Just over a year ago, the price of bitcoin registered an average low of $3,120 across many regulated and unregulated cryptocurrency exchanges. A year before that, the asset was trading at its Everest value of $20,000. The 84 percent decline in the “revolutionary” financial asset allowed .

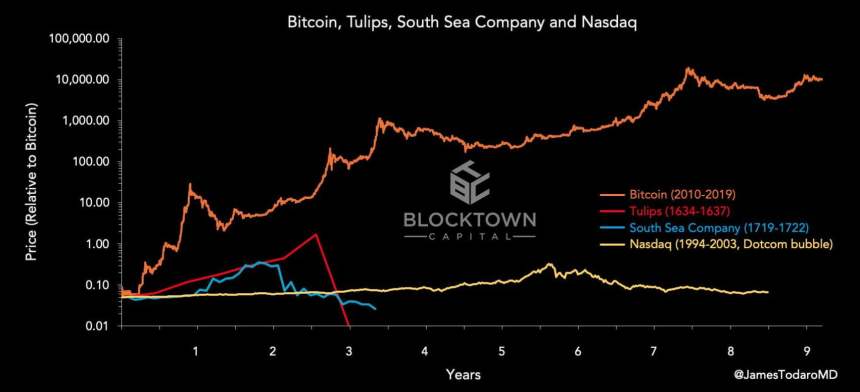

However, as of December 2019, the cryptocurrency is looking to close the year at a roughly doubled rate. At around $7,100, it is more than 100 percent higher than its price from the bottom formed in December 2018 at $3,150. Bitcoin remains a bubble – a bluffing bubble that pretends to pop but does not pop. By the time the mainstream media and every skeptic finish their hundred-word obituary about the cryptocurrency, it rises back to prove them all wrong.Tulip Mania

Mainstream media outlet CNN in 2017 was quick to compare , a financial bubble from the early 17th century wherein speculation drove the price of tulip bubbles to unheard levels. People were putting their homes on collateral to get into the Turkey-made bulb markets. As greed drove the tulip bubbles’ prices up, the result was a string of massive sales when the rates touched local highs. Those who bought the bulbs at higher rates were the firsts to feel the burn of an overvalued lightning instrument.Bitcoin is the biggest bubble & bust in history. Biggest as up 60X from 3 years before peak. Nasdaq was only 4X, so tiny bubble vs BTC. Even bankrupt South Sea was 8X. More similar to Mississippi (35X) that went bankrupt or Tulip-mania. BTC bust biggest/fastest too. Case rested! — Nouriel Roubini (@Nouriel)

Dotcom

Where the Tulip fails at proving bitcoin a bubble, the dot-com boom redefines it.The Dot-Com bubble had a few survivors, nevertheless. Amazon, for instance, was one of the top-earning firms during the boom – and remained a tech powerhouse despite a circa 94 percent crash in its stock value during the bust.

2020 a Litmus Test for Bitcoin

Bitcoin has survived beyond an average bubble phase. The cryptocurrency is looking at massive infrastructural developments with the launch of regulated spots and derivatives platforms. At the same time, its prominence against the dovish central banking policies is growing among the millennials. weighs:“When we talk to our younger clients – we have a core gold allocation in our portfolios, and they’ll ask about that and say, ‘What about crypto?’ And if you talk to, primarily millennials, and ask them which they prefer, bitcoin or gold, it’s a landslide. It’s not even close, it’s like 90% prefer bitcoin.”Part of the bullish sentiment comes from bitcoin’s potential to be used as a tool to transfer funds cheaply across borders. The rest believes that the cryptocurrency is a better gold owing to its scarcity, as well as minimal storage and movability requirements.

Bitcoin is now standing before global regulators that continue to look at it as a means to fund illegal activities. More so, 2020 will show whether or not they want to include the cryptocurrency into the mainstream.

In either case, bitcoin will have outlived every major financial bubble by that time.Featured Image from Shutterstock