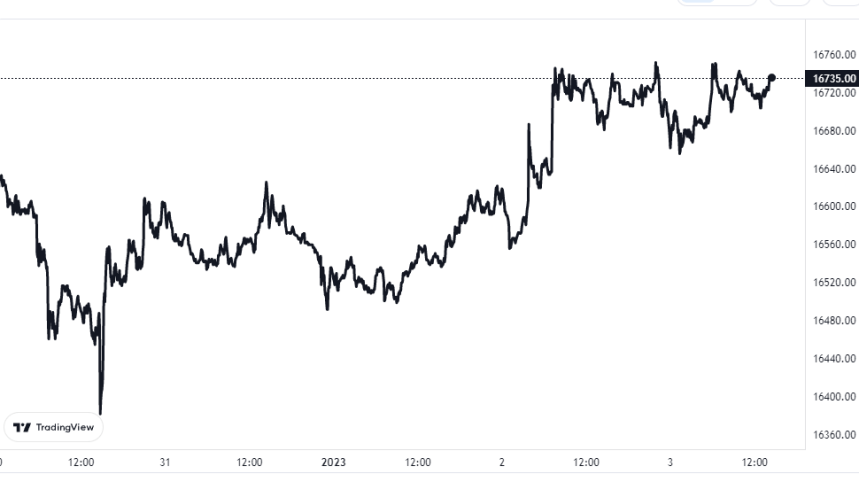

BTC Price

At the time of writing, Bitcoin’s price floats around $16,700, down 1% in the last week.

Looks like BTC has surged in the last couple of days | Source: